Alimony is gender-neutral in Utah, meaning either spouse can request support during the divorce process. Alimony is also called “spousal support.” When considering a request for alimony, the judge will evaluate the following factors to determine the type, amount, and duration of support:

the financial condition and needs of the supported spouse

the recipient’s earning capacity or ability to produce income, including an evaluation of whether the recipient lost work experience or skills while caring for the couple’s children

the paying spouse’s ability to pay support while maintaining financial independence

the length of the marriage

whether the recipient is a custodial parent of a child who requires child support

whether the recipient worked in a business owned or operated by the paying spouse, and

whether the recipient directly contributed to the increase in the paying spouse’s income by paying for education or job training during the marriage.

In addition to the above factors, the court can also consider a spouse’s fault (or marital misconduct) which caused the breakup of the marriage. In Utah, “fault” may include adultery, physical abuse or threats to the other spouse or children, or undermining the financial stability of the other spouse. It’s important to understand that the court can’t use alimony to punish a misbehaving spouse, so judges use fault in limited circumstances. Unlike child support in Utah, there is no formula for judges to use to calculate alimony in a divorce. Instead, judges’ base support amounts on the above factors and any other relevant circumstances in each case. If you and your spouse would like to maintain control over the alimony order, you can negotiate the terms in a settlement agreement and present it to the judge for approval.

The Marital Standard of Living

Duration of AlimonySometimes judges will award temporary alimony while the divorce is pending. Orders of temporary support terminate when the judge finalizes the divorce. For all other alimony orders, the law prohibits the judge from ordering support for longer than the length of the marriage unless the court reviews the order before the termination date and finds extenuating circumstances that require support to continue.

Terminating Alimony in Utah

Typically, the judge will set an end date for alimony in the original order. However, if the supported spouse remarries or dies, alimony terminates automatically. It’s no surprise that life goes on after a divorce. But, if the supported spouse begins cohabiting (living with) a new partner, the paying spouse can request termination of alimony. Cohabitation may terminate alimony, but only if you report it to the court and ask for support to end within one year of discovering the cohabitation.

Paying Alimony in Utah

Most alimony payments in Utah are periodic (monthly) and due on the first of every month unless the court orders otherwise. Most judges include an income withholding order for alimony, which directs the paying spouse’s employer to withhold the payments from the employee’s paycheck and forward it directly to the court. If the paying spouse doesn’t have a steady job or is self-employed, the court may order lump-sum payments or payment through property transfer. Lump-sum payments are installments, either one or several over a short period of time. Once you make the final payment, your alimony obligation to your spouse ends. Property transfers are rare, but helpful in cases where one spouse doesn’t have a steady income but has a significant amount of property that will fulfill the support order.

Modifying Alimony Orders

Unless the support order is non-modifiable, either spouse can request a review and modification (change) of alimony award if there is a substantial and material change in circumstances after the divorce. For example, if a paying spouse is disabled due to an unforeseen health issue and can’t work, the court may adjust or terminate alimony to ensure that both spouses remain financially stable. If there’s a change in circumstances that makes it difficult for you to pay support, it is important to request a review as soon as possible, and in the meantime, you must continue to pay. Failure to pay support can result in serious consequences, such as contempt hearings, fines, bank seizures, and in the most severe cases, a jail sentence. If your spouse isn’t paying support as ordered, you can file a formal petition with the court asking for help enforcing the order.

Taxes and Alimony

If you finalized your divorce on or before December 31, 2019, you can deduct your alimony payments, and your spouse must report and pay taxes on the income. However, for divorces on or after January 1, 2020, changes to the tax law eliminate both the tax deduction benefit and reporting requirements for alimony. Divorcing couples should consider the tax ramifications for both spouses before finalizing the divorce. If you’re unsure how the new tax law impacts your bottom line, you should speak to an experienced tax and divorce attorney near you.

Remarriage and Alimony in Utah

When couples divorce in Utah, the court may order one spouse to provide the other with financial support, called “alimony.” When the spouse receiving alimony (the “supported spouse”) remarries or begins living with someone else, however, the paying spouse will usually want to stop making alimony payments. Utah courts may order one spouse to pay the other alimony after a divorce, taking into account the specific circumstances of each marriage. The court may order alimony to be made in the form of a lump-sum payment, a transfer of property, or the most common type of alimony, periodic payments made until a certain date or until some event occurs.

Utah judges will consider any or all of the following factors when determining alimony:

the supported spouse’s financial needs

the supported spouse’s earning ability

the paying spouse’s ability to pay alimony

the length of the marriage

the supported spouse’s childcare duties

whether the supported spouse worked for a business owned by the paying spouse during the marriage

whether the supported spouse contributed to the paying spouse’s ability to earn income (for example, by paying for education or allowing the paying spouse to attend school during the marriage)

whether one spouse was at fault in causing the divorce (for example, by domestic abuse or adultery), and

any other factors the court deems relevant.

Impact of Remarriage on Alimony in Utah

Utah law provides that alimony ends when a supported spouse remarries, unless the divorce decree states otherwise. Sometimes, in long marriages, a divorcing couple will agree that one spouse will pay the other alimony for life regardless of whether the supported spouse remarries, but in most cases, alimony ends upon the supported spouse’s remarriage. When the supported spouse remarries, alimony ends automatically; the paying spouse does not need to file a motion or return to court for an order terminating alimony. The paying spouse can stop making alimony payments on the date the supported spouse gets remarried. If the paying spouse owed past due alimony at the time the supported spouse remarries, the paying spouse must still make those payments. Also, if the paying spouse was ordered to make a lump-sum payment or a transfer or property as alimony, he or she must still make that payment or property transfer, even if the other spouse is remarried.

Termination or Modification of Alimony In Utah

Utah law allows courts to modify or end alimony at any time if there has been a substantial change in the circumstances of either spouse after the divorce. Utah courts usually won’t consider the remarriage of the paying spouse to be a “substantial change in circumstances” for the purposes of modifying alimony. If the supported spouse has a significant increase in income or a decrease in financial needs, however, the court may reduce or end alimony payments. If you want to modify or end alimony payments in your case, you should file a motion of terminate or modify alimony in your county state court clerk’s office. The court will schedule a hearing where both you and your ex-spouse will have to appear. You should bring any evidence of the changed circumstances that support your request to change or end alimony payments. If you and your ex-spouse agree to modify alimony before the court date, you should put your agreement in writing, sign it, and submit it to the court for approval.

Impact of Cohabitation on Alimony in Utah

In Utah, all court orders for one spouse to pay the other alimony end when the supported spouse begins cohabiting with another person. Cohabitation is when two individuals live together in a romantic relationship while not married.

If you are paying alimony to your ex-spouse, and he or she begins living with another person in a romantic relationship, you’ll need to file a motion to terminate alimony with the court clerk’s office. Gather any evidence of your ex-spouse’s cohabitation to show the court (for example, photos or other proof that both individuals spend most nights at the same residence). If the judge believes you have proven that your ex-spouse is cohabiting with another person, he or she can end alimony retroactive to the date you filed your motion.

Types of Alimony

Courts may order temporary, short- and long-term alimony. Temporary alimony is granted at the discretion of the court during the divorce proceedings and before the final decree. Short-term alimony may be granted to allow the receiving party time to gain necessary skills. Long-term, or permanent, alimony may be granted to a spouse who has significant needs, and is usually reserved for lengthy marriages.

Temporary Alimony

The first type of alimony or spousal support that could be ordered in a case is temporary alimony. Typically this is alimony that is awarded during the pendency of the divorce. It allows the poorer spouse to get sufficient funds to take care of his or her needs. Temporary alimony usually lasts until a final divorce decree is entered. That means it can last for months and even years. It is extremely important, therefore, that you and your attorney make sure that all relevant financial information is presented to the judge to make sure the temporary alimony award is fair and reasonable. The judge needs to be in possession of information concerning every aspect of the parties’ income, debts, and assets from all sources to make a determination.

Transitionary Alimony

Transitionary alimony is a form of temporary alimony but is different in the sense that it is implemented in a final decree of divorce rather than prior to the divorce decree being entered. It is used to provide the spouse in need an opportunity for a specific amount of time to get an education, training, and other skills so that he or she can become self sufficient. It usually terminates with a new and permanent order which either sets a sum certain of spousal support for a specified time period or it terminates alimony altogether.

Permanent Alimony

Permanent alimony is the set amount of spousal support that the paying party will be obligated to pay for as long as the decree states. It can only be changed by a showing of substantial change in circumstances through a petition to modify.

How the Amount of Alimony is Determined

Unlike child support, which in most states is mandated according to very specific monetary guidelines, courts have broad discretion in determining whether to award spousal support and, if so, how much and for how long. In Utah there are several factors that the court will look at when it comes to spousal support, some statutes recommend that courts consider the following factors in making decisions about alimony awards:

The age, physical condition, emotional state, and financial condition of the former spouses;

The length of time the recipient would need for education or training to become self-sufficient;

The couple’s standard of living during the marriage;

The length of the marriage; and

The ability of the payer spouse to support the recipient and still support himself or herself.

Alimony is often deemed “rehabilitative,” that is, it’s ordered for only so long as is necessary for the recipient spouse to receive training and become self-supporting. If the divorce decree doesn’t specify a spousal support termination date, the payments must continue until the court orders otherwise. Most awards end if the recipient remarries. Termination upon the payer’s death isn’t necessarily automatic; in cases where the recipient spouse is unlikely to obtain gainful employment, due perhaps to age or health considerations, the court may order that further support be provided from the payer’s estate or life insurance proceeds.

Areas We Serve in Utah

We serve individuals and businesses in the following Utah locations:

Salt Lake City Utah

West Valley City Utah

Provo Utah

West Jordan Utah

Orem Utah

Sandy Utah

Ogden Utah

St. George Utah

Layton Utah

South Jordan Utah

Lehi Utah

Millcreek Utah

Taylorsville Utah

Logan Utah

Murray Utah

Draper Utah

Bountiful Utah

Riverton Utah

Herriman Utah

Spanish Fork Utah

Roy Utah

Pleasant Grove Utah

Kearns Utah

Tooele Utah

Cottonwood Heights Utah

Midvale Utah

Springville Utah

Eagle Mountain Utah

Cedar City Utah

Kaysville Utah

Clearfield Utah

Holladay Utah

American Fork Utah

Syracuse Utah

Saratoga Springs Utah

Magna Utah

Washington Utah

South Salt Lake Utah

Farmington Utah

Clinton Utah

North Salt Lake Utah

Payson Utah

North Ogden Utah

Brigham City Utah

Highland Utah

Centerville Utah

Hurricane Utah

South Ogden Utah

Heber Utah

West Haven Utah

Bluffdale Utah

Santaquin Utah

Smithfield Utah

Woods Cross Utah

Grantsville Utah

Lindon Utah

North Logan Utah

West Point Utah

Vernal Utah

Alpine Utah

Cedar Hills Utah

Pleasant View Utah

Mapleton Utah

Stansbury Par Utah

Washington Terrace Utah

Riverdale Utah

Hooper Utah

Tremonton Utah

Ivins Utah

Park City Utah

Price Utah

Hyrum Utah

Summit Park Utah

Salem Utah

Richfield Utah

Santa Clara Utah

Providence Utah

South Weber Utah

Vineyard Utah

Ephraim Utah

Roosevelt Utah

Farr West Utah

Plain City Utah

Nibley Utah

Enoch Utah

Harrisville Utah

Snyderville Utah

Fruit Heights Utah

Nephi Utah

White City Utah

West Bountiful Utah

Sunset Utah

Moab Utah

Midway Utah

Perry Utah

Kanab Utah

Hyde Park Utah

Silver Summit Utah

La Verkin Utah

Morgan Utah

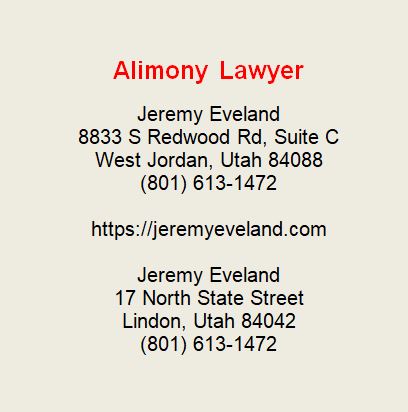

Alimony Lawyer Consultation

When you need help from an alimony lawyer, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

Business Lawyer South Salt Lake Utah

Legal Requirements for Utah Technology Startups

Business Lawyer Farmington Utah

Due Diligence For Buying A Utah Business

Understanding Utah’s Labor Laws

Business Lawyer North Salt Lake Utah

Product Liability Laws in Utah

Preventing Cybersecurity Breaches

Business Lawyer North Ogden Utah

Business Lawyer Brigham City Utah

Mastering Business Law: Key Essentials For Success

Business Lawyer Centerville Utah

Shareholder Agreements in Utah

Business Lawyer Hurricane Utah

Corporate Attorney West Jordan UT

Estate Planning For Survivorship Considerations

Construction Lawyer West Bountiful Utah

Truck Accident Lawyer North Logan Utah

Estate Planning for Business Asset Protection

Are Small Business Loans Worth It?

Estate Planning For Real Estate Holding Companies