Business Succession Lawyer St George Utah

St. George, Utah is home to a thriving business community and its residents rely heavily on the services of experienced attorneys to help them manage their business affairs. Business succession law is an essential part of any business plan, and a qualified attorney can provide legal counsel and advice on how to best protect a business and its owners from potential legal issues. As a St. George Law Firm, we provide top-tier legal services for businesses of all sizes and our team of business succession lawyers are committed to helping business owners in the St. George area plan for the future.

With decades of legal experience and a deep knowledge of business law, our team of lawyers can provide the legal counsel and advice that business owners need to ensure their businesses are protected. Our team of estate planning lawyers have a thorough understanding of the laws surrounding business succession and can advise clients on the best strategies for protecting their businesses and their families. Whether you’re looking to create a succession plan to pass your business onto a family member or simply want to ensure that your business is protected in the event of your death, our lawyers can provide the legal guidance and assistance you need.

At St. George Law Firm, we understand the importance of providing our clients with legal services that are tailored to meet their needs. We have local roots in Washington County and our attorneys are committed to serving the people of St. George and the surrounding areas. Our lawyers have experience in a variety of legal areas, including business law, estate planning, personal injury, and insurance defense. Our attorneys can provide legal advice on any type of business issue, from setting up a business to buying and selling a business to litigation.

Our attorneys also offer free consultation services in order to help our clients understand the legal process and make sure they are making informed decisions. We are committed to providing our clients with the highest ethical standards and legal solutions that meet their needs. Our attorneys are dedicated to helping business owners in the St. George area protect their businesses and their families.

Whether you need assistance creating a business succession plan or are looking for legal advice on any other type of business issue, our team of business succession lawyers are here to help. We can provide advice on estate planning law, intestate succession, buy-sell agreements, and more. We also offer a wide range of practice areas, including business litigation, real estate, and family business law. Our attorneys are committed to providing the legal representation that our clients need and will take the time to answer all of their questions and concerns.

At St. George Law Firm, our team of business succession lawyers can help you protect your business and plan for the future. With decades of legal experience and a deep knowledge of business law, our team of attorneys can provide the legal counsel and advice that business owners need to ensure their businesses are protected. Whether you need help creating a succession plan or are looking for legal representation on any other type of business issue, our attorneys can provide the legal solutions you need. Contact our team of business succession lawyers today to schedule a free consultation and get the legal advice you need.

Business Agreements

A business partnership agreement is a legally binding document that outlines details about business operations, ownership stake, financials and decision-making. Business partnership agreements, when coupled with other legal entity documents, could limit liability for each partner. Business partnership agreements should always be written and/or reviewed by legal counsel prior to any signatures. A business partnership agreement establishes clear rules for the operation of a business and the roles of each partner. Business partnership agreements are put in place to resolve any disputes that arise, as well as to delineate responsibilities and how profits or losses are allocated. Any business partnership in which two or more people own a stake of the company should create a business partnership agreement, as these legal documents could provide key guidance in more difficult times. A business partnership agreement is a legal document between two or more business partners that spells out the business structure, responsibilities of each partner, capital contribution, partnership property, ownership interest, decision-making conventions, the process for one business partner to sell or leave the company, and how the remaining partner or partners split profits and losses. While business partnerships seldom begin with concerns about a future partnership dispute or how to dissolve the business, these agreements can guide the process in the future, when emotions might otherwise take over. A written, legally binding agreement serves as an enforceable document, rather than just an oral agreement between partners.

Partnership Agreements

A business partnership agreement is a necessity because it establishes a set of agreed-upon rules and processes that the owners sign and acknowledge before problems arise. If any challenges or controversies do arise, the business partnership agreement spells out how to address those issues. A business partnership is just like a marriage: No one goes into it thinking that it’s going to fail. But if it does fail, it can be nasty. With the right agreements in place, which I’d always recommend be written by a qualified attorney, it makes any potential problems of the business partnership much more easily solved and/or legally enforceable.” In other words, a business partnership agreement protects all partners in the event things go sour. By agreeing to a clear set of rules and principles at the outset of a partnership, the partners are on a level playing field developed by consensus and backed by law.

Business partnership agreements are necessarily broad, touching virtually every aspect of a business partnership from start to finish. It is important to include all foreseeable issues that could arise regarding the co-management of the business. These are some of those issues:

Ownership Stake

A business partnership agreement clearly spells out who owns what percentage of the business, making each partner’s stake in the company clear.

Business Operations

Business partnership agreements should explain which activities the business will engage in, as well as which activities it will not.

Decision Making

A business partnership agreement should outline how decisions are made and the responsibility of each partner in the decision-making process. This includes who has financial control of the company and who must approve the addition of new partners. It should also include information on how profits and losses are distributed amongst the partners.

Liability

If the business partnership is set up as an LLC, the agreement should limit the liability each partner faces. To do so effectively, a partnership agreement should be paired with other documents, such as articles of incorporation. A business partnership agreement alone is likely not enough to fully protect the partners from liability.

Dispute Resolution

Any business partnership agreement should include a dispute resolution process. Even if partners are best friends, siblings or spouses, disagreements are a natural part of doing business together.

Business Dissolution

In the event the partners choose to dissolve the business, a business partnership agreement should outline how that dissolution should occur, as well as continuity or succession planning should any of the partners divest from the business.

Steps To Implement A Business Partnership Agreement

A business partnership agreement does not have to be set in stone, especially as a business grows and develops over time. There will come opportunities to implement new elements of a partnership agreement, especially if unforeseen circumstances occur.

Initial Partnership

This is when two or more partners first enter into business together. It involves drafting an agreement that governs general operation of the business, the decision-making process, ownership stakes and management responsibilities.

Addition of Limited Partners

As a business grows, it might have the opportunity to add new partners. The original partners might agree to a small carve-out of minor equity ownership for the new partner, as well as limited voting rights that give the new partner partial influence over business decisions.

Addition of Full Partners

Of course, sometimes the addition of a limited partner will lead to their inclusion as a full partner in the business. A business partnership agreement should include the requirements and process of elevating a limited partner to the status of full partner, complete with full voting rights and influence equal to that of the original partners.

Continuity and Succession

Finally, a business partnership agreement should take into account what happens when the founders retire or leave the company without initiating dissolution. It should be clear how ownership stake and responsibilities will be distributed among the remaining partners after the departing partners take their leave.

Partnership agreements need to be well crafted for a myriad of reasons. One main driver is that the desires and expectations of partners change and vary over time. A well-written partnership agreement can manage these expectations and give each partner a clear map or blueprint of what the future holds. Your partnership agreement should speak to your unique business relationship and business operation. Again, no two businesses are alike. However, there are key provisions that every partnership agreement should include:

Your Partnership’s Name

One of the first tasks you and your partners will check off your to-do list is making a decision on your business’ name. The business name may reflect the names of the partners or it may have a fictitious name. In either case, the name of your business should be registered with your state. Assuming you’ve conducted a comprehensive search of the name you’ve decided on, registration will confirm that no other business exist with the same name and will prevent others from using your name. The name of your business partnership is a key provision because it explicitly identifies the partnership and the business name for which the agreement exists. This eliminates confusion, especially when there are multiple partnerships and/or businesses that may be involved.

Partnership Contributions

In most cases, partners’ contributions (time, resources, and capital) to the business vary from partnership to partnership. While some partners provide start-up capital, others may provide operational or managerial expertise. In either case, the specific contributions should be stated in the written agreement. It’s also a good idea to include terms that address anticipated contributions that may be required before the business actually becomes profitable. For example, if the start-up investments are not sufficient to carry the business into a profitable state, the partnership agreement should state any expectations for additional financial contributions from each partner. This avoids any surprises down the road for a key contributor.

Allocations of Profits and Losses

Partnerships are formed with the expectation of making a profit. The partnership agreement should speak to the when and how profits are allocated to each eligible partner. In addition, it should speak to how losses will be distributed during the business’ operation and in the event of dissolution.

Partners’ Authority and Decision Making Powers

Each partner has a vested interest in the success of the business. Because of this vested interest, it’s generally understood that each partner has the authority to make decisions and to enter into agreements on behalf of the business. If this is not the case for your business, the partnership agreement should outline the specific rules pertaining to the authority given to each partner and how business decisions will be made. To avoid confusion and to protect everyone’s interest, you need to discuss, determine and document how business decisions will be made.

Business Management

In the beginning phase, there are many tasks to accomplish and some management roles may overlap (or may only require temporary oversight). While you do not have to address each partners’ duty as it relates to every single aspect of your business operations, there are some roles and responsibilities you need to assign and outline in a formal agreement. Roles and responsibilities related to accounting, payroll, and even human resources are worthy of noting in the partnership agreement because of their critical and sometimes sensitive nature. Even if you have an existing agreement, you may want to update your agreement to address these important managerial responsibilities.

Business Departure (Withdrawal) or Death of Partner

When entering a business partnership, it’s natural to want to avoid uncomfortable discussions about a future breakup that may never happen. No one wants to think of a possible separation when a relationship is just beginning. However, business separations happen all the time and occur for many reasons. Any of these reasons can affect you personally and professionally. Therefore, no matter the reason for the separation, the process and procedures for departure should be outlined in the partnership agreement. It’s also wise to include language that addresses buyouts and shifts in responsibility should one partner become disabled or deceased.

New Partners

As the business grows and expands, the increased need for new ideas, new resources, and new strategies grows as well. At times, growth may mean adding a new partner. Plan ahead for these new opportunities in the partnership agreement by specifying how new partners will be on-boarded into the existing partnership.

Dispute Resolution

As stated before, disputes are inevitable in any relationship. In business relationships, disputes can become deadlocked and may even require mediation, arbitration, or unfortunately lawsuits. Try avoiding the time and costs associated with lawsuits by requiring mediation and arbitration as a first (and hopefully final) resolution to business disputes. There are many ways to resolve disputes, so your partnership agreement can list alternative methods for dispute resolution. The point is to formally identify these methods of resolution in advance be listed them in the partnership agreement when all heads are cool and clear.

Why Your Business Partnership Needs a Written Agreement

To set up the roles and responsibilities of each partner and to describe how decisions are made. Who is the managing partner? What are the responsibilities of individually named partners? How do roles and responsibilities change?

To avoid tax issues, by having the tax status of the partnership spelled out, and to show that the partnership is distributing profits based on acceptable tax and accounting practices.

To avoid legal and liability issues, spelling out the liability of individual partners (general partners vs. limited partners) and the liability of all partners if there is a liability issue with one partner.

To deal with changes in the partnership due to life challenges of existing partners – partners who leave, become ill or incompetent, get divorced, or die. These are usually dealt with in buy-out agreements with each partner.

To describe the circumstances under which new partners can enter the partnership.

To deal with partner issues, like a conflict of interest and non-compete agreements.

To override state laws. Some states have required language in partnership agreements. But this language may not be the best for your particular partnership. If you don’t have a formal written agreement, you may find yourself having to abide by the default state laws.

To make disputes easier. It’s a good idea to include language in your partnership agreement that describes how disputes will be handled. Will arbitration be a possibility? What will be the responsibility of parties to the dispute? Who pays for what?

Why You Need an Attorney to Help Prepare a Business Partnership Agreement

The only disadvantage to having a partnership agreement is that you might have language that is unclear or incomplete. A DIY partnership agreement risks not getting the wording right, and a poorly worded contract is worse than none at all. Getting an attorney to help you with the process of preparing your partnership agreement seems like it’s an expensive waste of time. It’s not. Remember, if it isn’t in writing, it doesn’t exist, so putting every possible situation or contingency into a partnership agreement can prevent expensive and time-wasting lawsuits and hard feelings between the partners.

• To avoid tax issues, by having the tax status of the partnership spelled out, and to show that the partnership is distributing profits based on acceptable tax and accounting practices.

• To avoid legal and liability issues, spelling out the liability of individual partners (general partners vs. limited partners) and the liability of all partners if there is a liability issue with one partner.

• To deal with changes in the partnership due to life challenges of existing partners – partners who leave, become ill or incompetent, get divorced, or die. These are usually dealt with in buy-out agreements with each partner.

• To describe the circumstances under which new partners can enter the partnership.

• To deal with partner issues, like a conflict of interest and non-compete agreements.

• To override state laws. Some states have required language in partnership agreements. But this language may not be the best for your particular partnership. If you don’t have a formal written agreement, you may find yourself having to abide by the default state laws.

• To make disputes easier. It’s a good idea to include language in your partnership agreement that describes how disputes will be handled. Will arbitration be a possibility? What will be the responsibility of parties to the dispute? Who pays for what?

The only disadvantage to having a partnership agreement is that you might have language that is unclear or incomplete. A DIY partnership agreement risks not getting the wording right, and a poorly worded contract is worse than none at all. Getting an attorney to help you with the process of preparing your partnership agreement seems like it’s an expensive waste of time. It’s not. Remember, if it isn’t in writing, it doesn’t exist, so putting every possible situation or contingency into a partnership agreement can prevent expensive and time-wasting lawsuits and hard feelings between the partners.

Business Succession Lawyer St. George Utah Free Consultation

When you need a business succession lawyer in St. George Utah, call lawyer Jeremy Eveland (801) 613-1472.

Related Posts

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

The 10 Essential Elements of Business Succession Planning

St. George, Utah

|

St. George, Utah

|

|

|---|---|

| City of St. George | |

Overlook of downtown St. George and adjacent Pine Valley Mountains

|

|

| Nickname(s):

Utah’s Dixie, (the) STG

|

|

| Motto:

It’s The Brighter Side

|

|

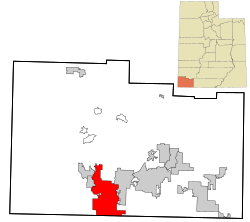

Location within Washington County

|

|

| Coordinates: 37°06′15″N 113°35′03″WCoordinates: 37°06′15″N 113°35′03″W[1] | |

| Country | United States |

| State | Utah |

| County | Washington |

| Settled | 1861 |

| Incorporated | 1862 |

| Named for | George A. Smith |

| Government

|

|

| • Type | Mayor-Council |

| • Mayor | Michelle Randall |

| • City Manager | John Willis |

| Area | |

| • City | 78.47 sq mi (203.22 km2) |

| • Land | 78.46 sq mi (203.22 km2) |

| • Water | 0.00 sq mi (0.01 km2) 0.72% |

| Elevation | 2,700 ft (800 m) |

| Population | |

| • City | 95,342 |

| • Rank | 1st in Washington County 7th in Utah |

| • Density | 1,215.17/sq mi (469.16/km2) |

| • Metro

|

180,279 (US: 239th) |

| • Metro density | 1,310/sq mi (510/km2) |

| Demonym | St. Georgian |

| Time zone | UTC−7 (Mountain) |

| • Summer (DST) | UTC−6 (Mountain) |

| ZIP Code |

84770–84771, 84790–84791

|

| Area code | 435 |

| FIPS ID | 49-65330 |

| GNIS feature ID | 1455098[1] |

| Website | sgcity.org |

St. George is a city in and the county seat of Washington County, Utah, United States. Located in southwestern Utah on the Arizona border, it is the principal city of the St. George Metropolitan Statistical Area (MSA). The city lies in the northeasternmost part of the Mojave Desert, adjacent to the Pine Valley Mountains and near the convergence of three distinct geologic areas and ecoregions: the Mojave Desert, Colorado Plateau, and the Great Basin.[4] The city is 118 miles (190 km) northeast of Las Vegas, Nevada, and 300 miles (480 km) south-southwest of Salt Lake City, Utah, on Interstate 15.

As of the 2020 U.S Census, the city had a population of 95,342, with the overall MSA having an estimated population of 180,279.[5][6] St. George is the seventh-largest city in Utah and most populous city in the state outside of the Wasatch Front.

The city was settled in 1861 as a cotton mission, earning it the nickname “Dixie“. While the crop never became a successful commodity, the area steadily grew in population. Between 2000 and 2005, St. George emerged as the fastest growing metropolitan area in the United States.[7] Today, the St. George region is well known for its year-round outdoor recreation and proximity to several state parks, Zion National Park and The Grand Canyon. Utah Tech University is located in St. George and is an NCAA Division I institution.

[geocentric_weather id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_about id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_neighborhoods id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_thingstodo id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_busstops id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_mapembed id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_drivingdirections id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

[geocentric_reviews id=”8d6fb119-af7d-4769-8b5e-7634206bf314″]

Business Succession Lawyer Free Consultation

When you need a business succession attorney, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Areas We Serve

We serve businesses and business owners for succession planning in the following locations:

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah