Are you a high net worth individual looking for ways to reduce your tax burden? Or perhaps you own a business that is facing tax problems and in need of legal guidance? Look no further than our tax attorney’s website, where you can find comprehensive information about tax law for trusts. Trusts can be a powerful tool for tax planning, asset protection, and succession planning. In this article, we will delve into the intricacies of tax law for trusts, providing you with valuable insights and answering your most frequently asked questions. By understanding the benefits and implications of trusts, you can make informed decisions to optimize your tax situation. Remember, our lawyer is just a phone call away, ready to provide expert advice tailored to your specific needs.

Tax Law For Trusts

Welcome to our comprehensive guide on tax law for trusts! In this article, we will cover everything you need to know about trusts and their taxation. Whether you are an individual looking to minimize your tax burden or a business with tax problems, understanding the intricacies of trust taxation is crucial. Let’s delve into the various aspects of tax law for trusts and explore how it can benefit you.

Overview of Trusts

Definition and Purpose of Trusts

A trust is a legal arrangement in which a person, known as the settlor, transfers assets to a trustee who manages these assets on behalf of the beneficiaries. The purpose of a trust is to protect and manage assets, distribute income or property to beneficiaries, and minimize tax liabilities. Trusts are commonly used in estate planning to ensure the smooth transfer of wealth and to provide for loved ones.

Types of Trusts

There are various types of trusts, each with its unique characteristics and tax implications. Common types include revocable trusts, irrevocable trusts, grantor trusts, charitable trusts, and specialized trusts. Revocable trusts can be modified or revoked by the settlor, while irrevocable trusts cannot be changed once established. Grantor trusts are those where the settlor retains certain rights or powers over the trust, and charitable trusts have a charitable purpose. Specialized trusts, such as generation-skipping trusts or educational trusts, serve specific purposes.

Benefits of Establishing a Trust

Establishing a trust can provide several benefits for individuals and businesses alike. Firstly, trusts allow for the efficient management and distribution of assets, ensuring that beneficiaries are taken care of. Secondly, trusts can provide asset protection, safeguarding assets from creditors and legal claims. Additionally, trusts offer privacy as they are not subject to public probate proceedings. Lastly, trusts can offer substantial tax advantages, which we will explore further in the next sections.

Common Uses of Trusts in Tax Planning

Trusts play a significant role in tax planning by offering various opportunities for minimizing tax burdens. Some common uses of trusts in tax planning include reducing estate taxes, protecting assets from taxation, facilitating charitable giving, and providing for family members with special needs. By strategically utilizing different types of trusts and understanding the tax consequences, individuals and businesses can optimize their tax positions while achieving their financial goals.

Taxation of Trusts

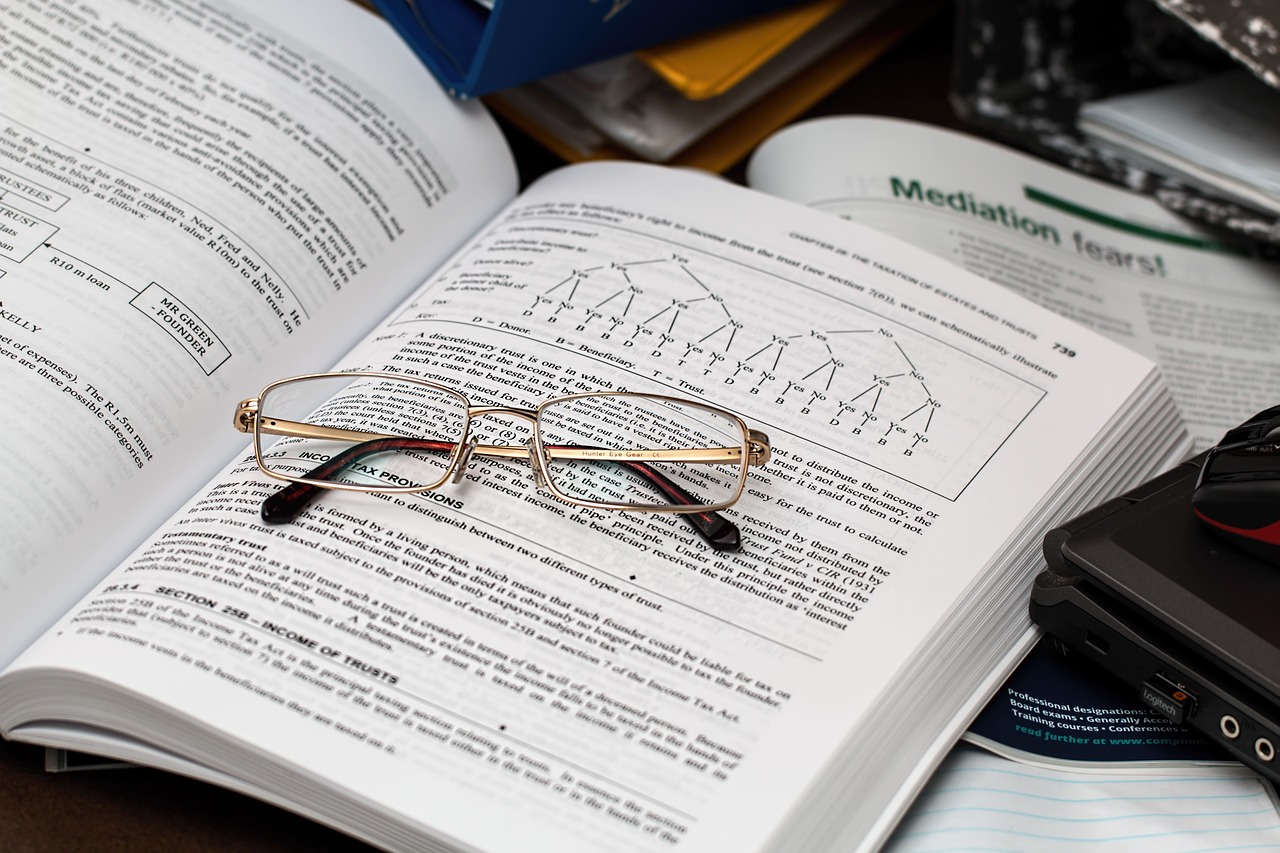

Classification of Trusts for Tax Purposes

For tax purposes, trusts are classified into two main categories: grantor trusts and non-grantor trusts. Grantor trusts are those where the settlor retains certain control or benefits over the trust, resulting in the settlor being responsible for reporting and paying taxes on the trust’s income. Non-grantor trusts, on the other hand, are separate taxable entities, and taxes are paid by the trust itself.

Taxation of Grantor Trusts

In grantor trusts, all items of income, deductions, and credits are reported on the grantor’s individual tax return. The income generated by the trust is effectively “passed through” to the grantor, who pays taxes on it as if it were their own. This can be advantageous for the grantor, as it avoids the potential for double taxation that occurs with non-grantor trusts.

Taxation of Non-Grantor Trusts

Non-grantor trusts are separate taxable entities, and they must file an income tax return (Form 1041). The trust itself is responsible for paying taxes on its generated income. The income tax rates for trusts can be higher compared to individual tax rates, making effective tax planning essential to minimize tax liability.

Tax Rates for Trusts

Trusts have their own graduated tax rate schedule. The tax rates applicable to trusts can be higher than individual tax rates, especially for higher-income trusts. It is crucial to consider these rates and be mindful of tax planning strategies to optimize the tax efficiency of trust structures.

Income Tax Reporting for Trusts

Trusts must file an annual income tax return, Form 1041. This return reports the trust’s income, deductions, credits, and taxes paid. Additionally, beneficiaries may receive a Schedule K-1, which outlines their share of the trust’s income, deductions, credits, and other relevant information. Proper income tax reporting for trusts is crucial to ensure compliance with tax regulations.

Tax Planning for Trusts

Strategies for Minimizing Trust Taxes

Effective tax planning strategies can minimize the tax burden associated with trusts. One common strategy is the distribution of income or assets to beneficiaries in lower tax brackets. By strategically timing distributions, it is possible to reduce the overall tax liability of the trust. Additionally, considering the use of specific types of trusts, such as charitable remainder trusts or generation-skipping trusts, can provide tax advantages in certain situations.

Distribution Planning for Tax Efficiency

Strategic distribution planning is a crucial aspect of trust tax planning. By distributing income or assets to beneficiaries in lower tax brackets, it is possible to minimize the tax liability of the trust as a whole. Careful consideration of the timing and frequency of distributions can have a significant impact on the overall tax efficiency of the trust.

Charitable Trusts and Tax Advantages

Charitable trusts offer unique tax advantages for those looking to support charitable causes while reducing their tax burden. By establishing a charitable trust, individuals can make tax-deductible contributions to the trust, reducing their taxable income. Additionally, the trust itself may qualify for tax-exempt status, further enhancing the tax benefits.

Estate Tax Planning with Trusts

Trusts are powerful tools for estate tax planning. By transferring assets to a trust, individuals can remove them from their taxable estate, thereby reducing potential estate tax liabilities. Various types of trusts, such as irrevocable life insurance trusts or qualified personal residence trusts, can be utilized to achieve estate tax planning goals.

Foreign Trusts and International Tax Considerations

For individuals with offshore assets or international tax considerations, foreign trusts can offer significant tax planning opportunities. However, it is crucial to understand the complex rules and reporting requirements associated with foreign trusts to ensure compliance with both domestic and international tax laws. Consulting with a knowledgeable tax attorney is essential in navigating these complexities.

Tax Reporting for Trusts

Filing Requirements for Trusts

Trusts have specific filing requirements that must be adhered to. Generally, if a trust generates more than $600 of income or has a nonresident alien as a beneficiary, it must file an income tax return (Form 1041). However, specialized trusts or certain situations may warrant additional reporting obligations. Properly understanding and complying with these filing requirements is essential to avoid penalties for non-compliance.

Income Tax Return for Trusts

Trusts must file an income tax return using Form 1041. This return reports the trust’s income, deductions, credits, and taxes paid. It is crucial to ensure accurate and timely filing of the income tax return to prevent penalties and maintain compliance with tax regulations.

Reporting Trust Income and Deductions

Properly reporting trust income and deductions is crucial for accurate tax reporting. Trust income, such as interest, dividends, rents, and capital gains, must be reported on the income tax return. Deductions, such as expenses related to the administration of the trust, can be claimed to reduce the taxable income of the trust. Consultation with a tax attorney is recommended to navigate the complexities of income and deduction reporting for trusts.

Gift and Estate Tax Reporting for Trusts

Trusts can have potential gift and estate tax implications, depending on the circumstances. When assets are transferred to a trust, potential gift tax consequences may arise. Additionally, when the grantor passes away, the assets held in the trust may be subject to estate taxes. Proper reporting of gifts and potential estate tax liabilities is essential to ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the tax reporting requirements for trusts can result in significant penalties. Late filing penalties, accuracy-related penalties, and fraud penalties may apply for non-compliance. It is crucial to prioritize accurate and timely tax reporting to avoid unnecessary penalties and maintain compliance with tax laws.

Tax Consequences of Trust Distributions

Taxable Distributions from Trusts

When a trust distributes income or assets to beneficiaries, certain tax consequences may apply. Taxable distributions from trusts are subject to income tax for both the trust and the beneficiary. The character of the distribution, such as interest, dividends, or capital gains, will determine how it is taxed.

Exceptions and Exemptions for Trust Distributions

Certain exceptions and exemptions may apply to trust distributions, potentially reducing or eliminating the tax liability associated with these distributions. For example, distributions for qualified charitable purposes may be tax-exempt, providing significant tax advantages. Additionally, distributions that are part of the trust’s distributable net income or are used for education or medical expenses may be eligible for favorable tax treatment.

Tax Treatment of Trust Beneficiaries

Trust beneficiaries are subject to tax on distributions they receive from the trust. The tax treatment of trust distributions depends on various factors, including the character of the distribution, the beneficiary’s tax bracket, and any applicable exceptions or exemptions. Consulting with a tax attorney can help beneficiaries navigate the tax implications of trust distributions and optimize their tax positions.

Distribution Timing for Tax Efficiency

Strategic distribution timing can optimize the tax efficiency of trust distributions. By considering the beneficiaries’ tax brackets and the timing of their other income sources, it is possible to minimize the overall tax liability associated with trust distributions. Proper planning and consultation with a tax attorney can ensure that distributions are timed to achieve the desired tax outcomes.

Tax Treatment of Trust Expenses

Deductibility of Trust Expenses

Trust expenses incurred in the administration and management of the trust may be deductible for tax purposes. Deductible trust expenses can help reduce the trust’s taxable income, thereby minimizing the overall tax liability. Proper documentation and understanding of the rules surrounding deductible trust expenses are essential to maximize tax benefits.

Types of Deductible Trust Expenses

Several types of trust expenses may be deductible for tax purposes. Examples include trustee fees, legal and accounting fees, investment advisory fees, and expenses incurred in the maintenance and operation of trust assets. It is crucial to carefully track and document these expenses to ensure proper deduction.

Limitations and Restrictions on Deductibility

While trust expenses can be deductible, there are limitations and restrictions that must be considered. For example, expenses that are unrelated to the production of trust income may not be deductible. Additionally, certain expenses may be subject to the 2% floor for miscellaneous itemized deductions. Consultation with a tax attorney can help navigate these limitations and maximize the deductibility of trust expenses.

Grantor Trusts and Taxation

Definition and Characteristics of Grantor Trusts

Grantor trusts are a unique type of trust in which the grantor retains certain control or benefits over the trust. This control or benefit results in the grantor being considered the owner of the trust for tax purposes. Grantor trusts offer several advantages, including the ability to “pass through” income to the grantor and avoid potential double taxation.

Taxation of Grantor Trusts

In grantor trusts, all items of income, deductions, and credits are reported on the grantor’s individual tax return. The grantor is responsible for paying taxes on the trust’s income as if it were their own. The ability to pass through income to the grantor can result in significant tax savings and increased tax efficiency.

Grantor Trust Rules and Tax Planning

The grantor trust rules outline the specific circumstances under which a trust is considered a grantor trust for tax purposes. Understanding these rules is crucial for effective tax planning. By utilizing grantor trusts strategically, individuals can achieve their tax planning goals while minimizing tax liabilities.

Taxation of Revocable Trusts

Tax Treatment of Revocable Trusts

Revocable trusts, also known as living trusts, are trusts that can be modified or revoked by the settlor during their lifetime. From a tax perspective, revocable trusts do not have separate tax identities. Instead, all income and deductions of the trust are reported on the settlor’s individual tax return. The settlor is responsible for paying taxes on the trust’s income as if it were their own.

Revocable Trusts and Estate Tax Planning

While revocable trusts offer several benefits, such as avoiding probate and providing for disability planning, they do not offer direct estate tax planning advantages. Upon the settlor’s death, the assets held in the revocable trust are included in the settlor’s taxable estate and may be subject to estate taxes. However, revocable trusts can still play a crucial role in overall estate planning strategies.

Income Tax Reporting for Revocable Trusts

Revocable trusts do not require separate income tax reporting. Instead, all income and deductions of the trust are reported on the settlor’s individual income tax return. The income generated by the trust is considered the settlor’s income, and taxes are paid accordingly.

FAQs

What is a trust?

A trust is a legal arrangement in which assets are transferred to a trustee who manages them on behalf of beneficiaries. Trusts are commonly used for estate planning, asset protection, and tax planning purposes.

How are trusts taxed?

The taxation of trusts depends on the type of trust. Grantor trusts are taxed as if the income belonged to the grantor, while non-grantor trusts are separate taxable entities. Trusts must file income tax returns, and distribution of income or assets to beneficiaries may have tax consequences.

Can trusts help reduce my tax burden?

Yes, trusts can be effective tools for reducing tax burdens. Strategic tax planning, utilizing specific types of trusts, and distributing income or assets to beneficiaries in lower tax brackets can all contribute to minimizing tax liabilities.

What are the reporting requirements for trusts?

Trusts must file an income tax return (Form 1041) if they generate more than $600 of income or have a nonresident alien as a beneficiary. Additionally, proper reporting of trust income and deductions is required.

Are there tax consequences to trust distributions?

Yes, trust distributions can have tax consequences. Taxable distributions are subject to income tax for both the trust and the beneficiary. However, certain exceptions and exemptions may apply, reducing or eliminating the tax liability associated with distributions.

Remember, our knowledgeable tax attorneys are here to help you navigate the complexities of tax law for trusts. If you have any questions or need assistance with your specific tax situation, don’t hesitate to contact us for a consultation. We are committed to providing personalized and effective tax solutions for individuals and businesses. Call us today to take the next step toward optimizing your tax planning and reducing your tax burden.