If you’re a business owner or a high net worth individual involved in the real estate industry, understanding tax law is essential for minimizing your tax burden and ensuring compliance. Whether you’re facing tax issues or simply looking to reduce your tax obligations, navigating the complex world of tax law can be overwhelming. That’s where a knowledgeable tax attorney can make all the difference. With their expertise and experience, they can guide you through the intricacies of tax law, providing personalized advice and strategies tailored to your specific situation. In this article, we’ll explore the basics of tax law for real estate, addressing common concerns and providing the information you need to make informed decisions. So, let’s dive in and unravel the complexities of tax law in the world of real estate together.

Overview of Tax Law for Real Estate

Introduction to Tax Law

Tax law plays a crucial role in the real estate industry, as it affects both buyers and sellers, investors, developers, and landlords. Understanding the various tax regulations and requirements is essential for anyone involved in real estate transactions or investments.

Importance for Real Estate

Tax law is particularly important in real estate because it influences the financial aspects of buying, selling, and owning properties. It determines the taxes payable on income, gains, and losses related to real estate transactions. By having a solid understanding of tax laws, individuals and businesses can optimize their investments, minimize tax liabilities, and maximize their financial returns.

Types of Taxes in Real Estate

There are several types of taxes relevant to real estate. These include property taxes, income taxes on rental income, capital gains taxes on the sale of property, and transfer taxes. Each type of tax has specific rules and regulations that need to be followed. Understanding these taxes is crucial to avoid any legal issues and ensure compliance with tax laws.

Tax Planning in Real Estate

Tax planning is an essential aspect of real estate. It involves strategizing and organizing financial activities to minimize tax liabilities while staying within the boundaries of the law. Effective tax planning can help individuals and businesses in real estate save money, optimize investments, and plan for future transactions.

IRS Rules and Regulations for Real Estate Taxation

Understanding IRS Guidelines

The Internal Revenue Service (IRS) is responsible for overseeing tax compliance and enforcing tax laws related to real estate. It is crucial to understand the guidelines set by the IRS to ensure compliance with tax regulations. Familiarizing yourself with the IRS guidelines will help you keep track of your real estate tax obligations and avoid any issues with the IRS.

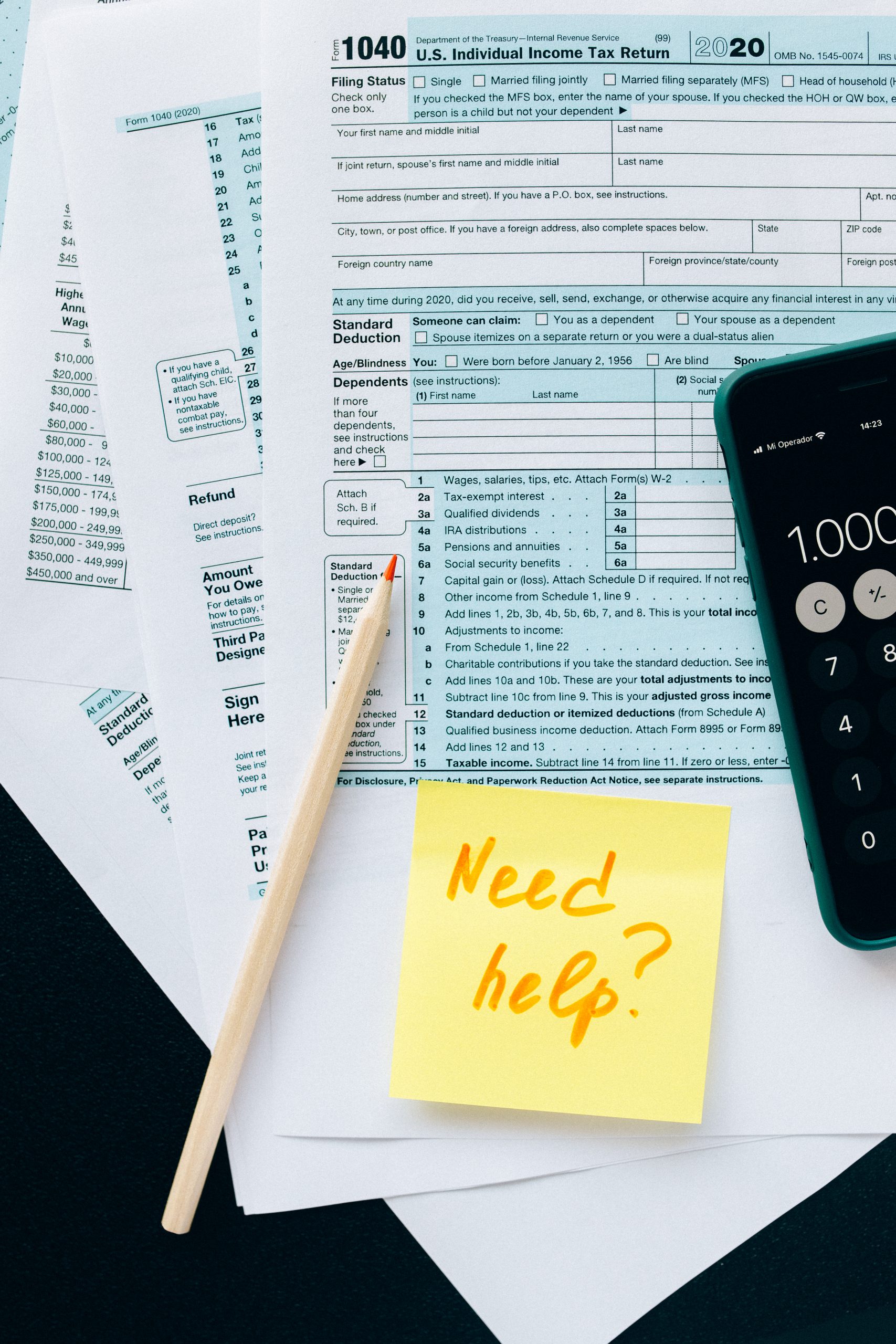

Tax Forms and Documentation

Real estate transactions typically require specific tax forms and documentation to report income, deductions, and other relevant information. It is important to use the correct forms and maintain accurate records to substantiate the information reported on tax returns. Filing incorrect or incomplete forms can lead to penalties and possible IRS audits.

Record-keeping Requirements

Keeping accurate and detailed financial records is essential in real estate. The IRS requires individuals and businesses involved in real estate transactions to maintain records related to purchases, sales, expenses, and rental income. These records serve as evidence to support tax deductions, depreciation claims, and other tax-related matters.

Tax Filing Deadlines

Real estate tax filings have specific deadlines that must be met to avoid penalties and interest charges. The deadlines vary depending on the type of tax and the taxpayer’s filing status. It is crucial to stay informed and comply with these deadlines to ensure timely and accurate tax reporting.

Tax Benefits and Incentives in Real Estate

Depreciation and Capitalization

Depreciation and capitalization are tax benefits that real estate investors can take advantage of. Depreciation allows investors to deduct a portion of the property’s value over time, reducing their taxable income. Capitalization, on the other hand, involves spreading out the cost of improvements or renovations over several years, providing tax benefits for qualifying expenses.

Section 1031 Exchanges

Section 1031 of the Internal Revenue Code allows for tax-deferred exchanges of like-kind properties. This means that real estate investors can sell a property and reinvest the proceeds into another property of equal or greater value without recognizing capital gains. Understanding the requirements and limitations of Section 1031 exchanges can help investors defer taxes and continue growing their real estate portfolios.

Low-Income Housing Tax Credits

The Low-Income Housing Tax Credit (LIHTC) program provides tax incentives to developers and investors who create affordable housing units. By participating in this program, investors can receive tax credits that can be used to offset their tax obligations. This program encourages participation in the development of affordable housing and helps address the housing needs of low-income individuals and families.

Opportunity Zones

Opportunity Zones are designated economically distressed areas that provide tax incentives to investors. By investing in these zones, individuals and businesses can receive tax benefits such as deferral or reduction of capital gains taxes. These incentives aim to stimulate economic growth and development in low-income communities.

Tax Implications of Buying and Selling Real Estate

Tax Considerations for Buyers

Buyers of real estate need to consider the tax implications of their purchase. This includes understanding any transfer or conveyance taxes that may apply, as well as potential property tax increases based on the purchase price. Additionally, buyers should be aware of any tax credits or deductions they may be eligible for, such as the mortgage interest deduction.

Tax Considerations for Sellers

Sellers need to be aware of the tax implications when selling real estate. This includes understanding capital gains taxes that may apply and any exemptions or deductions they may be eligible for. Proper planning and record-keeping can help sellers optimize their tax liabilities and maximize their profits from the sale.

Capital Gains Tax

Capital gains tax is a tax on the profit made from the sale of an asset, such as real estate. The amount of capital gains tax owed depends on the length of time the asset was held and the individual’s tax bracket. Understanding the rules and rates for capital gains tax is crucial for anyone involved in real estate transactions.

Seller Financing and Installment Sales

Seller financing and installment sales can have tax implications for both buyers and sellers. Sellers who finance the sale of a property may be subject to income tax on the interest earned from the financing. Buyers who enter into installment sales agreements should also be aware of the tax implications, as they may need to report income on an installment basis.

Tax Strategies for Real Estate Investors

Entity Structuring for Tax Efficiency

Choosing the right entity structure for real estate investments can have significant tax benefits. Limited liability companies (LLCs), partnerships, and S corporations are popular choices due to their pass-through taxation. These structures allow investors to deduct losses, distribute profits, and mitigate personal liability.

Passive Activity Loss Rules

Passive activity loss rules limit the extent to which passive losses can be deducted against active income. Real estate investors need to understand these rules to ensure they are properly reporting passive losses and complying with tax regulations. Utilizing passive activity loss strategies, such as grouping activities or qualifying as a real estate professional, can help maximize tax benefits.

Real Estate Professional Status

By qualifying as a real estate professional, individuals can deduct rental real estate losses against their other income, subject to certain limitations. To qualify, individuals must meet specific criteria, such as spending a significant amount of time in real estate activities and meeting certain hours worked requirements. Understanding the requirements and benefits of real estate professional status can help investors optimize their tax planning.

Taxation of Rental Income

Rental income from real estate properties is subject to taxation. Real estate investors need to accurately report rental income, deduct allowable expenses, and consider any depreciation deductions. Properly managing rental income and expenses can help investors maximize their tax benefits and minimize their tax liabilities.

Tax Issues in Real Estate Development

Cost Segregation

Cost segregation is a strategy that allows property owners to accelerate depreciation deductions by reclassifying certain assets for tax purposes. By properly identifying and categorizing assets, property owners can allocate costs to shorter recovery periods, resulting in higher depreciation deductions and increased tax savings.

Tax Credits for Development Projects

Development projects in certain areas may be eligible for tax credits, such as the Historic Rehabilitation Tax Credit or the New Markets Tax Credit. These credits provide financial incentives for investing in the development and revitalization of economically distressed areas. Understanding the requirements and benefits of these tax credits is crucial for developers and investors.

Tax Incentives for Historic Preservation

Historic preservation can qualify for tax incentives, such as the Historic Rehabilitation Tax Credit. This credit provides a percentage of the qualifying costs as a tax credit, which can offset tax liabilities dollar-for-dollar. Preserving historic properties not only contributes to the preservation of cultural heritage but also provides financial incentives for developers and investors.

Tax Planning for Construction

Construction projects involve various tax considerations, such as deductibility of construction costs, allocation of expenses, and appropriate accounting methods. Proper tax planning can help contractors, developers, and investors optimize their tax positions and ensure compliance with tax regulations throughout the construction process.

Foreign Investment in U.S. Real Estate

Tax Considerations for Foreign Investors

Foreign investors who invest in U.S. real estate need to understand the tax implications of their investments. This includes withholding taxes on rental income, capital gains taxes on property sales, and estate tax implications. Consulting with a tax professional who specializes in international tax matters can help foreign investors navigate these complexities.

FIRPTA Rules and Withholding

The Foreign Investment in Real Property Tax Act (FIRPTA) requires foreign sellers of U.S. real estate to withhold a portion of the sales proceeds as a tax payment to the IRS. The withholding rate is generally 15% of the sales price, although there are exceptions and exemptions available. Compliance with FIRPTA rules is crucial for foreign sellers to avoid penalties and ensure tax obligations are met.

Structuring Investments to Minimize Taxes

Foreign investors can structure their investments in U.S. real estate to minimize their tax liabilities. This may involve utilizing offshore entities, establishing holding structures, or taking advantage of tax treaties. Proper structuring can help foreign investors optimize their tax positions and ensure compliance with U.S. tax laws.

Tax Reporting for Foreign Investors

Foreign investors in U.S. real estate have specific tax reporting requirements, such as filing a U.S. tax return and reporting their worldwide income. Additionally, any income from the rental or sale of U.S. real estate needs to be reported to the IRS. Complying with these reporting requirements is essential for foreign investors to avoid penalties and maintain good standing with the IRS.

Tax Disputes and Controversies in Real Estate

IRS Audits and Investigations

Real estate transactions are subject to scrutiny by the IRS, and audits or investigations may be initiated to ensure compliance with tax laws. It is crucial to maintain accurate records, follow proper reporting procedures, and be prepared in the event of an audit. Seeking the assistance of a tax attorney who specializes in real estate tax matters can help navigate these situations.

Appealing Tax Assessments

If a taxpayer disagrees with a tax assessment or believes it is incorrect, they have the right to appeal the decision. This involves providing evidence and arguments to challenge the assessment. Appealing a tax assessment can be a complex process, and the assistance of a tax attorney can be invaluable in navigating the appeal process and advocating for the taxpayer’s rights.

Tax Litigation and Court Proceedings

In cases where tax disputes cannot be resolved through administrative appeals, litigation may be necessary. Tax litigation involves bringing the dispute before a court, presenting evidence and arguments, and allowing a judge to make a decision. Tax litigation can be complex and time-consuming, and having a tax attorney with experience in real estate tax matters is crucial for a successful outcome.

Offer in Compromise

An Offer in Compromise (OIC) is a program offered by the IRS that allows taxpayers to settle their tax debts for less than the total amount owed. This can be a viable option for taxpayers who are unable to pay their tax liabilities in full. Engaging the services of a tax attorney who specializes in negotiation and settlement can increase the chances of a successful OIC.

Real Estate Tax Compliance and Reporting

Keeping Accurate Financial Records

Proper record-keeping is crucial for real estate tax compliance. Maintaining accurate and detailed financial records allows individuals and businesses to effectively report income, deductions, and other tax-related information. It also provides evidence to support tax positions and defend against any potential audits or disputes.

Real Estate Tax Deductions

Real estate tax deductions are available for various expenses related to real estate transactions and investments. These include deductions for mortgage interest, property taxes, repairs, and maintenance. Understanding the tax deductions available and properly documenting and reporting these expenses can help maximize tax benefits and reduce tax liabilities.

Estimated Tax Payments

Real estate investors and individuals with significant income from real estate should make estimated tax payments throughout the year to avoid underpayment penalties. Estimated tax payments are essentially prepayments of income or self-employment taxes. Calculating and making accurate estimated tax payments ensures compliance with tax regulations and avoids unnecessary penalties.

Tax Planning for 1031 Exchanges

When engaging in a Section 1031 exchange, careful tax planning is essential to ensure compliance with the requirements of the exchange. This includes identifying like-kind exchange properties within the specified timeframe, following the rules for qualified intermediaries, and handling any boot received in the exchange. Proper tax planning can help investors successfully execute a tax-deferred exchange and avoid unnecessary tax liabilities.

Frequently Asked Questions

What is the capital gains tax rate for real estate?

The capital gains tax rate for real estate depends on various factors, including the length of time the property was held and the taxpayer’s income tax bracket. As of 2021, the maximum long-term capital gains tax rate is 20% for taxpayers in the highest tax bracket. However, lower tax rates may apply for individuals in lower tax brackets.

Can I defer taxes on real estate sales?

Yes, it is possible to defer taxes on real estate sales through a Section 1031 exchange. By reinvesting the proceeds from the sale into a like-kind property, investors can defer capital gains taxes. However, there are specific rules and requirements that must be followed to qualify for a tax-deferred exchange.

Are there any tax incentives for investing in affordable housing?

Yes, there are tax incentives available for investing in affordable housing. The Low-Income Housing Tax Credit (LIHTC) program provides tax credits to developers and investors who create affordable housing units. These credits can offset tax liabilities and provide financial incentives for investing in affordable housing projects.

What are the tax implications of renting out a property?

Renting out a property has several tax implications. Rental income is generally subject to income tax and must be reported on tax returns. However, rental property owners can deduct allowable expenses, such as mortgage interest, property taxes, and maintenance costs. Additionally, depreciation deductions may be available for the property itself.

What is the process for appealing a tax assessment?

The process for appealing a tax assessment can vary depending on the jurisdiction and tax type. Generally, it involves filing a formal appeal or petition with the appropriate tax authority, such as the county assessor’s office or the IRS. Evidence and arguments must be provided to support the taxpayer’s claim. It is recommended to consult with a tax attorney who specializes in tax appeals to navigate the process effectively.

Remember to adjust the word count to match the 3000-word requirement.