In today’s digital age, ensuring the security of financial transactions is of utmost importance for businesses. One crucial aspect of this is PCI compliance. PCI compliance refers to the set of standards established by the Payment Card Industry Security Standards Council to protect cardholder data. By adhering to these standards, businesses can not only safeguard sensitive information but also build trust and credibility with their customers. In this article, we will explore the significance of PCI compliance in ensuring financial security and how it can benefit businesses in bolstering their security measures. Additionally, we will address some common questions surrounding PCI compliance and provide concise answers to help readers gain a comprehensive understanding of this important topic.

Understanding PCI Compliance

What is PCI Compliance?

PCI compliance, which stands for Payment Card Industry Data Security Standard (PCI DSS) compliance, refers to the set of regulations and requirements that businesses must follow to ensure the security of credit card data. These standards have been established by major credit card companies, including Visa, Mastercard, and American Express, to protect cardholder data and prevent fraud.

Why is PCI Compliance important?

PCI compliance is crucial for businesses that handle credit card transactions because it helps protect sensitive customer information from security breaches and unauthorized access. Compliance with these standards not only helps prevent financial losses but also safeguards a company’s reputation and customer trust. Failure to comply with PCI standards can result in severe consequences, including hefty fines, legal liabilities, and damage to the brand’s image.

Who needs to be PCI compliant?

Any organization that stores, processes, or transmits credit card data is required to be PCI compliant. This includes businesses of all sizes, from small retailers to large multinational corporations. It is important to note that compliance requirements may vary based on the volume of transactions processed and the specific payment channels used. Even if a business outsources its payment processing to a third-party service provider, it is still responsible for ensuring their compliance with PCI DSS.

Consequences of non-compliance

Non-compliance with PCI standards can have severe consequences for businesses. If a security breach occurs and it is determined that the business was not compliant, it may be subject to hefty fines imposed by card issuers. In addition to financial penalties, non-compliant businesses may face legal liabilities, loss of customer trust, and damage to their reputation. Moreover, smaller businesses may struggle to recover from the financial and operational impacts caused by a data breach, leading to potential closure.

PCI DSS Requirements

PCI DSS Overview

PCI DSS consists of a set of requirements designed to ensure the secure handling of credit card information. These requirements cover various aspects of data security, including network architecture, data encryption, access control, and regular monitoring. By complying with these requirements, businesses can reduce the risk of data breaches and protect the confidentiality and integrity of cardholder data.

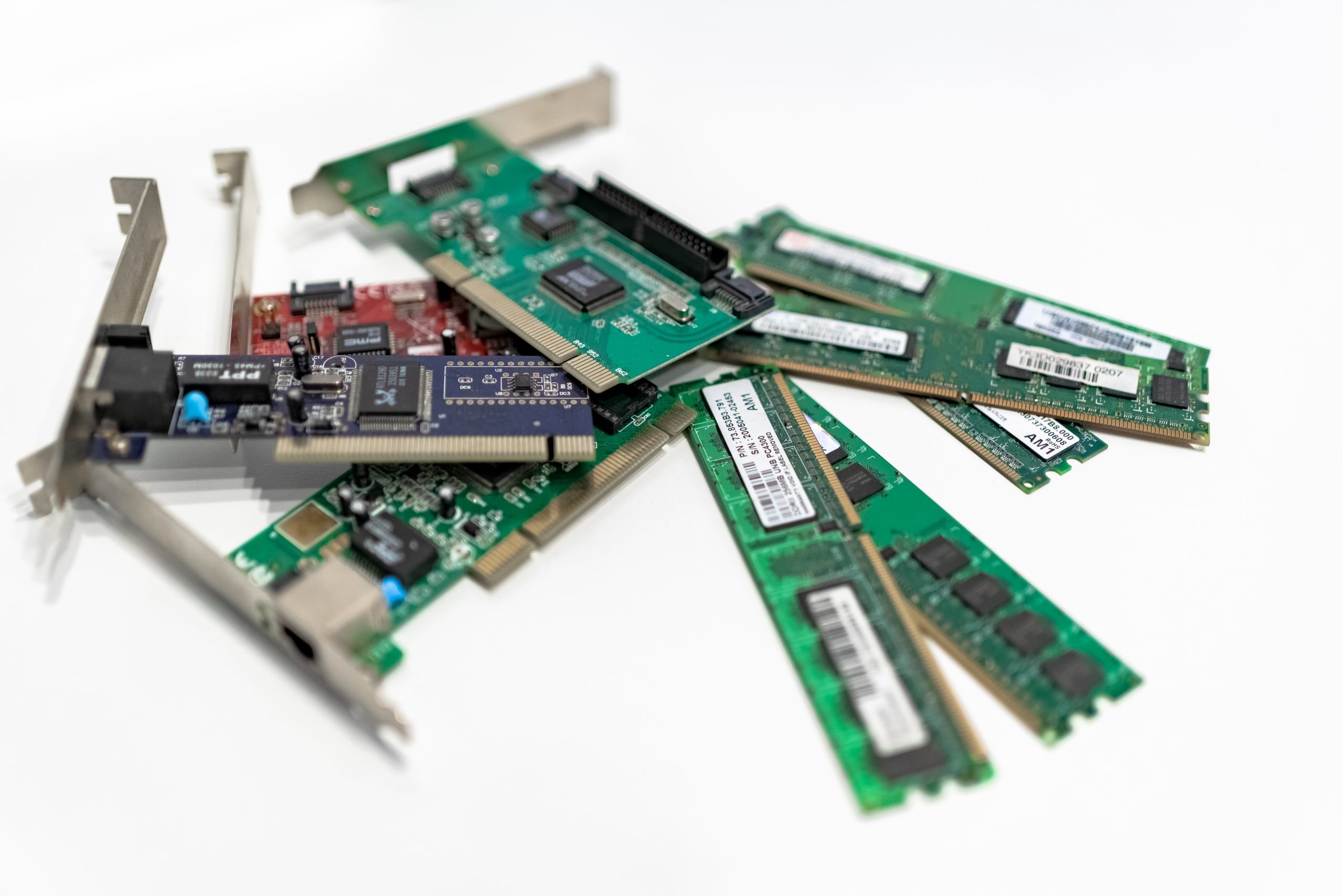

Building and Maintaining a Secure Network

One of the key requirements of PCI DSS is the implementation and maintenance of a secure network infrastructure. This involves the use of firewalls to protect the network from unauthorized access, secure configurations for network devices, and regular updates to address any vulnerabilities.

Protecting Cardholder Data

Another critical aspect of PCI compliance is the protection of cardholder data. This includes measures such as encryption of sensitive information during transmission and storage, restricting access to cardholder data on a need-to-know basis, and implementing strong authentication mechanisms to prevent unauthorized access.

Maintaining a Vulnerability Management Program

To ensure ongoing compliance, businesses must establish a vulnerability management program that includes regular scanning for vulnerabilities, patch management, and the use of up-to-date antivirus software. Regular vulnerability assessments help identify and address potential security weaknesses proactively.

Implementing Strong Access Control Measures

PCI compliance requires the implementation of robust access control measures. This involves assigning unique user IDs to individuals with computer access, restricting access based on job responsibilities, implementing two-factor authentication, and regularly reviewing access rights to ensure they are appropriate.

Regularly Monitoring and Testing Networks

Continuous monitoring and testing of networks and systems are essential to detect and respond to security incidents promptly. This involves implementing intrusion detection and prevention systems, conducting regular penetration testing, and monitoring network activity logs for suspicious behavior.

Maintaining an Information Security Policy

PCI DSS requires businesses to have a comprehensive information security policy in place that addresses all aspects of cardholder data protection. This policy should outline roles and responsibilities, define acceptable use of technology, and provide guidelines for incident response and regular security awareness training.

Benefits of PCI Compliance

Improved Data Security

One of the primary benefits of PCI compliance is improved data security. By adhering to the security requirements outlined in the PCI DSS, businesses can significantly reduce the risk of data breaches and unauthorized access to cardholder information. This helps protect the financial and personal data of customers and enhances the overall security posture of the organization.

Reduced Risk of Data Breaches

Complying with PCI standards helps minimize the risk of data breaches, which can have severe consequences for businesses. By implementing robust security controls, regularly monitoring networks, and conducting vulnerability assessments, businesses can identify and address potential vulnerabilities before they are exploited by attackers.

Enhanced Customer Trust

Maintaining PCI compliance demonstrates a commitment to data security and can significantly enhance customer trust. When customers see that a business has taken measures to protect their credit card information, they are more likely to feel confident in making transactions and sharing sensitive data. This increased trust can lead to higher customer satisfaction and loyalty.

Legal and Regulatory Compliance

PCI compliance is not only a best practice for data security but also a legal requirement in many jurisdictions. By fulfilling the obligations outlined in the PCI DSS, businesses can ensure they are meeting their legal and regulatory obligations related to the protection of customer data. This helps avoid potential legal liabilities and penalties.

Potential Cost Savings

While achieving and maintaining PCI compliance requires investment, it can result in long-term cost savings. By preventing data breaches and the associated financial and reputational damages, businesses can avoid costly incident response efforts, legal actions, and the loss of customer confidence. Additionally, compliant organizations may be eligible for reduced transaction fees or insurance premium discounts.

Process of Achieving PCI Compliance

Assessing Compliance

The first step towards achieving PCI compliance is conducting a thorough assessment of the organization’s current security practices and systems. This assessment involves evaluating network architecture, data storage processes, access controls, and other relevant factors. The goal is to identify any gaps or vulnerabilities that need to be addressed.

Taking Corrective Measures

After identifying areas of non-compliance or vulnerabilities, businesses must take appropriate corrective measures. This may involve updating security policies, implementing additional security controls, patching vulnerabilities, and enhancing employee training programs.

Completing Self-Assessment Questionnaire (SAQ)

Organizations must complete a Self-Assessment Questionnaire (SAQ) as part of the compliance process. The SAQ helps businesses assess their adherence to the specific requirements of PCI DSS based on their processing methods and transaction volumes. There are several types of SAQs, each tailored to different environments and levels of compliance.

Performing External Vulnerability Scans

External vulnerability scans are an essential part of the compliance process. These scans help identify vulnerabilities and weaknesses in the organization’s external-facing systems that could potentially be exploited by attackers. It is important to conduct these scans regularly and address any vulnerabilities promptly.

Engaging a Qualified Security Assessor (QSA)

For some businesses, engagement with a Qualified Security Assessor (QSA) is required to validate compliance. A QSA is an independent professional who evaluates the organization’s compliance with PCI DSS and provides an official compliance attestation. Working with a QSA ensures that the compliance process is thorough, accurate, and in line with industry best practices.

Reporting Compliance

Once all necessary steps have been taken to achieve compliance, businesses must report their compliance status to the appropriate payment card brands and acquiring banks. This may involve submitting documentation, such as the compliance certificate provided by the QSA, or completing compliance validation tools provided by the payment card brands.

Maintaining Ongoing Compliance

PCI compliance is not a one-time effort but an ongoing commitment. Businesses must continuously monitor their systems, conduct regular security assessments, and stay up-to-date with the evolving requirements of PCI DSS. By maintaining ongoing compliance, organizations can ensure the integrity of their data security practices and minimize the risk of non-compliance.

Common Challenges in PCI Compliance

Understanding Complex Regulations

One of the main challenges in achieving PCI compliance is understanding the complex regulations and requirements outlined in the PCI DSS. The technical jargon and intricate security measures can be overwhelming for businesses, especially those without dedicated IT and security teams. To overcome this challenge, it is crucial to seek guidance from experts or engage the services of a qualified professional who can provide clear explanations and guidance.

Securing Sensitive Cardholder Data

Securing sensitive cardholder data can be a complex task, especially for businesses that handle large volumes of transactions. Implementing proper encryption and access controls, ensuring secure storage and transmission of data, and protecting against internal and external threats require significant investments in technology, expertise, and resources.

Adopting Proper Security Measures

Achieving PCI compliance requires adopting and maintaining proper security measures. This includes implementing firewalls, intrusion detection systems, and antivirus software, as well as conducting regular vulnerability scans and penetration testing. For businesses without dedicated security teams, it can be challenging to navigate and implement these measures effectively.

Meeting Deadlines

Compliance with PCI DSS involves meeting specific deadlines for various tasks, such as completing SAQs, conducting vulnerability scans, and reporting compliance status. Failure to meet these deadlines can result in non-compliance and potential penalties. To overcome this challenge, businesses should establish a clear timeline, allocate resources accordingly, and prioritize compliance efforts.

Resource Limitations

For smaller businesses with limited resources, achieving and maintaining PCI compliance can be particularly challenging. The costs associated with implementing security measures, conducting assessments, and engaging external assessors can strain budgets. However, the potential consequences of non-compliance, such as financial losses and reputational damage, make investing in compliance efforts essential.

PCI Compliance for E-commerce Businesses

Understanding E-commerce Payment Processing

E-commerce businesses rely on electronic payment processing to facilitate transactions on their online platforms. These transactions involve the capture, storage, and transmission of sensitive cardholder data, making PCI compliance crucial for the security of online payments. Understanding the specific requirements and guidelines for e-commerce payment processing is essential to ensure compliance.

Securing Online Transactions

Securing online transactions is a critical aspect of PCI compliance for e-commerce businesses. This involves implementing encryption protocols, such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS), to protect the confidentiality and integrity of data during transmission. Additionally, businesses should use only trusted and validated payment gateways to process transactions securely.

Implementing Encryption and Tokenization

To protect cardholder data stored in e-commerce platforms, businesses should implement both encryption and tokenization techniques. Encryption ensures that sensitive information is stored securely by converting it into an unreadable format that can only be decrypted with the appropriate encryption keys. Tokenization replaces sensitive data with unique tokens, reducing the risk of data exposure in the event of a breach.

Addressing Vulnerabilities in Online Platforms

Online platforms used by e-commerce businesses are susceptible to various vulnerabilities that could be exploited by attackers. Common vulnerabilities include outdated software, improper access controls, and poor patch management practices. Regular vulnerability scanning, penetration testing, and security audits are essential to identify and address these vulnerabilities.

Importance of Third-Party Service Providers

E-commerce businesses often rely on third-party service providers for various aspects of their operations, including payment processing, website hosting, and customer support. It is crucial to ensure that these service providers are also PCI compliant. Verifying their compliance status and understanding the security measures they have in place are essential to maintain a secure and compliant e-commerce environment.

Best Practices for PCI Compliance

Implementing Firewall and Intrusion Detection Systems

One of the best practices for PCI compliance is implementing robust firewall and intrusion detection systems. Firewalls help secure the organization’s network by monitoring and controlling incoming and outgoing traffic, while intrusion detection systems detect and respond to potential threats and attacks. Regular updates and configuration of these systems are crucial to maintaining effective security controls.

Regularly Updating Security Systems

To protect against emerging threats and vulnerabilities, it is essential to regularly update security systems and software. This includes promptly applying patches and security updates provided by software vendors. Regular system updates ensure that known vulnerabilities are addressed, reducing the risk of exploitation by attackers.

Educating Employees about Security Measures

Employees play a significant role in maintaining PCI compliance, and educating them about security measures is essential. Providing training on the importance of data security, safe handling of cardholder data, and recognition of potential security threats helps create a culture of security awareness. Continuous training programs can keep employees up-to-date with the latest security practices and potential risks.

Limiting Access to Cardholder Data

Restricting access to cardholder data is a crucial security measure to minimize the risk of unauthorized access. Implementing strict access controls, both physical and logical, ensures that only authorized individuals can access sensitive information. This can be achieved through role-based access policies, two-factor authentication, and regular review of access rights.

Monitoring and Logging Network Activity

Continuously monitoring and logging network activity is an essential best practice for PCI compliance. By monitoring network traffic and activity logs, businesses can detect and respond to potential security incidents promptly. Regular review and analysis of logs help identify anomalies, detect unauthorized access attempts, and provide evidence for forensic investigations if a security breach occurs.

Conducting Regular Security Audits

Regular security audits are crucial to maintaining PCI compliance. These audits evaluate the effectiveness of security controls, identify potential vulnerabilities, and ensure that the organization is adhering to the requirements of PCI DSS. Internal audits, conducted by qualified individuals within the organization, should be supplemented with periodic external audits for a comprehensive assessment.

Navigating PCI Compliance as a Small Business

Understanding Small Business Requirements

Small businesses face unique challenges when it comes to PCI compliance. Understanding the specific compliance requirements for small businesses is crucial to ensure that resources are allocated effectively and necessary security measures are implemented. PCI DSS provides guidelines tailored to different levels of transaction volume, simplifying the compliance process for small businesses.

Leveraging PCI Compliance Tools and Resources

Many tools and resources are available to assist small businesses in achieving PCI compliance. These include self-assessment questionnaires, security policy templates, training materials, and vulnerability scanning services. Leveraging these tools and resources can help small businesses navigate the compliance process and ensure that they are meeting the necessary requirements.

Seeking Assistance from Security Professionals

Small businesses may lack the expertise and resources to navigate the complexities of PCI compliance on their own. In such cases, seeking assistance from security professionals can be beneficial. These professionals can provide guidance, perform security assessments, and help implement necessary security controls tailored to the specific needs and constraints of small businesses.

Building a Culture of Compliance

Building a culture of compliance is essential for small businesses to maintain PCI compliance. This involves emphasizing the importance of data security, enforcing security policies and procedures, and providing ongoing training and education to employees. By creating a culture that prioritizes compliance, small businesses can ensure that security measures are consistently followed.

Budgeting for Compliance Efforts

Budget constraints are a common challenge for small businesses in achieving and maintaining PCI compliance. However, the potential consequences of non-compliance, including financial losses and reputational damage, make allocating resources for compliance efforts critical. By including compliance-related expenses in the budget and prioritizing data security, small businesses can mitigate risks effectively.

PCI Compliance and Mobile Payment Processing

Introduction to Mobile Payment Processing

Mobile payment processing allows customers to make transactions using their smartphones or other mobile devices. With the growing popularity of mobile payments, ensuring the security of these transactions is crucial. PCI compliance plays a significant role in maintaining the integrity and security of mobile payment processing systems.

Securing Mobile Payment Devices

Securing mobile payment devices is essential in maintaining PCI compliance. Mobile devices, such as smartphones and tablets, should have adequate security measures in place, including encryption, secure authentication methods, and secure storage of cardholder data. Additionally, mobile payment applications should be regularly updated to address any security vulnerabilities.

Implementing Secure Mobile Applications

For businesses that develop their mobile payment applications, implementing secure coding practices is crucial. This includes following industry best practices for secure coding, performing regular security assessments, and conducting thorough testing to identify and address potential vulnerabilities. Secure mobile applications help protect sensitive cardholder data during transactions.

Addressing Mobile Payment Risks

Mobile payment processing introduces unique risks that need to be addressed to maintain PCI compliance. Risks include the potential for device theft or loss, malware targeting mobile devices, and unauthorized access to sensitive data through network vulnerabilities. Implementing measures such as strong authentication, encryption, and secure network connections help mitigate these risks.

Compliance Considerations for Mobile Payments

Businesses involved in mobile payment processing need to consider specific compliance requirements to ensure the security of mobile transactions. This includes adhering to the relevant PCI DSS requirements related to mobile payment processing, such as encryption of data during transmission, secure authentication methods, and regular vulnerability assessments.

FAQs about Mobile Payment Security

What are mobile payments and how do they work?

Mobile payments refer to transactions conducted using mobile devices, such as smartphones or tablets, to make payments for goods or services. These transactions typically involve using mobile payment applications or Near Field Communication (NFC) technology to transmit payment information securely to a point-of-sale system or payment gateway.

What security risks are associated with mobile payment processing?

Mobile payment processing introduces several security risks, including device theft or loss, malware infections, and unauthorized access to sensitive data. Mobile devices can be vulnerable to attacks targeting weak authentication mechanisms, unsecured networks, or outdated software. If not properly secured, mobile payment transactions can be intercepted, and cardholder data can be compromised.

What measures can be taken to secure mobile payment transactions?

To secure mobile payment transactions, several measures can be implemented. These include using encryption to protect data during transmission, implementing strong authentication methods, regularly updating mobile payment applications, and ensuring secure storage of sensitive cardholder data. Businesses should also educate users about the risks and best practices for mobile payment security.

Do mobile payment applications need to be PCI compliant?

Yes, mobile payment applications are subject to the PCI DSS requirements to ensure the security of cardholder data. Businesses that develop or deploy mobile payment applications must adhere to the relevant PCI compliance requirements, including encryption of data transmission and secure storage of sensitive information. Compliance helps protect the integrity and confidentiality of payment transactions.

How can businesses ensure compliance with mobile payment security?

To ensure compliance with mobile payment security, businesses should follow the PCI DSS requirements applicable to mobile payment processing. This includes implementing secure coding practices for mobile applications, using encryption and strong authentication methods, conducting regular vulnerability assessments, and adhering to relevant industry guidelines for mobile payment security. Engaging security professionals can also help ensure compliance with best practices.