Business Transaction Lawyer Provo Utah

-

Table of Contents

- How to Choose the Right Business Transaction Lawyer in Provo

- Utah

- Understanding the Benefits of Working with a Business Transaction Lawyer in Provo

- Utah

- Common Business Transactions and How a Lawyer Can Help in Provo

- Utah

- What to Expect When Working with a Business Transaction Lawyer in Provo

- Utah

- Navigating the Complexities of Business Transactions in Provo

- Utah: What You Need to Know

How to Choose the Right Business Transaction Lawyer in Provo

When it comes to choosing the right business transaction lawyer in Provo, it is important to take the time to research and find the right fit for your needs. Here are some tips to help you make the best decision:

1. Consider Your Needs: Before you start your search for a business transaction lawyer, it is important to consider your needs. What type of legal services do you need? Are you looking for a lawyer to help you with contract negotiations, mergers and acquisitions, or other business transactions? Knowing what type of legal services you need will help you narrow down your search.

2. Research Potential Lawyers: Once you know what type of legal services you need, it is time to start researching potential lawyers. Look for lawyers who specialize in business transactions and have experience in the area you need help with. Check out their websites and read reviews from past clients to get an idea of their experience and expertise.

3. Ask for Referrals: Ask your friends, family, and colleagues for referrals to business transaction lawyers in Provo. This is a great way to get an idea of who is reputable and who has a good track record.

4. Schedule a Consultation: Once you have narrowed down your list of potential lawyers, it is time to schedule a consultation. During the consultation, ask questions about their experience, fees, and any other information you need to make an informed decision.

By following these tips, you can be sure to find the right business transaction lawyer in Provo for your needs. With the right lawyer on your side, you can be sure to get the best legal advice and representation for your business transactions.

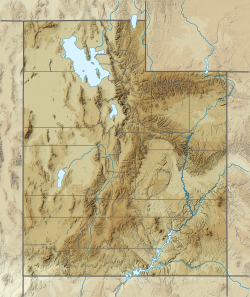

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. It is also home to some of the most spectacular national parks in the United States, including Zion National Park, Bryce Canyon National Park, and Arches National Park.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 33rd most populous state, with a population of 3,205,958 as of 2020. The capital of Utah is Salt Lake City, which is also the most populous city in the state.

Utah is known for its strong economy, which is largely based on the mining and energy industries. It is also home to a number of technology companies, including Adobe, eBay, and Oracle. The state is also home to a number of universities, including the University of Utah, Brigham Young University, and Utah State University.

Utah is known for its unique culture, which is heavily influenced by its Mormon heritage. The state is home to a number of popular tourist attractions, including Temple Square in Salt Lake City, the Great Salt Lake, and the Bonneville Salt Flats. Utah is also home to a number of outdoor activities, including skiing, snowboarding, hiking, and camping.

Utah is a beautiful and diverse state with a lot to offer. From its stunning national parks to its vibrant cities, Utah is a great place to visit and explore.

Understanding the Benefits of Working with a Business Transaction Lawyer in Provo

When it comes to business transactions, it is important to have a knowledgeable and experienced lawyer on your side. A business transaction lawyer in Provo can provide invaluable assistance in a variety of areas, from contract negotiation to dispute resolution. Working with a business transaction lawyer can help ensure that your business transactions are conducted in a legally sound manner and that your interests are protected.

One of the primary benefits of working with a business transaction lawyer is that they can provide guidance and advice on the legal aspects of a transaction. A business transaction lawyer can help you understand the legal implications of a contract or agreement, as well as the potential risks and rewards associated with it. They can also provide advice on how to structure a transaction to maximize the benefits for all parties involved.

A business transaction lawyer can also help you negotiate the terms of a contract or agreement. They can help you identify potential areas of dispute and provide advice on how to resolve them. They can also help you draft contracts and agreements that are legally sound and protect your interests.

In addition, a business transaction lawyer can provide assistance in dispute resolution. If a dispute arises between parties involved in a transaction, a business transaction lawyer can help you navigate the legal process and ensure that your interests are protected. They can also provide advice on how to resolve the dispute in a timely and cost-effective manner.

Finally, a business transaction lawyer can provide assistance in protecting your intellectual property. They can help you register trademarks, copyrights, and patents, as well as provide advice on how to protect your intellectual property from infringement.

By working with a business transaction lawyer in Provo, you can ensure that your business transactions are conducted in a legally sound manner and that your interests are protected. A business transaction lawyer can provide invaluable assistance in a variety of areas, from contract negotiation to dispute resolution. They can also provide advice on how to protect your intellectual property and ensure that your interests are protected.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. The state is home to five national parks, seven national monuments, and numerous state parks and recreation areas.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 11th most populous state, with a population of 3,205,958 as of 2019. The capital of Utah is Salt Lake City, which is also the most populous city in the state. Other major cities include West Valley City, Provo, West Jordan, and Ogden.

Utah is known for its natural beauty and outdoor recreation opportunities. The state is home to five national parks, including Arches National Park, Bryce Canyon National Park, Canyonlands National Park, Capitol Reef National Park, and Zion National Park. These parks offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to seven national monuments, including Cedar Breaks National Monument, Dinosaur National Monument, Hovenweep National Monument, Natural Bridges National Monument, Rainbow Bridge National Monument, Timpanogos Cave National Monument, and Zion National Park. These monuments offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to numerous state parks and recreation areas. These parks offer visitors a variety of activities, such as hiking, camping, fishing, boating, and more. Some of the most popular state parks in Utah include Antelope Island State Park, Bear Lake State Park, Goblin Valley State Park, and Wasatch Mountain State Park.

Utah is a great place to visit for outdoor recreation and sightseeing. With its diverse landscape and numerous parks and monuments, Utah offers something for everyone. Whether you’re looking for a relaxing getaway or an adventure-filled vacation, Utah has something for you.

Common Business Transactions and How a Lawyer Can Help in Provo

Business transactions are an important part of any business, and having a lawyer to help with these transactions can be invaluable. In Provo, Utah, a lawyer can help with a variety of common business transactions, such as contracts, mergers and acquisitions, and intellectual property protection.

Contracts are a common business transaction, and a lawyer can help ensure that all parties involved are protected. A lawyer can review contracts to make sure that all parties understand their rights and obligations, and that the contract is legally binding. They can also help negotiate the terms of the contract and ensure that all parties are in agreement.

Mergers and acquisitions are another common business transaction, and a lawyer can help with the process. They can review the documents involved in the transaction, such as the purchase agreement, and ensure that all parties understand their rights and obligations. They can also help negotiate the terms of the transaction and ensure that all parties are in agreement.

Intellectual property protection is also an important part of any business transaction. A lawyer can help protect a business’s intellectual property by filing for trademarks, copyrights, and patents. They can also help with licensing agreements and other legal matters related to intellectual property.

Having a lawyer to help with common business transactions in Provo can be invaluable. They can help ensure that all parties involved are protected and that the transaction is legally binding. They can also help negotiate the terms of the transaction and ensure that all parties are in agreement. With the help of a lawyer, businesses can be sure that their transactions are handled properly and that their rights and interests are protected.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. The state is home to five national parks, seven national monuments, and numerous state parks and recreation areas.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 11th most populous state, with a population of 3,205,958 as of 2019. The capital of Utah is Salt Lake City, which is also the most populous city in the state. Other major cities include West Valley City, Provo, West Jordan, and Ogden.

Utah is known for its natural beauty and outdoor recreation opportunities. The state is home to five national parks, including Arches National Park, Bryce Canyon National Park, Canyonlands National Park, Capitol Reef National Park, and Zion National Park. These parks offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to seven national monuments, including Cedar Breaks National Monument, Dinosaur National Monument, Hovenweep National Monument, Natural Bridges National Monument, Rainbow Bridge National Monument, Timpanogos Cave National Monument, and Zion National Park. These monuments offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to numerous state parks and recreation areas. These parks offer visitors a variety of activities, such as hiking, camping, fishing, boating, and more. Some of the most popular state parks in Utah include Antelope Island State Park, Bear Lake State Park, Goblin Valley State Park, and Wasatch Mountain State Park.

Utah is a great place to visit for outdoor recreation and sightseeing. With its diverse landscape and numerous parks and monuments, Utah offers something for everyone. Whether you’re looking for a relaxing getaway or an adventure-filled vacation, Utah has something for you.

What to Expect When Working with a Business Transaction Lawyer in Provo

When working with a business transaction lawyer in Provo, you can expect a professional and knowledgeable legal partner. Your lawyer will be able to provide you with the legal advice and guidance you need to make informed decisions about your business.

Your lawyer will be able to review and draft contracts, negotiate deals, and provide advice on the best course of action for your business. They will also be able to help you understand the legal implications of any business decisions you make.

Your lawyer will be able to provide you with the necessary legal documents to ensure that your business is compliant with all applicable laws and regulations. They will also be able to help you navigate the complexities of the legal system and ensure that your business is protected from potential legal issues.

Your lawyer will be able to provide you with the necessary guidance and support to ensure that your business is successful. They will be able to provide you with the necessary resources to help you make informed decisions and ensure that your business is running smoothly.

Your lawyer will be able to provide you with the necessary advice and guidance to ensure that your business is compliant with all applicable laws and regulations. They will also be able to help you understand the legal implications of any business decisions you make.

Your lawyer will be able to provide you with the necessary legal documents to ensure that your business is compliant with all applicable laws and regulations. They will also be able to help you navigate the complexities of the legal system and ensure that your business is protected from potential legal issues.

Your lawyer will be able to provide you with the necessary guidance and support to ensure that your business is successful. They will be able to provide you with the necessary resources to help you make informed decisions and ensure that your business is running smoothly.

Your lawyer will be able to provide you with the necessary advice and guidance to ensure that your business is compliant with all applicable laws and regulations. They will also be able to help you understand the legal implications of any business decisions you make.

Overall, when working with a business transaction lawyer in Provo, you can expect a professional and knowledgeable legal partner who will be able to provide you with the necessary guidance and support to ensure that your business is successful.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. It is also home to some of the most spectacular national parks in the United States, including Zion National Park, Bryce Canyon National Park, and Arches National Park.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 33rd most populous state, with a population of 3,205,958 as of 2020. The capital of Utah is Salt Lake City, which is also the most populous city in the state.

Utah is known for its strong economy, which is largely based on the mining and energy industries. It is also home to a number of technology companies, including Adobe, eBay, and Oracle. The state is also home to a number of universities, including the University of Utah, Brigham Young University, and Utah State University.

Utah is known for its unique culture, which is heavily influenced by its Mormon heritage. The state is home to a number of popular tourist attractions, including Temple Square in Salt Lake City, the Great Salt Lake, and the Bonneville Salt Flats. Utah is also home to a number of outdoor activities, including skiing, snowboarding, hiking, and camping.

Utah is a beautiful and diverse state with a lot to offer. From its stunning national parks to its vibrant cities, Utah is a great place to visit and explore.

Navigating the Complexities of Business Transactions in Provo

Navigating the complexities of business transactions in Provo can be a daunting task. With the ever-changing legal landscape, it is important to understand the nuances of the local business environment. This article will provide an overview of the key considerations when conducting business transactions in Provo.

First, it is important to understand the local laws and regulations that govern business transactions in Provo. This includes understanding the local zoning laws, tax codes, and other regulations that may affect the transaction. Additionally, it is important to be aware of any applicable state or federal laws that may apply.

Second, it is important to understand the local business culture. Provo is home to a diverse range of businesses, from small startups to large corporations. Understanding the local business culture can help ensure that the transaction is conducted in a manner that is respectful and beneficial to all parties involved.

Third, it is important to understand the local market. Provo is home to a variety of industries, from technology to manufacturing. Understanding the local market can help ensure that the transaction is conducted in a manner that is beneficial to all parties involved.

Finally, it is important to understand the local financial landscape. Provo is home to a variety of financial institutions, from banks to venture capital firms. Understanding the local financial landscape can help ensure that the transaction is conducted in a manner that is beneficial to all parties involved.

Navigating the complexities of business transactions in Provo can be a daunting task. However, by understanding the local laws, business culture, market, and financial landscape, it is possible to ensure that the transaction is conducted in a manner that is beneficial to all parties involved.

Utah: What You Need to Know

Utah is a state located in the western United States. It is known for its diverse landscape, which includes mountains, deserts, and forests. It is also home to a variety of wildlife, including bison, elk, and antelope.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is bordered by Idaho, Wyoming, Colorado, Arizona, and Nevada. The capital of Utah is Salt Lake City, which is also the most populous city in the state.

Utah has a population of 3.2 million people, making it the 33rd most populous state in the country. The majority of the population is concentrated in the Salt Lake City metropolitan area. The state is also home to a large number of Native American tribes, including the Navajo, Ute, and Paiute.

Utah is known for its natural beauty and outdoor recreation opportunities. It is home to five national parks, including Zion National Park, Bryce Canyon National Park, and Arches National Park. It also has numerous state parks, forests, and monuments.

The economy of Utah is largely based on tourism, agriculture, and mining. The state is also home to a number of technology companies, including Adobe, eBay, and Oracle.

Utah is a great place to live and visit. It has a diverse landscape, a vibrant economy, and plenty of outdoor recreation opportunities. Whether you’re looking for a place to call home or just a place to visit, Utah has something for everyone.

Business Transaction Lawyer Provo Utah Consultation

When you need legal help from a Business Transaction Lawyer in Provo Utah, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

What Is The Relationship Between Business Law And Economies?

Business Transaction Lawyer West Valley City Utah

Do I Need A Permit To Start A Business In Utah?

Business Succession Lawyer Draper Utah

Business Contract Lawyer Salt Lake City

What Is The Difference Between Corporate And Commercial Law?

Business Contract Lawyer West Valley City

Business Lawyer West Jordan Utah

Irrevocable Life Insurance Trusts

What Is The Purpose Of A Business Attorney?

Business Transaction Lawyer Provo Utah

West Valley City, Utah

Provo, Utah

Jump to navigationJump to search

|

Provo, Utah

|

|

|---|---|

| City of Provo | |

Downtown Provo

|

|

| Motto:

“Welcome Home”

|

|

Location within Utah County

|

|

| Coordinates: 40°14′40″N 111°39′39″WCoordinates: 40°14′40″N 111°39′39″W | |

| Country | |

| State | |

| County | Utah |

| Founded | 1849 |

| Incorporated | April 1850 |

| Named for | Étienne Provost[1] |

| Government

|

|

| • Type | Strong mayor |

| • Mayor | Michelle Kaufusi (R) |

| • Council Chair | David Harding |

| Area | |

| • City | 44.19 sq mi (114.44 km2) |

| • Land | 41.69 sq mi (107.97 km2) |

| • Water | 2.50 sq mi (6.47 km2) |

| Elevation

|

4,551 ft (1,387 m) |

| Population | |

| • City | 115,162 |

| • Density | 2,762.34/sq mi (1,066.61/km2) |

| • Metro

|

620,000 |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP Codes |

84601-84606

|

| Area codes | 385, 801 |

| FIPS code | 49-62470[5] |

| GNIS ID | 1444661[6] |

| Website | www |

Provo (/ˈproʊvoʊ/ PROH-voh) is the fourth-largest city in Utah, United States. It is 43 miles (69 km) south of Salt Lake City along the Wasatch Front. Provo is the largest city and county seat of Utah County and is home to Brigham Young University (BYU).[7]

Provo lies between the cities of Orem to the north and Springville to the south. With a population at the 2020 census of 115,162.[3] Provo is the principal city in the Provo-Orem metropolitan area, which had a population of 526,810 at the 2010 census.[8] It is Utah’s second-largest metropolitan area after Salt Lake City.

Provo is the home to Brigham Young University, a private higher education institution operated by the Church of Jesus Christ of Latter-day Saints (LDS Church). Provo also has the LDS Church’s largest Missionary Training Center (MTC). The city is a focus area for technology development in Utah, with several billion-dollar startups.[9] The city’s Peaks Ice Arena was a venue for the Salt Lake City Winter Olympics in 2002. Sundance Resort is 13 miles (21 km) northeast, up Provo Canyon.

In 2015, Forbes cited Provo among the “Best Small And Medium-Size Cities For Jobs,”[10] and the Bureau of Labor Statistics found Utah County had the year’s highest job growth.[11] In 2013, Forbes ranked Provo the No. 2 city on its list of Best Places for Business and Careers.[12] Provo was ranked first for community optimism (2012)[13] and first in health/well-being (2014).[14]

[geocentric_weather id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_about id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_neighborhoods id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_thingstodo id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_busstops id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_mapembed id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_drivingdirections id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]

[geocentric_reviews id=”b6e1f4da-d96d-4229-bb2f-fc6b15899f98″]