In today’s digital age, divorce can have far-reaching consequences beyond the dissolution of a marriage. As technology becomes more integrated into our lives, protecting your privacy during a divorce has become a critical concern. With sensitive information and personal data easily accessible online, understanding the importance of cybersecurity is essential. In this article, we will explore the key steps you can take to safeguard your privacy during a divorce, ensuring that your personal information remains secure and protected.

Introduction

Divorce is a challenging and emotional process that can have various implications on different aspects of your life, including your privacy. In today’s digital age, protecting your privacy during a divorce is more crucial than ever. From safeguarding personal data to securing online accounts and networks, there are important steps you can take to mitigate privacy concerns. This comprehensive guide will provide you with valuable information, tips, and strategies to ensure your privacy remains intact throughout the divorce process.

1. Understanding the Impact of Divorce on Privacy

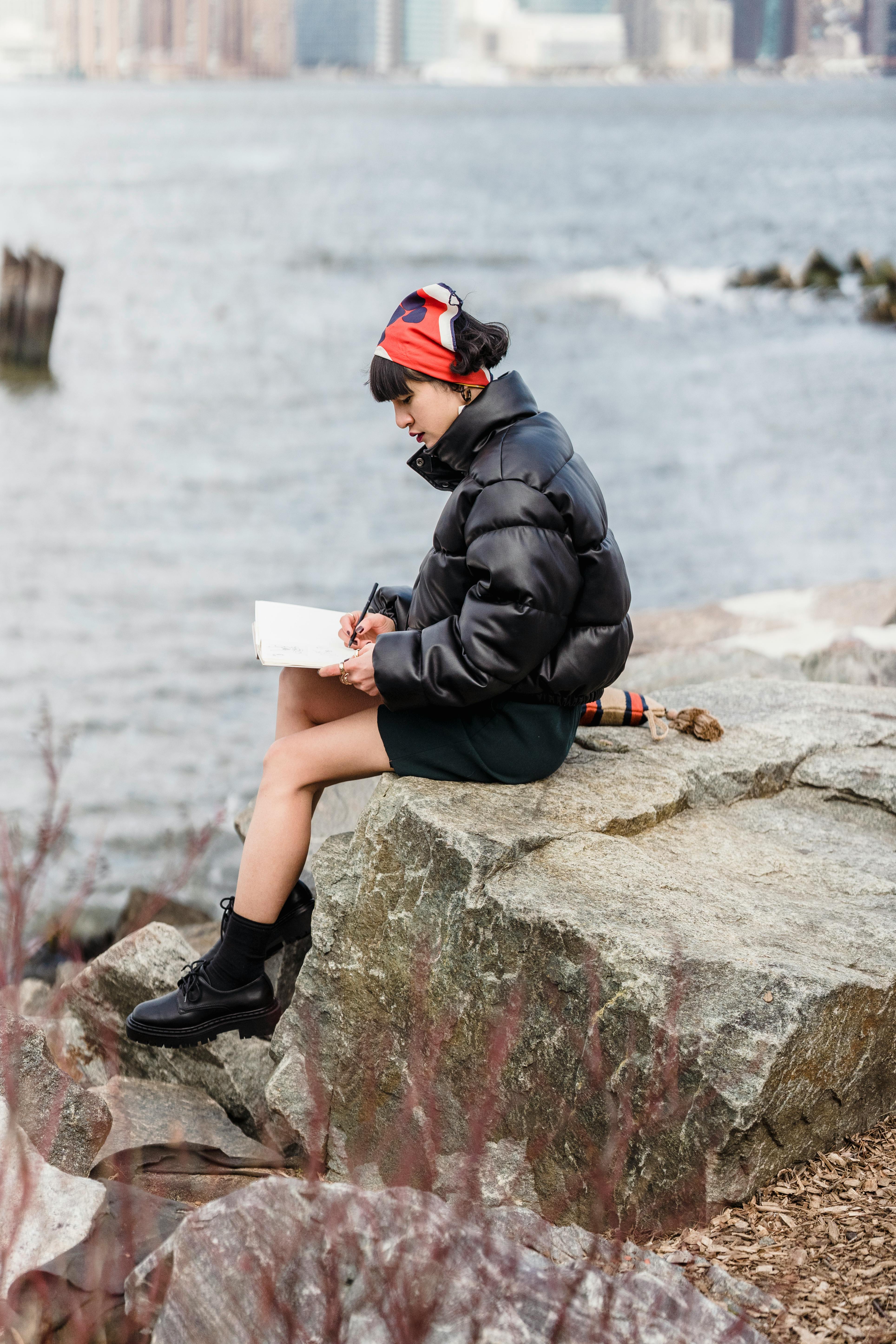

1.1 Emotional privacy

Divorce can significantly impact your emotional well-being, and maintaining emotional privacy during this time is essential. It’s important to establish boundaries and communicate your needs to your ex-spouse and those around you. Take time for self-care, seek support from trusted friends or family, and consider therapy or counseling to help you navigate through this difficult period while protecting your emotional privacy.

1.2 Financial privacy

Divorce often involves the disclosure of financial information, which can pose a risk to your financial privacy. It’s crucial to ensure that your personal financial information remains confidential during and after divorce proceedings. This includes safeguarding bank statements, tax returns, investment accounts, and other financial documents. Consider working with a financial advisor or accountant who can guide you on protecting your financial privacy.

1.3 Child privacy

If you have children, their privacy should be a top priority during the divorce process. This includes protecting their personal information, such as their school records, medical history, and social security numbers. Additionally, be mindful of what you and your ex-spouse share about the children on social media or in public discussions. Respecting their privacy will help maintain their trust and emotional well-being during this challenging time.

2. Common Privacy Concerns in Divorce

2.1 Leakage of personal information

Divorce can bring out intense emotions, and unfortunately, sometimes personal information may be shared or leaked without your consent. This can include private conversations, personal photos, or sensitive documents. It’s crucial to be cautious about who you share information with and take steps to prevent potential leaks that could compromise your privacy.

2.2 Invasion of privacy through surveillance

During a divorce, there may be instances where one party attempts to invade the other’s privacy by conducting surveillance. This can include monitoring emails, phone calls, social media activity, or even physical surveillance. Being aware of your surroundings and taking precautions to protect your privacy is essential.

2.3 Manipulation of online information

In today’s digital world, online information can be manipulated or misused to harm your reputation or gain an advantage during divorce proceedings. This can include altering or fabricating social media posts, deleting important emails or messages, or spreading false information. It’s vital to be vigilant and take steps to protect your online presence and prevent any manipulation of information.

3. Safeguarding Personal Data during Divorce Proceedings

3.1 Organizing and securing documents

During divorce proceedings, you may need to share various documents with your attorney or the court. It’s crucial to organize and store these documents securely. Keep physical documents in a safe place, and consider scanning and password-protecting digital files. Only share necessary information with trusted individuals involved in the legal process to minimize the risk of data breaches.

3.2 Protecting confidential information in court documents

When filing court documents, it’s essential to be mindful of any confidential or sensitive information that may be included. This includes personal financial details, social security numbers, or any other information that could be misused. Work closely with your attorney to properly redact or seal any confidential information to protect your privacy during the proceedings.

4. Protecting Online Accounts and Digital Assets

4.1 Creating strong and unique passwords

Using strong and unique passwords for all your online accounts is critical to maintaining privacy. Avoid using easily guessable passwords and consider incorporating a mix of letters, numbers, and symbols. Regularly update your passwords and avoid reusing them across different accounts to minimize the risk of unauthorized access.

4.2 Enabling two-factor authentication

Two-factor authentication adds an extra layer of security to your online accounts. By enabling this feature, you will be required to provide a second form of verification, such as a text message code or fingerprint scan, in addition to your password. This helps prevent unauthorized access to your accounts, even if your password is compromised.

4.3 Updating account recovery options

Review and update the account recovery options for your online accounts. Ensure that the associated email addresses or phone numbers are current and secure. This will help you regain access to your accounts in case of a security incident or if you suspect unauthorized access.

4.4 Safeguarding digital assets

Digital assets, such as photos, videos, and important documents, should be protected during a divorce. Consider backing up these assets to secure cloud storage services or external hard drives. Encrypt sensitive files to add an additional layer of protection. Be cautious about sharing digital assets during divorce proceedings to prevent any misuse or manipulation.

5. Communicating Privately during Divorce

5.1 Using secure communication channels

When communicating about sensitive divorce matters, use secure and private channels. Opt for encrypted messaging apps or secure email services that offer end-to-end encryption. Be cautious about discussing sensitive topics or sharing personal information through unsecured channels like social media or public Wi-Fi networks.

5.2 Encryption for email and messaging

Encrypting your emails and messages can help safeguard your communication from unauthorized access. Many email providers and messaging apps offer encryption options that can protect your conversations from interception or manipulation. Explore these options to ensure your privacy during divorce-related communication.

5.3 Being cautious of public Wi-Fi networks

Public Wi-Fi networks can pose a significant security risk, as they are often not encrypted and can be easily compromised. Avoid using public Wi-Fi networks for any sensitive or confidential communication during your divorce proceedings. Instead, rely on secure cellular data or trusted private networks to ensure your privacy.

6. Securing Electronic Devices and Networks

6.1 Regularly updating software and applications

Regularly updating your devices’ software and applications is vital to protect against security vulnerabilities. Enable automatic updates or manually check for updates to ensure you have the latest security patches and bug fixes. Outdated software can pose a significant risk to your privacy and security.

6.2 Using antivirus and firewall protection

Install reputable antivirus software and enable firewall protection on all your electronic devices. Antivirus software can detect and remove malicious programs that could compromise your privacy. Firewalls can act as a barrier between your devices and external threats, adding an extra layer of security to your network.

6.3 Securing home networks

Secure your home network by setting up a strong Wi-Fi password and enabling network encryption. Change the default credentials of your router to prevent unauthorized access. Consider creating a separate guest network to limit access to your main network and protect your privacy from potential intrusions.

6.4 Disposing of old devices securely

When disposing of old electronic devices, ensure you wipe all personal data from them. Use a professional data wiping tool or seek assistance from a reputable IT service provider to ensure no trace of personal information remains. This prevents the risk of identity theft or unauthorized access to your private data.

7. Maintaining Online Reputation and Social Media Privacy

7.1 Limiting social media presence

During divorce proceedings, it’s advisable to limit your social media presence or consider temporarily deactivating your accounts. Adjust your privacy settings to limit who can see your posts and personal information. Be cautious about what you share and avoid discussing sensitive divorce-related matters online.

7.2 Adjusting privacy settings

Review and update the privacy settings on your social media accounts. Ensure that only trusted contacts can view your posts, photos, and personal information. Regularly monitor and adjust these settings to maintain control over what others can see on your social media profiles.

7.3 Being mindful of shared content

Be mindful of what you share or are tagged in by others on social media. Even if your own privacy settings are secure, others may still share posts or photos that could impact your divorce proceedings. Communicate with friends and family about your privacy concerns and ask them to respect your boundaries during this challenging time.

8. Dealing with Cyberstalking and Harassment

8.1 Recognizing signs of cyberstalking

Cyberstalking can manifest in different ways, such as persistent unwanted messages, online harassment, or intrusive surveillance. Recognize the signs of cyberstalking, including feeling constantly monitored or harassed online. Trust your instincts, and if something feels off or makes you uncomfortable, take it seriously.

8.2 Taking immediate action

If you suspect cyberstalking or harassment, take immediate action to protect yourself. Document any evidence, such as screenshots or timestamps of abusive messages or interactions. Block and report the harasser on relevant platforms, and consider seeking a restraining order if necessary. Inform your attorney about the situation to explore potential legal actions.

8.3 Reporting incidents to authorities

If you feel threatened or believe your safety is at risk, don’t hesitate to report cyberstalking or harassment incidents to the relevant authorities. Provide them with any evidence you have collected, such as chat logs, emails, or social media interactions. Law enforcement can investigate and take necessary actions to ensure your safety and privacy.

9. Child Privacy in Divorce Cases

When it comes to children involved in divorce cases, their privacy is of utmost importance. Parents should prioritize protecting their children’s personal information, including their medical records, school-related details, and social security numbers. Avoid discussing sensitive information about children on public platforms and ensure their well-being is safeguarded throughout the divorce process.

10. Seeking Legal Assistance for Privacy Concerns

Privacy concerns during divorce can be complex and may require legal expertise to navigate. Consult with a knowledgeable divorce attorney who specializes in privacy matters to ensure your rights are protected throughout the process. An attorney can guide you on your options for safeguarding your privacy, addressing any legal concerns that may arise, and offering reassurance and support.

Frequently Asked Questions

Q: How can divorce impact my online privacy?

A: divorce can impact your online privacy in various ways. It may involve the sharing or leakage of personal information, surveillance, manipulation of online information, or even cyberstalking. Taking proactive steps to safeguard your privacy is crucial during this time.

Q: What should I do if I suspect my spouse is spying on me online during divorce proceedings?

A: If you suspect your spouse is spying on you online, document any evidence of their actions and consult with a divorce attorney. They can provide guidance on potential legal actions and help protect your privacy rights throughout the proceedings.

Q: How can a divorce attorney help protect my privacy during the process?

A: A divorce attorney experienced in privacy matters can provide invaluable guidance on safeguarding your privacy throughout the divorce process. They can advise you on privacy laws, help protect your personal information, address online harassment or surveillance, and advocate for your privacy rights in court.