Utah Business Law

This is a part of our Business Law series.

Utah business law is a set of statutes, regulations, and court decisions that govern business practices within the state of Utah. It encompasses the full range of legal topics including business formation, antitrust laws, unfair trade practices, business entity formation, project management, deceptive trade practices, hour laws, consumer protection, vertical price fixing, actual damages, and more. It is important for businesses of all sizes to understand Utah business law and how it applies to them in order to remain compliant and protect their interests. We’ve previously discussed business succession law and the Utah Uniform Partnership Act.

Business Formation

Forming a business in Utah requires careful consideration of the various laws, regulations, and taxes that the business must adhere to. There are several different types of business entities that can be formed in the state, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each of these business entities carries different benefits and liabilities, and businesses should consult with a business attorney to determine which is right for their particular situation.

Antitrust Laws

The Sherman Act, the Clayton Act, and the Federal Trade Commission Act are all essential antitrust laws that businesses must comply with in Utah. These laws are designed to protect competition and prevent price-fixing and other anti-competitive practices. Businesses must ensure that they are in compliance with these laws in order to avoid costly civil and criminal penalties.

Additional Articles on Business Law

We have also posted the following articles regarding the topic of business law:

What Is A Tender In Business Law?

Unfair Trade Practices

Under Utah law, unfair trade practices are defined as any act or practice that is likely to mislead or deceive a consumer. This includes false or misleading advertising, deceptive pricing, bait and switch tactics, and any other deceptive practices. Businesses that engage in unfair trade practices can be subject to civil and criminal penalties, as well as actual damages.

Business Entity Formation

When forming a business entity in Utah, it is important to understand the different legal considerations that must be taken into account. The state of Utah requires businesses to register with the state and obtain an EIN (Employer Identification Number). Additionally, businesses must choose a business name and ensure that it is not already in use. Once the business is registered, it must adhere to all applicable state and federal laws and regulations.

Project Management

Project management is an essential component of any business in Utah. Businesses must manage their projects effectively in order to ensure that they are completed on time and within budget. Businesses should consult with a business attorney to ensure that they are in compliance with all applicable laws and regulations.

Deceptive Trade Practices

Deceptive trade practices include any act or practice that is likely to mislead or deceive a consumer. This includes false or misleading advertising, deceptive pricing, bait and switch tactics, and other deceptive practices. In Utah, businesses that engage in deceptive trade practices can be subject to civil and criminal penalties, as well as actual damages.

Hour Laws

Under Utah law, employers must comply with the state’s hour laws, which are designed to protect employees from unfair or excessive working hours. These laws include restrictions on the number of hours an employee can work in a given shift, overtime pay, and other restrictions. Employers must ensure that they are in compliance with these laws in order to avoid legal trouble.

Consumer Protection

The state of Utah has a number of laws designed to protect consumers from deceptive and unfair practices. These laws include the Utah Consumer Protection Act, the Utah Deceptive Trade Practices Act, and the Utah Unfair Sales Practices and Consumer Protection Act. These laws are designed to prevent businesses from engaging in deceptive or unfair practices, and businesses must ensure that they are in compliance in order to avoid costly penalties.

Vertical Price Fixing

Vertical price fixing is a form of antitrust violation in which a business sets a price for a product or service that is higher than what the market would normally bear. This practice is illegal in Utah, and businesses that engage in it can be subject to civil and criminal penalties.

Actual Damages

Actual damages are a form of monetary compensation that a business may be required to pay for violating a consumer’s rights. These damages can include lost wages, medical expenses, and other costs associated with the violation. Businesses must be aware of their potential liability for actual damages in order to protect themselves from costly lawsuits.

Free Consultation

Businesses in Utah can benefit from a free consultation with a business attorney. A business lawyer can provide advice and guidance on the various legal considerations that must be taken into account when forming a business, such as business formation, antitrust laws, unfair trade practices, business entity formation, project management, deceptive trade practices, hour laws, consumer protection, vertical price fixing, actual damages, and more. Additionally, a business lawyer can help businesses to understand the various legal documents they will need to file in order to remain compliant with state and federal laws.

Businesses in Utah should also consider consulting with a business attorney for any legal advice or assistance that they may need. Whether it is legal advice about forming a business, setting up an LLC, or understanding the antitrust laws that apply to their business, an experienced business attorney can provide invaluable assistance. Additionally, many business attorneys offer free initial consultations, so businesses can get an idea of what legal advice they may need without any financial obligation.

Lawyer Jeremy Eveland

Jeremy Eveland is a Utah business attorney that focuses in business formation, business law, advertising law, real estate law and estate planning and probate cases. The firm offers free consultations to businesses, as well as comprehensive services such as business entity formation, project management, antitrust laws, unfair trade practices, consumer protection, vertical price fixing, actual damages, advertising law, compliance issues, business consulting, performance coaching, and more. Jeremy Eveland has a business degree and a law degree so he is also able to provide legal services such as business formation, LLC formation, and business entity formation. Additionally, he offers services such as intellectual property protection, contract review, and dispute resolution.

Utah Pyramid Scheme Law

The Utah Pyramid Scheme law is a consumer protection law that protects consumers from deceptive and unfair trade practices. The law is designed to protect consumers from false or misleading advertising, deceptive pricing, bait and switch tactics, and other deceptive practices. Businesses must ensure that they are in compliance with this law in order to avoid legal trouble.

Minimum Wage Laws

The state of Utah has a minimum wage law that requires employers to pay employees a certain minimum wage. This law is designed to protect employees from unfair and exploitative labor practices, and businesses must comply with it in order to avoid civil and criminal penalties. Additionally, employers must ensure that they are in compliance with the Fair Labor Standards Act (FLSA) in order to avoid costly fines and penalties.

Legal Help or Tips

Businesses in Utah should take the time to understand the various laws and regulations that apply to their business. Additionally, businesses should consult with a business attorney for any legal advice or assistance that they may need. Finally, businesses should ensure that they are in compliance with all applicable laws and regulations in order to protect their interests and avoid costly penalties.

Utah Business Lawyer Free Consultation

When you need a Utah business attorney, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Areas We Serve

We serve businesses and business owners for succession planning in the following locations:

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Business Transaction Lawyer Salt Lake City Utah

Utah

|

Utah

|

|

|---|---|

| State of Utah | |

| Nickname(s):

“Beehive State” (official), “The Mormon State”, “Deseret”

|

|

| Motto:

Industry

|

|

| Anthem: “Utah…This Is the Place“ | |

Map of the United States with Utah highlighted

|

|

| Country | United States |

| Before statehood | Utah Territory |

| Admitted to the Union | January 4, 1896 (45th) |

| Capital (and largest city) |

Salt Lake City |

| Largest metro and urban areas | Salt Lake City |

| Government

|

|

| • Governor | Spencer Cox (R) |

| • Lieutenant Governor | Deidre Henderson (R) |

| Legislature | State Legislature |

| • Upper house | State Senate |

| • Lower house | House of Representatives |

| Judiciary | Utah Supreme Court |

| U.S. senators | Mike Lee (R) Mitt Romney (R) |

| U.S. House delegation | 1: Blake Moore (R) 2: Chris Stewart (R) 3: John Curtis (R) 4: Burgess Owens (R) (list) |

| Area

|

|

| • Total | 84,899 sq mi (219,887 km2) |

| • Land | 82,144 sq mi (212,761 km2) |

| • Water | 2,755 sq mi (7,136 km2) 3.25% |

| • Rank | 13th |

| Dimensions

|

|

| • Length | 350 mi (560 km) |

| • Width | 270 mi (435 km) |

| Elevation

|

6,100 ft (1,860 m) |

| Highest elevation | 13,534 ft (4,120.3 m) |

| Lowest elevation | 2,180 ft (664.4 m) |

| Population

(2020)

|

|

| • Total | 3,271,616[4] |

| • Rank | 30th |

| • Density | 36.53/sq mi (14.12/km2) |

| • Rank | 41st |

| • Median household income

|

$60,365[5] |

| • Income rank

|

11th |

| Demonym | Utahn or Utahan[6] |

| Language

|

|

| • Official language | English |

| Time zone | UTC−07:00 (Mountain) |

| • Summer (DST) | UTC−06:00 (MDT) |

| USPS abbreviation |

UT

|

| ISO 3166 code | US-UT |

| Traditional abbreviation | Ut. |

| Latitude | 37° N to 42° N |

| Longitude | 109°3′ W to 114°3′ W |

| Website | utah |

| hideUtah state symbols | |

|---|---|

|

|

|

|

| Living insignia | |

| Bird | California gull |

| Fish | Bonneville cutthroat trout[7] |

| Flower | Sego lily |

| Grass | Indian ricegrass |

| Mammal | Rocky Mountain Elk |

| Reptile | Gila monster |

| Tree | Quaking aspen |

| Inanimate insignia | |

| Dance | Square dance |

| Dinosaur | Utahraptor |

| Firearm | Browning M1911 |

| Fossil | Allosaurus |

| Gemstone | Topaz |

| Mineral | Copper[7] |

| Rock | Coal[7] |

| Tartan | Utah State Centennial Tartan |

| State route marker | |

|

|

| State quarter | |

Released in 2007

|

|

| Lists of United States state symbols | |

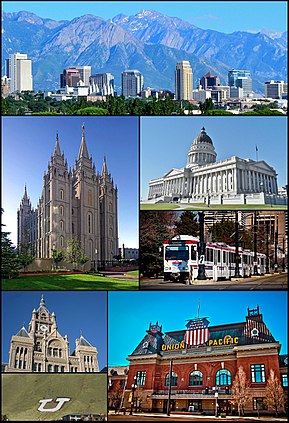

Utah (/ˈjuːtɑː/ YOO-tah, /ˈjuːtɔː/ (![]() listen) YOO-taw) is a landlocked state in the Mountain West subregion of the Western United States. It is bordered to its east by Colorado, to its northeast by Wyoming, to its north by Idaho, to its south by Arizona, and to its west by Nevada. Utah also touches a corner of New Mexico in the southeast. Of the fifty U.S. states, Utah is the 13th-largest by area; with a population over three million, it is the 30th-most-populous and 11th-least-densely populated. Urban development is mostly concentrated in two areas: the Wasatch Front in the north-central part of the state, which is home to roughly two-thirds of the population and includes the capital city, Salt Lake City; and Washington County in the southwest, with more than 180,000 residents.[8] Most of the western half of Utah lies in the Great Basin.

listen) YOO-taw) is a landlocked state in the Mountain West subregion of the Western United States. It is bordered to its east by Colorado, to its northeast by Wyoming, to its north by Idaho, to its south by Arizona, and to its west by Nevada. Utah also touches a corner of New Mexico in the southeast. Of the fifty U.S. states, Utah is the 13th-largest by area; with a population over three million, it is the 30th-most-populous and 11th-least-densely populated. Urban development is mostly concentrated in two areas: the Wasatch Front in the north-central part of the state, which is home to roughly two-thirds of the population and includes the capital city, Salt Lake City; and Washington County in the southwest, with more than 180,000 residents.[8] Most of the western half of Utah lies in the Great Basin.

Utah has been inhabited for thousands of years by various indigenous groups such as the ancient Puebloans, Navajo and Ute. The Spanish were the first Europeans to arrive in the mid-16th century, though the region’s difficult geography and harsh climate made it a peripheral part of New Spain and later Mexico. Even while it was Mexican territory, many of Utah’s earliest settlers were American, particularly Mormons fleeing marginalization and persecution from the United States. Following the Mexican–American War in 1848, the region was annexed by the U.S., becoming part of the Utah Territory, which included what is now Colorado and Nevada. Disputes between the dominant Mormon community and the federal government delayed Utah’s admission as a state; only after the outlawing of polygamy was it admitted in 1896 as the 45th.

People from Utah are known as Utahns.[9] Slightly over half of all Utahns are Mormons, the vast majority of whom are members of the Church of Jesus Christ of Latter-day Saints (LDS Church), which has its world headquarters in Salt Lake City;[10] Utah is the only state where a majority of the population belongs to a single church.[11] The LDS Church greatly influences Utahn culture, politics, and daily life,[12] though since the 1990s the state has become more religiously diverse as well as secular.

Utah has a highly diversified economy, with major sectors including transportation, education, information technology and research, government services, mining, and tourism. Utah has been one of the fastest growing states since 2000,[13] with the 2020 U.S. census confirming the fastest population growth in the nation since 2010. St. George was the fastest-growing metropolitan area in the United States from 2000 to 2005.[14] Utah ranks among the overall best states in metrics such as healthcare, governance, education, and infrastructure.[15] It has the 14th-highest median average income and the least income inequality of any U.S. state. Over time and influenced by climate change, droughts in Utah have been increasing in frequency and severity,[16] putting a further strain on Utah’s water security and impacting the state’s economy.[17]