Business Succession Lawyer Orem Utah

Hiring Attorney Jeremy Eveland to draft a business succession plan in Orem, Utah is a wise decision for anyone looking for experienced legal counsel. With many years of experience in business law, Jeremy is well-versed in the nuances of business succession planning and has a deep understanding of the legal process. He works diligently with clients to ensure they understand their options and can make informed decisions. Jeremy has extensive experience in the Orem area and is a member of the Utah State Bar.

This article is part of business succession law, which is a subsection of business law.

When business disputes happen, he is an effective working with the mediator, and assisting parties to come to an agreement that meets their mutual needs. He is also a skilled litigator, having handled a variety of business cases in his career. He is committed to providing ethical and legal advice to the clients he serves.

Orem Utah Business Lawyer

For those looking for probate, estate planning, or estate administration lawyers, Jeremy is a solid choice. He is knowledgeable in the areas of estate planning, probate, and liability, and is experienced in creating partnership agreements, buy-sell agreements, and other documents related to business succession planning. He is well-versed in the tax implications of estate planning and can provide advice on how to minimize taxes and maximize estate value.

Business Formation Attorney Orem UT

Jeremy is also well-versed in the process of creating LLCs and other business entities. He can help clients draft the necessary paperwork, such as partnership agreements and operating agreements, to ensure the business is properly formed and all parties involved are properly protected. He can also provide legal advice on the ownership stakes of each business partner and the ownership interests of each party.

Jeremy is committed to providing the best legal services and solutions to his clients. He offers free consultations and is available to answer any questions clients might have. He is also available to discuss mediation, if necessary, to reach a settlement agreement between parties.

Utah Business Entity

When we talk about business entities, we are referring to the type or structure of a business as opposed to what the business does. How a business is structured affects how taxes are paid, liabilities are determined, and of course, paperwork. Business entities—organizations created by one or more people to carry on a trade—are usually created at the state level, often by filing documents with a state agency such as the Secretary of State.

Business entities are subject to taxation and must file a tax return.

For federal income tax purposes, some business entities are, by default, considered not to be separate from their owner. Such is the case with sole proprietors and single-member limited liability companies. The income and deductions related to these entities are normally reported on the same tax return as the owner of the business. The IRS calls these disregarded entities because it “disregards” the separate name and structure of the business. However, a disregarded entity can choose to be treated as if it were a separate entity. This is done by making an Entity Classification Election using Form 8832 and filing this form with the IRS. The purpose of this form is to choose a classification other than the default classification provided by federal tax laws.

Confusion Over Business and tax Terms

Distinguishing between the actual organizational structure created under state law and the tax classification can cause confusion, especially if the same words are used for both concepts. Colloquially, when accountants talk about “entities” or “entity returns,” they are referring to tax returns other than for individual people.

In simplest terms, a business entity is an organization created by an individual or individuals to conduct business, engage in a trade, or partake in similar activities. There are various types of business entities—sole proprietorship, partnership, LLC, corporation, etc.—and a business’s entity type dictates both the structure of that organization and how that company is taxed.

When starting a business, one of the first things you want to do is choose the structure of your company—in other words, choose a business entity type. This decision will have important legal and financial implications for your business. The amount of taxes you have to pay depends on your business entity choice, as does the ease with which you can get a small business loan or raise money from investors. Plus, if someone sues your business, your business entity structure determines your risk exposure. State governments in the U.S. recognize more than a dozen different types of business entities, but the average small business owner chooses between these six: sole proprietorship, general partnership, limited partnership (LP), limited liability company (LLC), C-corporation, and S-corporation.

Business Succession Lawyer Free Consultation

When you need a business succession attorney, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Areas We Serve

We serve businesses and business owners for succession planning in the following locations:

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Types of Business Entities in Utah

As we mentioned above, at a very basic level, a business entity simply means an organization that has been formed to conduct business. However, the type of entity you choose for your business determines how your company is structured and taxed. For example, by definition, a sole proprietorship must be owned and operated by a single owner. If your business entity type is a partnership, on the other hand, this means there are two or more owners. Similarly, if you establish a business as a sole proprietorship, this means for tax purposes, you’re a pass-through entity (the taxes are passed onto the business owner). Conversely, if you establish your business as a corporation, this means the business exists separately from its owners, and therefore, pays separate taxes. Generally, to actually establish your business’s entity structure, you’ll register in the state where your business is located. With all of this in mind, the chart below summarizes the various entity types business owners can choose from:

Business Entity Type

• Sole proprietorship: Unincorporated business with one owner or jointly owned by a married couple

• General partnership: Unincorporated business with two or more owners

• Limited partnership: Registered business composed of active, general partners and passive, limited partners

• Limited liability partnership: Partnership structure that shields all partners from personal liability

• Limited liability limited partnership: Type of limited partnership with some liability protection for general partners

• Limited liability company (LLC): Registered business with limited liability for all members

• Professional limited liability company: LLC structure for professionals, such as doctors and accountants

• C-corporation: Incorporated business composed of shareholders, directors, and officers

• S-corporation: Incorporated business that is taxed as a pass-through entity

• Professional corporation: Corporate structure for professionals, such as doctors and accountants

• B-corporation: For-profit corporation that is certified for meeting social and environmental standards

• Nonprofit: Corporation formed primarily to benefit the public interest rather than earn a profit

• Estate: Separate legal entity created to distribute an individual’s property after death

• Municipality: Corporate status given to a city or town

• Cooperative: Private organization owned and controlled by a group of individuals for their own benefit

As you can see, there are numerous types of business entities; however, most business owners will choose from the six most common options: sole proprietorship, general partnership, limited partnership, LLC, C-corporation, or S-corporation. Below, we’ve explained each of these popular business entity types, as well as the pros and cons of choosing each particular structure for your company.

Sole Proprietorship

A sole proprietorship is the simplest business entity, with one person (or a married couple) as the sole owner and operator of the business. If you launch a new business and are the only owner, you are automatically a sole proprietorship under the law. There’s no need to register a sole proprietorship with the state, though you might need local business licenses or permits depending on your industry. Freelancers, consultants, and other service professionals commonly work as sole proprietors, but it’s also a viable option for more established businesses, such as retail stores, with one person at the helm.

Pros of Sole Proprietorship

• Easy to start (no need to register your business with the state).

• No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc.

• You can deduct most business losses on your personal tax return.

• Tax filings is easy—simply fill out and attach Schedule C-Profit or Loss From Business to your personal income tax return.

Cons of Sole Proprietorship

• As the only owner, you’re personally responsible for all of the business’s debts and liabilities—someone who wins a lawsuit against your business can take your personal assets (your car, personal bank accounts, even your home in some situations).

• There’s no real separation between you and the business, so it’s more difficult to get a business loan and raise money (lenders and investors prefer LLCs or corporations).

• It’s harder to build business credit without a registered business entity.

Sole proprietorships are by far the most popular type of business structure in the U.S. because of how easy they are to set up. There’s a lot of overlap between your personal and business finances, which makes it easy to launch and file taxes. The problem is that this same lack of separation can also land you in legal trouble. If a customer, employee, or another third party successfully sues your business, they can take your personal assets. Due to this risk, most sole proprietors eventually convert their business to an LLC or corporation.

General Partnership (GP)

Partnerships share many similarities with sole proprietorships—the key difference is that the business has two or more owners. There are two kinds of partnerships: general partnerships (GPs) and limited partnerships (LPs). In a general partnership, all partners actively manage the business and share in the profits and losses. Like a sole proprietorship, a general partnership is the default mode of ownership for multiple-owner businesses—there’s no need to register a general partnership with the state. I’ve written about the Utah Uniform Partnership Act previously.

Pros of General Partnership

• Easy to start (no need to register your business with the state).

• No corporate formalities or paperwork requirements, such as meeting minutes, bylaws, etc.

• You don’t need to absorb all the business losses on your own because the partners divide the profits and losses.

• Owners can deduct most business losses on their personal tax returns.

Cons of General Partnership

• Each owner is personally liable for the business’s debts and other liabilities.

• In some states, each partner may be personally liable for another partner’s negligent actions or behavior (this is called joint and several liability).

• Disputes among partners can unravel the business (though drafting a solid partnership agreement can help you avoid this).

• It’s more difficult to get a business loan, land a big client, and build business credit without a registered business entity.

Most people form partnerships to lower the risk of starting a business. Instead of going all-in on your own, having multiple people sharing the struggles and successes can be very helpful, especially in the early years. This being said, if you do go this route, it’s very important to choose the right partner or partners. Disputes can seriously limit a business’s growth, and many state laws hold each partner fully responsible for the actions of the others. For example, if one partner enters into a contract and then violates one of the terms, the third party can personally sue any or all of the partners.

Limited Partnership (LP)

Unlike a general partnership, a limited partnership is a registered business entity. To form an LP, therefore, you must file paperwork with the state. In an LP, there are two kinds of partners: those who own, operate, and assume liability for the business (general partners), and those who act only as investors (limited partners, sometimes called “silent partners”). Limited partners don’t have control over business operations and have fewer liabilities. They typically act as investors in the business and also pay fewer taxes because they have a more tangential role in the company.

Pros of Limited Partnership

• An LP is a good option for raising money because investors can serve as limited partners without personal liability.

• General partners get the money they need to operate but maintain authority over business operations.

• Limited partners can leave anytime without dissolving the business partnership.

Cons of Limited Partnership

• General partners are personally responsible for the business’s debts and liabilities.

• More expensive to create than a general partnership and requires a state filing.

• A limited partner may also face personal liability if they inadvertently take too active a role in the business.

Multi-owner businesses that want to raise money from investors often do well as LPs because investors can avoid liability. You might come across yet another business entity structure called a limited liability partnership (LLP). In an LLP, none of the partners have personal liability for the business, but most states only allow law firms, accounting firms, doctor’s offices, and other professional service firms to organize as LLPs. These types of businesses can organize as an LLP to avoid each partner being liable for the other’s actions. For example, if one doctor in a medical practice commits malpractice, having an LLP lets the other doctors avoid liability.

C-Corporation

A C-corporation is an independent legal entity that exists separately from the company’s owners. Shareholders (the owners), a board of directors, and officers have control over the corporation, although one person in a C-corp can fulfill all of these roles, so it is possible to create a corporation where you’re in charge of everything. This being said, with this type of business entity, there are many more regulations and tax laws that the company must comply with. Methods for incorporating, fees, and required forms vary by state.

Pros of C-corporation

• Owners (shareholders) don’t have personal liability for the business’s debts and liabilities.

• C-corporations are eligible for more tax deductions than any other type of business.

• C-corporation owners pay lower self-employment taxes.

• You have the ability to offer stock options, which can help you raise money in the future.

Cons of C-corporation

• More expensive to create than sole proprietorships and partnerships (the filing fees required to incorporate a business range from $100 to $500 based on which state you’re in).

• C-corporations face double taxation: The company pays taxes on the corporate tax return, and then shareholders pay taxes on dividends on their personal tax returns.

• Owners cannot deduct business losses on their personal tax returns.

• There are a lot of formalities that corporations have to meet, such as holding board and shareholder meetings, keeping meeting minutes, and creating bylaws.

Most small businesses pass over C-corps when deciding how to structure their business, but they can be a good choice as your business grows and you find yourself needing more legal protections. The biggest benefit of a C-corp is limited liability. If someone sues the business, they are limited to taking business assets to cover the judgment—they can’t come after your home, car, or other personal assets. This being said, corporations are a mixed bag from a tax perspective—there are more tax deductions and fewer self-employment taxes, but there’s the possibility of double taxation if you plan to offer dividends. Owners who invest profits back into the business as opposed to taking dividends are more likely to benefit under a corporate structure.

S-Corporation

An S-corporation preserves the limited liability that comes with a C-corporation but is a pass-through entity for tax purposes. This means that, similar to a sole prop or partnership, an S-corp’s profits and losses pass through to the owners’ personal tax returns. There’s no corporate-level taxation for an S-corp.

Pros of S-corporation

• Owners (shareholders) don’t have personal liability for the business’s debts and liabilities.

• No corporate taxation and no double taxation: An S-corp is a pass-through entity, so the government taxes it much like a sole proprietorship or partnership.

Cons of S-corporation

• Like C-corporations, S-corporations are more expensive to create than both sole proprietorships and partnerships (requires registration with the state).

• There are more limits on issuing stock with S-corps vs. C-corps.

• You still need to comply with corporate formalities, like creating bylaws and holding board and shareholder meetings.

In order to organize as an S-corporation or convert your business to an S-corporation, you have to file IRS form 2553. S-corporations can be a good choice for businesses that want a corporate structure but like the tax flexibility of a sole proprietorship or partnership.

Limited Liability Company (LLC)

A limited liability company takes positive features from each of the other business entity types. Like corporations, LLCs offer limited liability protections. But, LLCs also have less paperwork and ongoing requirements, and in that sense, they are more like sole proprietorships and partnerships. Another big benefit is that you can choose how you want the IRS to tax your LLC. You can elect to have the IRS treat it as a corporation or as a pass-through entity on your taxes.

Pros of LLC

• Owners don’t have personal liability for the business’s debts or liabilities.

• You can choose whether you want your LLC to be taxed as a partnership or as a corporation.

• Not as many corporate formalities compared to an S-corp or C-corp.

Cons of LLC

• It’s more expensive to create an LLC than a sole proprietorship or partnership (requires registration with the state).

LLCs are popular among small business owners, including freelancers, because they combine the best of many worlds: the ease of a sole proprietorship or partnership with the legal protections of a corporation.

At the end of the day, hiring Attorney Jeremy Eveland to draft a business succession plan in Orem, Utah is a wise decision. With his extensive experience, knowledge, and commitment to providing the best legal solutions, clients can be assured that their business succession plan will be drafted with the utmost care and consideration. Jeremy is committed to providing the best legal advice and is available to answer any questions or concerns clients may have. With Jeremy’s help, clients can feel confident in their business succession plan and the future of their business.

Orem, Utah

|

Orem, Utah

|

|

|---|---|

Orem City Center

|

|

| Nickname:

Family City USA

|

|

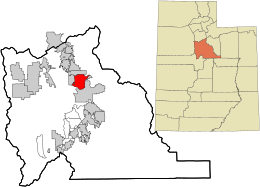

Location in Utah County and the state of Utah

|

|

| Coordinates: 40°17′56″N 111°41′47″WCoordinates: 40°17′56″N 111°41′47″W | |

| Country | United States |

| State | Utah |

| County | Utah |

| Settled | 1877 |

| Town charter granted | May 5, 1919 |

| Named for | Walter C. Orem |

| Government

|

|

| • Mayor | David Young |

| • Spokesman | Steven Downs |

| • City Manager | James P. Davidson[2] |

| Area

|

|

| • Total | 18.57 sq mi (48.10 km2) |

| • Land | 18.57 sq mi (48.10 km2) |

| • Water | 0.00 sq mi (0.00 km2) |

| Elevation

|

4,774 ft (1,455 m) |

| Population

(2020)

|

|

| • Total | 98,129[1] |

| • Density | 5,267.22/sq mi (2,033.67/km2) |

| Time zone | UTC-7 (Mountain (MST)) |

| • Summer (DST) | UTC-6 (MDT) |

| Area codes | 385, 801 |

| FIPS code | 49-57300[3] |

| GNIS feature ID | 1444110[4] |

| Website | www |

Orem is a city in Utah County, Utah, United States, in the northern part of the state. It is adjacent to Provo, Lindon, and Vineyard and is approximately 45 miles (72 km) south of Salt Lake City.

Orem is one of the principal cities of the Provo-Orem, Utah Metropolitan Statistical Area, which includes all of Utah and Juab counties. The 2020 population was 98,129,[1] while the 2010 population was 88,328[5] making it the fifth-largest city in Utah. Utah Valley University is located in Orem.

[geocentric_weather id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_about id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_neighborhoods id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_thingstodo id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_busstops id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_mapembed id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_drivingdirections id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]

[geocentric_reviews id=”fc15bdb1-6bb4-44ef-a8fb-37e8effdd9db”]