If you are a business owner in Riverdale, Utah, it is crucial to have a reliable and experienced business lawyer by your side. Navigating the complex world of business law requires expert knowledge and a meticulous attention to detail. Whether you are starting a new venture, handling contracts and agreements, or facing legal disputes, the right lawyer can provide invaluable guidance and representation. In this article, we will explore the importance of having a skilled business lawyer in Riverdale, Utah and how they can protect and advance your business interests. By the end of this article, you will have a comprehensive understanding of why seeking the assistance of a business lawyer is essential and may even be inspired to reach out for their services.

What is Business Law?

Definition of Business Law

Business law refers to the legal rules and regulations that govern the operations and transactions of businesses. It covers a wide range of legal areas such as contracts, employment, intellectual property, and dispute resolution. Business law ensures that businesses operate within the boundaries of the law and helps protect their interests and rights.

Importance of Business Law for Businesses

Business law plays a crucial role in the smooth and successful functioning of businesses. It provides a framework for businesses to operate ethically and responsibly, ensuring compliance with legal requirements. By understanding and adhering to business laws, businesses can protect themselves from legal disputes, penalties, and reputational damage. Moreover, business law provides guidance on navigating complex legal issues related to contracts, intellectual property, employment, and business formation, enabling businesses to make informed decisions and mitigate risks.

Why Do You Need a Business Lawyer?

Ensuring Compliance with Laws and Regulations

Businesses are subject to various laws and regulations at federal, state, and local levels. Compliance with these laws is essential to avoid legal consequences and maintain good standing. A business lawyer can help you understand the applicable laws and regulations, ensure compliance, and develop policies and procedures to minimize legal risks.

Assistance with Contracts and Agreements

Contracts are integral to any business operation, from vendor agreements to employment contracts. A business lawyer can review and draft contracts to ensure that they protect your interests and comply with legal requirements. They can also provide guidance on negotiating favorable terms and resolving contract disputes.

Handling Business Disputes and Litigation

Disputes are an unfortunate reality in business, whether with customers, partners, or employees. A business lawyer can represent your interests in resolving disputes through negotiation, mediation, arbitration, or litigation. They can offer legal advice, protect your rights, and work towards achieving a favorable resolution.

Protecting Intellectual Property

Intellectual property, such as trademarks, copyrights, and patents, is often a valuable asset for businesses. A business lawyer can help you file for and protect your intellectual property rights, enforce them against infringement, and advise on licensing agreements to maximize their value.

Guidance on Business Formation and Corporate Structure

Choosing the right business structure, such as a sole proprietorship, partnership, corporation, or limited liability company, has significant legal and financial implications. A business lawyer can guide you through the process of business formation, considering factors like liability, taxation, and governance. They can assist in drafting formation documents, obtaining necessary licenses and permits, and ensuring compliance with legal requirements.

Choosing the Right Business Lawyer

Experience and Expertise

When selecting a business lawyer, consider their experience and expertise in business law. Look for a lawyer who has handled cases similar to your business needs and has a proven track record of success. An experienced lawyer will be well-versed in the intricacies of business law and can provide valuable insights and guidance.

Client Testimonials and Reviews

Reading client testimonials and reviews can give you an idea of the lawyer’s reputation and the level of satisfaction clients have experienced. Look for testimonials that highlight the lawyer’s professionalism, responsiveness, and ability to achieve positive outcomes for their clients.

Communication and Availability

Effective communication with your business lawyer is crucial throughout your business relationship. Choose a lawyer who is responsive and accessible, promptly addressing your concerns and keeping you informed about the progress of your case. Clear and open communication will help you work together more effectively.

Cost and Billing Structure

Discuss the fee structure and billing arrangements with potential business lawyers. Understand how they charge for their services, whether it’s an hourly rate, a flat fee, or a contingency fee arrangement. Ensure that you are comfortable with the cost and have a clear understanding of the services covered by the fees.

Compatibility and Trust

Building a strong attorney-client relationship requires compatibility and trust. You should feel comfortable discussing sensitive business matters with your lawyer and have confidence in their abilities to represent your interests effectively. Trust your instincts when assessing whether a lawyer is the right fit for your business.

Services Provided by a Business Lawyer

Business Formation and Structuring

A business lawyer can assist you in choosing and establishing the appropriate legal structure for your business. They can help with filing the necessary documents, obtaining licenses and permits, and ensuring compliance with state and federal regulations.

Drafting and Reviewing Contracts

Contracts are vital for any business, and a business lawyer can draft, review, and negotiate contracts on your behalf. They can ensure that contracts protect your interests, minimize legal risks, and comply with relevant laws and regulations.

Intellectual Property Protection

Protecting your intellectual property is crucial for maintaining a competitive edge in the market. A business lawyer can help you identify and protect your intellectual property rights through trademarks, copyrights, patents, and trade secrets. They can also assist in drafting licensing agreements and addressing infringement issues.

Employment Law Compliance

Employment laws govern the relationship between employers and employees, covering areas such as hiring, termination, discrimination, and wage and hour regulations. A business lawyer can help you navigate these complex laws, create compliant employment policies, and resolve disputes with employees.

Business Transactions and Negotiations

Whether you are buying or selling a business, entering into partnerships, or engaging in mergers and acquisitions, a business lawyer can guide you through the transaction process. They can assist in due diligence, contract negotiations, drafting agreements, and ensuring compliance with legal requirements.

Dispute Resolution and Litigation

In the event of a business dispute, a business lawyer can represent your interests in resolving the issue through negotiation, mediation, arbitration, or litigation. They can assess the merits of your case, develop legal strategies, and advocate for your rights in court if necessary.

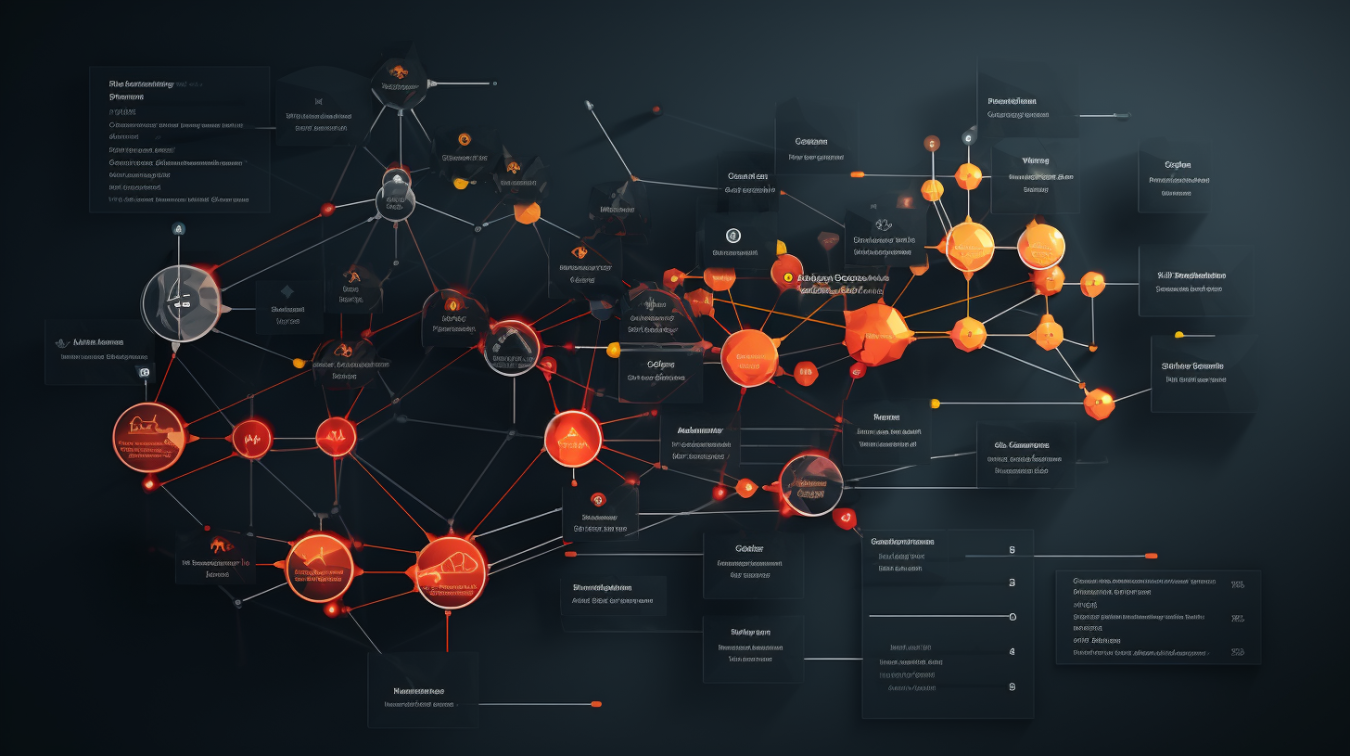

Risk Assessment and Management

A business lawyer can assess potential legal risks faced by your business and provide strategies to mitigate those risks. They can help you develop policies and procedures to ensure compliance with laws and regulations, minimize liability, and protect your business from legal disputes and penalties.

Initial Consultation with a Business Lawyer

Preparing for the Consultation

Before meeting with a business lawyer, it is helpful to gather relevant documents and information related to your business. This may include contracts, financial records, employment policies, and any ongoing legal disputes. Being prepared will allow the lawyer to better understand your specific needs and provide tailored advice.

Discussion of Legal Needs and Goals

During the initial consultation, openly discuss your legal needs, concerns, and long-term business goals with the lawyer. This will help them assess your situation and provide guidance on how they can assist you. Be transparent about any ongoing legal issues or potential risks you are facing.

Assessment of Potential Legal Issues

Based on the information you provide, the business lawyer will evaluate potential legal issues that may impact your business. They will identify areas of vulnerability and suggest legal strategies to mitigate risks and ensure compliance with laws and regulations.

Examination of Available Legal Strategies

The lawyer will discuss the different legal strategies available to address your specific business needs. They will explain the potential benefits and drawbacks of each strategy, empowering you to make informed decisions that align with your goals.

Explanation of Fees and Billing Structure

During the initial consultation, the lawyer will explain their fee structure and billing arrangements. They will discuss how they charge for their services and provide an estimate of the costs involved. It is essential to have a clear understanding of the fees to ensure there are no surprises down the road.

The Benefits of Hiring a Local Business Lawyer

Knowledge of Local Laws and Regulations

A local business lawyer will have a deep understanding of the specific laws and regulations relevant to your location. They can ensure that your business complies with local legal requirements and provide insights into any specific challenges or opportunities in your area.

Understanding of the Local Business Landscape

A local business lawyer will be familiar with the local business landscape, including industry practices, market trends, and common legal issues faced by businesses in your area. This knowledge can be invaluable in offering tailored advice and guiding your business through local challenges.

Established Professional Network

Local business lawyers often have established professional networks, including connections with other professionals such as accountants, tax advisors, and consultants. These connections can be beneficial in providing you with comprehensive legal and business services and facilitating collaborations when needed.

Convenience and Accessibility

Having a local business lawyer means that they are more accessible and available to meet in person when necessary. They can quickly respond to your queries, attend meetings, and provide timely legal advice. This convenience can be especially advantageous during urgent situations or when face-to-face discussions are preferred.

Common Legal Issues Faced by Utah Businesses

Business Formation and Registration

When starting a business in Utah, it is crucial to navigate the legal requirements for business formation and registration. A business lawyer can assist with choosing the right legal structure, filing necessary documents with the Utah Division of Corporations and Commercial Code, and ensuring compliance with state laws.

Employment Law Compliance

Utah businesses must comply with various employment laws, including wage and hour regulations, anti-discrimination laws, and workers’ compensation requirements. A business lawyer can help you understand these laws, create employment policies, and ensure compliance to avoid legal disputes and penalties.

Contract Disputes

Disputes over contracts are common in business transactions. Whether it is a breach of contract, non-payment of funds, or disagreement over terms, a business lawyer can provide guidance on resolving contract disputes effectively. They can advocate for your rights and explore alternative dispute resolution methods if litigation is not the best option.

Intellectual Property Infringement

Protecting intellectual property is crucial for businesses in Utah. A business lawyer can assist in detecting and addressing intellectual property infringement, including trademarks, copyrights, and patents. They can enforce your rights and help you take legal action against those who unlawfully use your intellectual property.

Taxation and Regulatory Compliance

Utah businesses must comply with state and federal tax laws and regulatory requirements. A business lawyer can provide guidance on tax planning, help you understand your obligations, and ensure compliance with tax laws and regulations. They can also assist in responding to audits and resolving tax disputes.

Shareholder and Partnership Disputes

In businesses with multiple owners, shareholder and partnership disputes may arise. These disputes can impact the smooth operation of the business and jeopardize its success. A business lawyer can help resolve conflicts, protect your interests, and, if necessary, represent you in litigation to ensure a fair resolution.

How a Business Lawyer Helps Startups

Choosing the Right Business Structure

Startups often face the challenge of selecting the most appropriate legal structure. A business lawyer can guide you through the process, considering factors such as liability, taxation, and fundraising requirements. They can explain the pros and cons of each structure and help you make an informed decision.

Drafting and Negotiating Contracts

Startups engage in various contracts, including with employees, suppliers, and investors. A business lawyer can assist in drafting and negotiating these contracts to protect your interests and minimize legal risks. They can ensure that contracts align with your startup’s unique needs and comply with relevant laws.

Complying with Employment Laws

Hiring employees and complying with employment laws can be complex for startups. A business lawyer can help you understand employment laws, create compliant policies and contracts, and ensure adherence to anti-discrimination laws, wage and hour regulations, and other employment requirements.

Protecting Intellectual Property

Startups often have valuable intellectual property, such as innovative ideas, software, or unique branding. A business lawyer can help you identify and protect your intellectual property, including filing patent applications, registering trademarks, and drafting licensing agreements.

Navigating Funding and Investor Agreements

Startups often seek funding from investors to fuel their growth. A business lawyer can assist in navigating funding rounds, drafting investment agreements, and ensuring compliance with securities laws. They can help negotiate favorable terms and protect your interests during the investment process.

Handling Business Disputes

Negotiation and Mediation

In many cases, business disputes can be resolved through negotiation and mediation. A business lawyer can represent your interests and help facilitate discussions between parties to reach a mutually acceptable resolution. They use their negotiation skills and legal expertise to protect your rights and achieve a favorable outcome without the need for litigation.

Arbitration

Arbitration is an alternative dispute resolution method where an arbitrator, appointed by the parties or a chosen arbitration institute, hears the case and makes a binding decision. A business lawyer can guide you through the arbitration process, represent you during the proceedings, and help present your case effectively.

Litigation Process

In some cases, litigation becomes necessary to resolve business disputes. A business lawyer will advocate for your interests in court, presenting legal arguments, gathering evidence, and cross-examining witnesses. They will guide you through the entire litigation process, from filing the complaint to enforcing judgments and awards.

Enforcement of Judgments and Awards

After successfully resolving a business dispute through negotiation, mediation, arbitration, or litigation, it may be necessary to enforce any judgments or awards obtained. A business lawyer can assist in enforcing court orders or arbitration awards, ensuring that you receive the compensation or resolution agreed upon.

FAQs

What does a business lawyer do?

A business lawyer provides legal advice and representation to businesses on various matters such as compliance with laws and regulations, contract drafting and negotiation, dispute resolution, intellectual property protection, and business formation.

How much does a business lawyer charge?

The fees charged by business lawyers can vary depending on factors such as the complexity of the case, the lawyer’s experience, and the location. Lawyers typically charge by the hour, offer flat fee arrangements, or work on a contingency basis for certain types of cases.

Do I need a business lawyer for a small business?

While small businesses may face less complex legal issues, having a business lawyer can be beneficial. A business lawyer can ensure compliance with laws, draft contracts, protect intellectual property, and provide guidance on various legal matters, ultimately helping to avoid potential legal disputes and risks.

What are the potential consequences of not having a business lawyer?

Not having a business lawyer can expose your business to various risks. You may face legal disputes, penalties for non-compliance with laws, and potential loss of intellectual property. Without legal guidance, you may also make uninformed decisions that can impact the long-term success of your business.

How can I find a reliable business lawyer in Riverdale, Utah?

To find a reliable business lawyer in Riverdale, Utah, consider seeking recommendations from other business owners or professionals in your industry. Research local law firms and lawyers, review their qualifications and experience, and schedule consultations to assess their compatibility with your needs.

If you need an attorney in Utah, you can call:

Jeremy Eveland

8833 South Redwood Road

West Jordan, Utah 84088

(801) 613-1472

https://jeremyeveland.com