LLC Formation

Looking to start your own business? Well, did you know that forming an LLC can give you the freedom and protection you need? In fact, over 70% of small businesses in the United States choose to operate as LLCs. So, if you're ready to take control of your entrepreneurial journey, this article is for you. We'll walk you through the steps of forming an LLC in Utah and highlight the benefits it brings. Let's get started on your path to liberation!

Key Takeaways

- LLC formation creates a separate legal entity that provides personal liability protection for owners.

- The process of forming an LLC involves filing documents and paying fees to the appropriate state agency.

- Choosing a unique business name is important to establish a strong brand identity and protect it from being used by others.

- Forming an LLC offers flexibility in taxation options, adds credibility to the business, and allows for risk-taking without jeopardizing personal finances.

What is an LLC?

An LLC, or limited liability company, is a type of business entity that provides personal liability protection for its owners. If you're looking to start your own business and want the freedom to pursue your dreams without worrying about personal financial risk, forming an LLC might be the perfect choice for you.

When you form an LLC, you create a separate legal entity that shields your personal assets from any liabilities of the business. This means that if your LLC faces financial difficulties or legal issues, your personal belongings like your home or car won't be at risk. You can breathe easy knowing that you have this protection in place.

Forming an LLC is relatively straightforward. The process varies slightly depending on the state where you plan to establish your business, but generally involves filing certain documents with the appropriate state agency and paying any necessary fees. It's essential to follow all the steps required by your state to ensure proper formation of your LLC.

In Utah specifically, there are several steps involved in forming an LLC. These include selecting a unique name for your company, appointing a registered agent who will receive legal documents on behalf of the LLC, filing Articles of Organization with the Utah Division of Corporations and Commercial Code, and creating an Operating Agreement that outlines how your company will be managed.

Steps to Forming an LLC in Utah

To form an LLC in Utah, you'll need to complete several steps. Here's a quick overview of the process:

-

Choose a name for your LLC: Selecting the right business name is crucial as it will represent your brand and create the first impression on potential customers. Make sure the name is unique and not already taken by another business in Utah.

-

File Articles of Organization: This is a formal document that you must file with the Utah Division of Corporations and Commercial Code (DCC) to officially establish your LLC. The articles typically include basic information about your company, such as its name, address, and purpose.

-

Create an Operating Agreement: Although not required by law in Utah, having an operating agreement is highly recommended. This document outlines how your LLC will be managed, including membership rights and responsibilities, profit distribution, decision-making processes, and more.

After completing these steps, you'll be well on your way to forming your LLC in Utah. Remember that each state might have slightly different requirements or additional steps, so always check with local authorities or seek professional advice to ensure compliance.

Once you've formed your LLC successfully, it's time to move on to choosing the right business name for your llc

Choosing the Right Business Name for Your LLC

Choosing the right business name for your LLC is crucial because it represents your brand and makes a first impression on potential customers. When it comes to llc formation, the name you choose can play a significant role in attracting clients and establishing your identity in the market. Your LLC name should reflect your business entity's values, mission, and overall vision.

When choosing the right business name for your LLC, consider brainstorming ideas that align with your desired image. Think about what sets you apart from competitors and how you want to be perceived by customers. A catchy, memorable name can make a lasting impact and help build brand recognition.

It's important to check if the chosen LLC name is available before moving forward with the llc formation process. Conduct thorough research to ensure there are no conflicts or similarities with existing businesses in your industry. You can do this by searching state databases or hiring professionals who specialize in trademark searches.

Once you've settled on a suitable LLC name, include it in the articles of organization when forming your LLC. This document officially establishes your business entity and ensures legal compliance. By including the chosen business name in these articles, you protect it from being used by others within your state.

Remember that choosing the right business name for your LLC reflects not only who you are but also what you stand for as an entrepreneur. It's an opportunity to create a strong brand presence that resonates with potential customers and helps differentiate yourself from competitors in the market. So take some time to brainstorm ideas and find a unique, impactful llc name that truly represents your passion and goals.

Filing the Necessary Paperwork for LLC Formation

When filing the necessary paperwork for your LLC, make sure to check if the chosen business name is available. This step is crucial to ensure that your LLC formation process goes smoothly. Here are three key things you should keep in mind when it comes to filing the necessary paperwork for your LLC:

-

Research and Select a Unique Business Name: Before filing the paperwork, conduct a thorough search to ensure that no other business is using the same or similar name. You can check with your state's Secretary of State office or use online databases to verify name availability. Choosing a unique and distinctive name will help you establish a strong brand identity for your LLC.

-

Prepare and File Articles of Organization: The articles of organization are essential documents required for LLC formation. They outline important details such as the LLC's name, address, purpose, management structure, and members' names. Make sure to accurately complete these forms and submit them along with any required fees to the appropriate state agency.

-

Obtain an Employer Identification Number (EIN): An EIN is a unique nine-digit number issued by the IRS that identifies your LLC for tax purposes. It is necessary if you plan on hiring employees or opening business bank accounts. You can apply for an EIN online through the IRS website, making the process quick and convenient.

Understanding the Benefits of Forming an LLC

Understanding the benefits of forming an LLC can help you make an informed decision about your business structure. When it comes to llc formation, there are several advantages that can empower you and liberate your entrepreneurial spirit.

One of the key benefits of forming an LLC is personal liability protection. By establishing your business as an LLC, you create a legal separation between yourself and your company. This means that if your business faces any financial or legal troubles, your personal assets will be protected from being seized to cover those liabilities. This liberation gives you peace of mind and allows you to take risks without jeopardizing your personal finances.

Another benefit is the flexibility in taxation options. When you form an LLC, you have the freedom to choose how you want to be taxed: either as a sole proprietorship, partnership, S corporation or C corporation. This understanding lets you optimize your tax strategy and potentially save money by taking advantage of deductions and credits available for each type of taxation.

Forming an LLC also provides credibility and professionalism to your business. It shows potential clients, partners, and investors that you are serious about what you do and have taken steps to establish a legitimate entity. This perception can open doors for new opportunities and lead to increased success.

Frequently Asked Questions

What Are the Tax Implications of Forming an Llc?

Forming an LLC has tax implications that you should know. It can provide benefits like pass-through taxation and limited liability protection. Consult a tax professional to understand how it specifically affects your situation.

Can I Form an LLC on My Own, or Do I Need Legal Assistance?

You can form an LLC on your own if you feel confident navigating the legal requirements. However, it's advisable to seek legal assistance to ensure proper compliance and minimize potential risks or mistakes.

How Much Does It Cost to Form an LLC in Utah?

You're wondering about the cost to form an LLC in Utah. Well, it depends on various factors like filing fees and legal assistance. But remember, "you get what you pay for."

Are There Any Restrictions on the Type of Business That Can Be Formed as an Llc?

There are no restrictions on the type of business that can be formed as an LLC. You have the freedom to choose any kind of business and enjoy the benefits of limited liability protection.

What Are the Ongoing Compliance Requirements for Maintaining an LLC in Utah?

To maintain your LLC in Utah, you must fulfill ongoing compliance requirements. These include filing an annual report and paying the necessary fees. By meeting these obligations, you can ensure the smooth operation of your business.

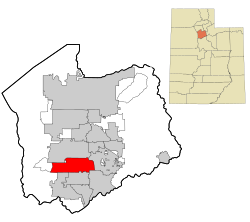

Areas We Serve

We serve individuals and businesses in the following locations:

Salt Lake City Utah

West Valley City Utah

Provo Utah

West Jordan Utah

Orem Utah

Sandy Utah

Ogden Utah

St. George Utah

Layton Utah

South Jordan Utah

Lehi Utah

Millcreek Utah

Taylorsville Utah

Logan Utah

Murray Utah

Draper Utah

Bountiful Utah

Riverton Utah

Herriman Utah

Spanish Fork Utah

Roy Utah

Pleasant Grove Utah

Kearns Utah

Tooele Utah

Cottonwood Heights Utah

Midvale Utah

Springville Utah

Eagle Mountain Utah

Cedar City Utah

Kaysville Utah

Clearfield Utah

Holladay Utah

American Fork Utah

Syracuse Utah

Saratoga Springs Utah

Magna Utah

Washington Utah

South Salt Lake Utah

Farmington Utah

Clinton Utah

North Salt Lake Utah

Payson Utah

North Ogden Utah

Brigham City Utah

Highland Utah

Centerville Utah

Hurricane Utah

South Ogden Utah

Heber Utah

West Haven Utah

Bluffdale Utah

Santaquin Utah

Smithfield Utah

Woods Cross Utah

Grantsville Utah

Lindon Utah

North Logan Utah

West Point Utah

Vernal Utah

Alpine Utah

Cedar Hills Utah

Pleasant View Utah

Mapleton Utah

Stansbury Par Utah

Washington Terrace Utah

Riverdale Utah

Hooper Utah

Tremonton Utah

Ivins Utah

Park City Utah

Price Utah

Hyrum Utah

Summit Park Utah

Salem Utah

Richfield Utah

Santa Clara Utah

Providence Utah

South Weber Utah

Vineyard Utah

Ephraim Utah

Roosevelt Utah

Farr West Utah

Plain City Utah

Nibley Utah

Enoch Utah

Harrisville Utah

Snyderville Utah

Fruit Heights Utah

Nephi Utah

White City Utah

West Bountiful Utah

Sunset Utah

Moab Utah

Midway Utah

Perry Utah

Kanab Utah

Hyde Park Utah

Silver Summit Utah

La Verkin Utah

Morgan Utah

LLC Formation Lawyer Consultation

When you need help from an attorney for LLC Formations, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

Mastering Business Law: Key Essentials For Success

Business Lawyer Centerville Utah

Shareholder Agreements in Utah

Business Lawyer Hurricane Utah

Business Lawyer South Ogden Utah

Last Will and Testament Lawyer

Business Lawyer Heber City Utah

Business Lawyer Hurricane Utah

Business Lawyer West Haven Utah

Do I Need A License To Start A Business?

Business Lawyer Bluffdale Utah

Business Lawyer Santaquin Utah

Legal Implications of Cryptocurrency in Business Transactions

Business Lawyer Smithfield Utah

Structuring A Flow Through Entity

Business Lawyer Woods Cross Utah

Business Lawyer Grantsville Utah

Structuring Turn Around Investments

Business Lawyer North Logan Utah

How Many Types of Business Law Are There?