What Are The 4 Different Types Of Business Law

Are you looking to gain a deeper understanding of the legal aspects that govern businesses? If so, you've come to the right place. In this article, we will explore the four different types of business law that are crucial for any entrepreneur or business owner to be aware of. By familiarizing yourself with these areas, you can ensure that your business operates within the boundaries of the law and avoid potential legal pitfalls.

The first type of business law is contract law. This branch focuses on ensuring that agreements entered into by individuals or entities are valid and enforceable. Understanding contract law is essential as it governs any written or verbal agreement between parties involved in a business transaction. From purchase contracts to employment agreements, having a solid grasp of contract law will enable you to negotiate favorable terms while protecting your rights and interests.

Next up is employment law, which deals with the legal relationship between employers and employees. This area covers various aspects such as hiring practices, workplace safety regulations, discrimination laws, and termination procedures. Being well-versed in employment law is crucial for creating a fair and productive work environment while avoiding costly lawsuits or disputes.

Moving on to intellectual property law – this branch focuses on protecting intangible assets such as trademarks, copyrights, patents, and trade secrets. With technology advancing at an unprecedented rate, intellectual property has become increasingly valuable in today's competitive landscape. Understanding how intellectual property rights work can help safeguard your innovative ideas from being copied or stolen by competitors.

Lastly, we have corporate law – an area that encompasses the legal structure and governance of a company. Corporate lawyers assist businesses in forming legal entities such as corporations or limited liability companies (LLCs). They also advise on matters related to shareholder rights, mergers and acquisitions, compliance with regulatory requirements, and more.

By gaining knowledge about these four types of business law – contract law, employment law, intellectual property law, and corporate law – you can navigate the complex legal landscape with confidence. Whether you're starting a new business or managing an existing one, having a solid understanding of these areas will not only protect your interests but also contribute to the long-term success and sustainability of your enterprise. So, let's dive in and explore each type of business law in more detail!

Contract Law: Ensuring Valid and Enforceable Agreements

Contract law ensures that agreements are valid and enforceable, giving individuals the power to protect their rights and hold others accountable. In the realm of business law, contract law plays a crucial role in establishing the foundation for successful transactions and relationships. By understanding the principles of contract law, businesses can create legally binding agreements that provide clarity and protection for all parties involved.

Valid agreements are a fundamental aspect of contract law. For an agreement to be considered valid, certain elements must be present. These include an offer made by one party, acceptance by the other party, consideration (something of value exchanged between the parties), legal capacity of both parties to enter into the agreement, genuine consent without any coercion or misrepresentation, as well as legality in terms of not violating any laws or public policies. Valid agreements ensure that both parties have willingly entered into a contractual relationship with full understanding and intent.

Once an agreement is deemed valid, it becomes enforceable under contract law. This means that if one party fails to fulfill their obligations outlined in the agreement, the other party has legal remedies available to them. Enforceable agreements give businesses confidence knowing they can take action if necessary to protect their interests. The courts play a vital role in enforcing contracts by providing remedies such as monetary damages or specific performance (requiring a party to fulfill their contractual obligations).

Understanding contract law is essential for businesses because it enables them to navigate negotiations with confidence and clarity. By ensuring that agreements are valid and enforceable, businesses can establish trust among their partners and clients while minimizing potential conflicts or disputes. Contract law provides a framework through which business relationships can flourish based on mutual understanding and accountability.

As we transition into discussing employment law – which focuses on navigating the legal relationship between employers and employees – it's important to note how contract law intersects with this area of business law. Employment contracts play a vital role in outlining the rights and responsibilities of both employers and employees. By recognizing how contract law shapes the employer-employee relationship, businesses can ensure compliance with legal obligations and foster a harmonious work environment.

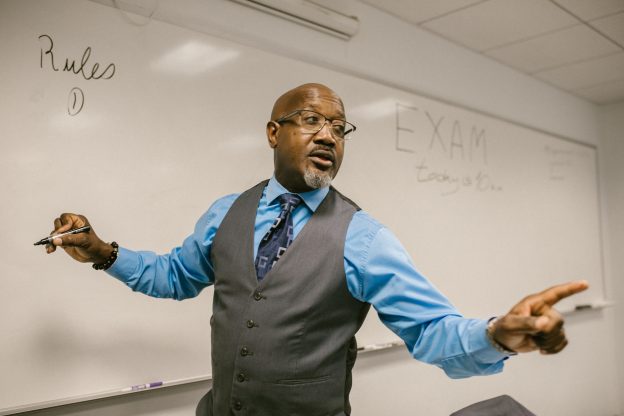

Employment Law: Navigating the Legal Relationship between Employers and Employees

Navigate the complex legal landscape of employment relationships and learn how employers and employees can establish a mutually beneficial partnership. Employment law encompasses the legal relationship between employers and employees, providing guidelines for both parties to follow in order to ensure fair treatment and protection of rights. This area of business law covers various aspects such as hiring, compensation, workplace safety, discrimination, termination, and more. By understanding employment law, employers and employees can navigate this intricate framework to create a harmonious work environment that benefits all parties involved.

To fully comprehend the complexities of employment law, it is essential to understand the different dimensions that make up this legal relationship. The following table provides an overview of three key areas within employment law:

| Aspect |

Description |

| Hiring |

Covers the process of recruiting and selecting employees in compliance with anti-discrimination laws. |

| Compensation |

Addresses issues related to wages, overtime pay, benefits packages, leave policies, and more. |

| Workplace Safety |

Focuses on ensuring a safe working environment through regulations such as health and safety standards. |

Navigating these aspects requires employers to be aware of their responsibilities towards their workforce while also safeguarding their interests as business owners. It entails adhering to labor laws regarding fair hiring practices, providing appropriate compensation packages based on regulatory requirements or industry standards, and maintaining a safe workplace by implementing necessary precautions.

Employees also have certain rights under employment law that protect them from unfair treatment or discriminatory practices. These include the right to receive fair wages for their work hours or overtime efforts when applicable; access to suitable benefits packages such as paid time off or healthcare coverage; protection against harassment or discrimination based on factors like race, gender, religion; a safe working environment free from hazards or risks.

Understanding these fundamental aspects of employment law allows both employers and employees to establish a legally sound foundation for their relationship. By navigating this legal landscape effectively while respecting the rights and responsibilities of each party, a mutually beneficial partnership can be achieved. In the next section, we will explore another crucial area of business law: intellectual property law, which focuses on safeguarding intangible assets such as inventions, trademarks, and copyrights.

Note: To protect your intangible assets from unauthorized use or infringement, it is important to understand how intellectual property law operates.

Intellectual Property Law: Protecting Your Intangible Assets

Intellectual Property Law is like a shield that safeguards your intangible assets, such as inventions and trademarks, from the hands of unauthorized users. It is one of the four different types of business laws that you need to understand to protect your assets effectively. Intellectual property refers to creations of the mind, including inventions, literary and artistic works, designs, symbols, names, and images used in commerce. Business owners often invest significant time and resources into developing these intangible assets, making it crucial to have legal protection.

In today's highly competitive market, intellectual property plays a vital role in maintaining a competitive edge. By registering your intellectual property under intellectual property law, you gain exclusive rights over its use and can prevent others from using or copying it without permission. This helps you preserve the value of your creations and prevents competitors from unfairly benefiting from your hard work.

However, navigating intellectual property law can be complex due to various legal issues that may arise. For example, determining whether your creation qualifies for copyright protection or patent requirements can be challenging without proper guidance. Additionally, enforcing your rights against infringement requires a thorough understanding of legal procedures and potential remedies available under intellectual property law.

Understanding the nuances of intellectual property law is essential for protecting your assets effectively. By having knowledge about this area of business law, you can make informed decisions regarding licensing agreements or negotiations with potential partners or investors who might want access to your valuable intangible assets.

Transitioning into the next section about corporate law: Understanding the legal structure and governance of a company is crucial for ensuring compliance with applicable regulations while running a successful business entity.

Corporate Law: Understanding the Legal Structure and Governance of a Company

Corporate Law is essential for ensuring the proper structure and governance of a company, guaranteeing compliance with regulations and driving business success. It encompasses a wide range of legal issues that pertain to the formation, operation, and dissolution of a company. One key aspect of corporate law is establishing the legal structure of a company, which can be in the form of a corporation, limited liability company (LLC), partnership, or sole proprietorship. The choice of legal structure has significant implications for taxes, liability protection, ownership rights, and more.

In addition to determining the legal structure, corporate law also governs how a company operates on a day-to-day basis. This includes setting rules and procedures for decision-making processes within the organization, such as board meetings and shareholder voting. Corporate law also regulates matters related to shareholder rights and responsibilities, director duties and liabilities, executive compensation, mergers and acquisitions, and much more.

Understanding corporate law is crucial for business owners as it ensures that they are aware of their obligations towards stakeholders such as shareholders, employees, customers, creditors, and society at large. By adhering to corporate governance principles outlined by applicable laws and regulations in their article section specific to their jurisdiction or industry standards like Sarbanes-Oxley Act (SOX) for publicly traded companies in the United States; businesses can build trust with investors while safeguarding against potential legal disputes or reputational damage.

Transition: Now that you have an understanding of corporate law's importance in establishing the legal structure and governance of a company let's delve into another critical aspect – compliance with regulations: staying on the right side of business law.

Compliance with Regulations: Staying on the Right Side of Business Law

Make sure you're not caught in the crosshairs of legal trouble by understanding how to comply with regulations and stay on the right side of the law, just like a skilled tightrope walker gracefully balances their weight to avoid falling off and facing serious consequences. Compliance with regulations is essential for businesses to operate ethically, maintain a positive reputation, and avoid costly penalties or legal actions. To help you navigate this complex landscape, here are three key aspects of compliance in the context of business law:

-

Stay informed: Keeping up-to-date with relevant laws and regulations is crucial for ensuring compliance. Regularly review industry-specific guidelines, federal and state legislation, as well as any local ordinances that affect your business operations. It's important to have a thorough understanding of all applicable rules so that you can make informed decisions and implement necessary measures to remain compliant.

-

Develop internal policies: Establishing comprehensive internal policies is an effective way to ensure compliance within your organization. These policies should outline specific procedures and practices that align with legal requirements while promoting ethical behavior among employees. Clearly communicate these policies through training programs and regular reminders to reinforce their importance.

-

Conduct regular audits: Regularly assessing your business practices through internal audits helps identify areas where compliance may be lacking. Audits serve as a proactive measure to detect potential issues before they escalate into larger problems or attract regulatory scrutiny. By conducting thorough inspections, you can address any non-compliance promptly, develop corrective action plans, and mitigate associated risks.

By prioritizing compliance with regulations in your business operations, you demonstrate a commitment to ethical conduct while safeguarding yourself from legal troubles. Understanding the importance of staying on the right side of business law allows you to navigate confidently through various challenges that may arise in today's complex regulatory environment.

Transition: As invaluable as it is to proactively comply with regulations, sometimes disputes cannot be entirely avoided despite best efforts in adhering to business laws. Thus, it is essential to have strategies for resolving business conflicts in place.

Legal Dispute Resolution: Strategies for Resolving Business Conflicts

Discover effective strategies for resolving conflicts in your business, ensuring that you can overcome disputes and maintain harmony within your organization. When it comes to dispute resolution, understanding the legal aspects is crucial. One strategy is negotiation, where parties involved discuss their differences and try to reach a mutually satisfactory agreement. This approach allows for open communication and compromise, often leading to a resolution that benefits both parties. Another strategy is mediation, where a neutral third party facilitates discussions between the conflicting parties. Mediation can be effective in finding common ground and maintaining relationships while avoiding costly litigation.

In addition to negotiation and mediation, arbitration is another strategy for resolving business conflicts. In arbitration, an impartial third party reviews the evidence presented by both sides and makes a binding decision. This process tends to be quicker and less formal than traditional litigation, providing businesses with a more efficient way of settling disputes. Finally, if all else fails, litigation may be necessary. Litigation involves taking the dispute to court and having a judge or jury make a final ruling based on the presented evidence.

By employing these various strategies for dispute resolution, businesses can effectively handle conflicts that arise within their organization. It is important to understand which strategy suits each situation best as there is no one-size-fits-all approach. However, by utilizing negotiation or mediation when possible and resorting to arbitration or litigation when necessary, businesses can navigate legal complexities while preserving relationships and minimizing costs.

Resolving conflicts through effective dispute resolution strategies not only helps businesses avoid potential legal pitfalls but also promotes long-term success by creating an environment of trust and collaboration within the organization. By harnessing the power of business law in conflict resolution efforts, you can ensure that your company operates smoothly while upholding legal standards. The ability to resolve disputes efficiently demonstrates your commitment to fair practices and enhances your reputation among employees, customers, suppliers, and other stakeholders alike. With this solid foundation in place through successful conflict resolution techniques rooted in business law principles, your organization can confidently move forward in pursuit of long-term success.

Long-Term Success: Harnessing the Power of Business Law for Your Business

In the previous section, we explored various strategies for resolving legal disputes in a business setting. Now, let's delve into the topic of long-term success and how harnessing the power of business law can greatly benefit your business.

Business law plays a crucial role in ensuring the smooth operation and growth of your company. By understanding and utilizing the principles of business law, you can navigate complex legal issues, minimize risks, and maximize opportunities for long-term success.

To illustrate this concept further, let's take a closer look at four key aspects of business law that are essential to achieving long-term success:

-

Contract Law: Contracts form the backbone of any business transaction or relationship. Understanding contract laws allows you to create legally binding agreements that protect your interests and outline clear expectations for all parties involved. This promotes trust, reduces conflicts, and fosters successful partnerships.

-

Intellectual Property Law: In today's knowledge-based economy, protecting intellectual property is vital for maintaining a competitive advantage. By leveraging intellectual property laws, such as patents, trademarks, and copyrights, you can safeguard your innovative ideas, unique branding elements, and creative works from unauthorized use or infringement by others.

-

Employment Law: Your employees are one of your most valuable assets as they contribute to the overall success of your business. Complying with employment laws ensures fair treatment of workers while also guarding against potential legal liabilities related to recruitment practices, employee contracts, workplace safety standards, discrimination issues, and more.

-

Corporate Governance: Establishing effective corporate governance practices is crucial for businesses aiming for long-term sustainability. Adhering to corporate governance guidelines improves transparency in decision-making processes within your organization while also maintaining ethical standards that build trust among stakeholders.

By incorporating these four pillars of business law into your operations effectively and ethically managing legal matters will lead to increased stability and prosperity for your company in the long run.

Now that we have explored how harnessing the power of business law can contribute to your long-term success, let's move on to the next section to delve deeper into the intricacies of each aspect mentioned above.

Frequently Asked Questions

How can businesses ensure that their contracts are legally binding and enforceable?

To ensure that your contracts are legally binding and enforceable, there are several steps you can take. First, make sure that you have a clear and detailed contract that outlines all the terms and conditions of the agreement. Use specific language and avoid ambiguous or vague wording to minimize any potential confusion. Secondly, it's crucial to include consideration in your contract, which means each party must give something of value in exchange for what they receive. This ensures that both sides have a legal obligation to fulfill their promises. Additionally, be sure to incorporate any necessary legal elements such as signatures from all parties involved and witnesses if required by law. Finally, consider consulting with a lawyer who specializes in business law to review your contracts before finalizing them. They can provide valuable insights and ensure that your agreements comply with all relevant laws and regulations. By following these steps, you can increase the likelihood that your contracts will be legally binding and enforceable in the event of any disputes or breaches of agreement.

What are the legal rights and responsibilities of employers and employees in the workplace?

In the workplace, both employers and employees have specific legal rights and responsibilities. As an employer, you are responsible for providing a safe and healthy working environment for your employees, ensuring that they receive fair wages and benefits, and complying with laws regarding discrimination, harassment, and worker's compensation. You also have the right to set expectations for performance, discipline employees when necessary, and protect your business's confidential information. On the other hand, as an employee, you have the right to be treated fairly and with respect by your employer. This includes receiving accurate pay stubs, being paid at least minimum wage or the agreed-upon salary, having access to breaks and rest periods as required by law, and being free from discrimination or harassment based on protected characteristics such as race or gender. Additionally, both employers and employees have a responsibility to adhere to any contractual agreements they enter into regarding employment terms or obligations. By understanding these rights and responsibilities in the workplace, both parties can create a harmonious work environment that is conducive to productivity and mutual success.

How can businesses protect their intellectual property rights, such as trademarks, copyrights, and patents?

To protect their intellectual property rights, businesses can take several measures. One effective way is by registering trademarks, copyrights, and patents with the appropriate government agencies. For example, let's consider a hypothetical case study of a software company that has developed a groundbreaking technology for data encryption. By obtaining a patent for their unique encryption algorithm, they can prevent others from using or selling their invention without permission. Additionally, implementing robust internal policies and procedures can help businesses safeguard their intellectual property. This may include non-disclosure agreements (NDAs) for employees and partners to ensure confidentiality. Regular monitoring of the market for potential infringements is also crucial in identifying any unauthorized use of trademarks or copyrighted materials. Finally, businesses can seek legal recourse by taking infringers to court if necessary, thereby protecting their valuable intellectual assets from exploitation and maintaining a competitive edge in the market.

What are the legal requirements and regulations that businesses must comply with in order to operate legally?

In order to operate legally, businesses must comply with a variety of legal requirements and regulations. These can vary depending on the nature of the business and its location, but there are some common areas that most businesses need to address. First and foremost, businesses must adhere to laws related to licensing and permits. This includes obtaining the necessary licenses or permits required by their industry or profession, such as a liquor license for a bar or a medical license for a healthcare provider. Additionally, businesses must comply with labor and employment laws, which govern issues such as minimum wage, working hours, and workplace safety. They also need to ensure they are in compliance with tax laws by accurately reporting their income and paying taxes on time. Another important area is consumer protection laws, which regulate how businesses interact with customers and protect consumers from unfair practices. Lastly, businesses must also be mindful of environmental regulations to minimize their impact on the environment. By adhering to these legal requirements and regulations, businesses can operate legally while maintaining trust with customers and avoiding potential legal issues.

What are some effective strategies for resolving legal disputes in a business setting?

Ah, legal disputes in a business setting. It's like watching a thrilling game of chess, except the players are wearing fancy suits and arguing over money instead of moving pieces around. But fear not, my friend, for there are effective strategies to resolve these battles of the suits. One such strategy is negotiation – using your silver tongue to find common ground and reach a mutually beneficial agreement. Another option is mediation, where an impartial third party helps facilitate communication and find a resolution. If all else fails, you can always take it to court and let the judge decide who wears the crown of victory. Just remember, when it comes to legal disputes in the business world, it's not about winning or losing; it's about finding that sweet spot where both parties can walk away feeling satisfied and perhaps even slightly amused by this dramatic dance of justice.

Summary

Business law is a broad field of law that encompasses a variety of legal issues that arise in the context of business operations. In Utah, business law is governed by a combination of state statutes, case law, and common law. Utah’s business law covers a wide range of topics, including contracts, torts, intellectual property, business organizations, and more.

One of the most important topics in business law is contracts. A contract is an agreement between two or more parties that creates certain legal obligations. Utah law requires that contracts be valid, enforceable, and in writing in order to be enforceable. Under Utah law, contracts are governed by the Utah Code, as well as the common law of contracts. Utah case law is particularly important in interpreting and understanding the law of contracts.

Another important area of business law is torts. A tort is a civil wrong that results in harm to a person or property. In Utah, torts are governed by the Utah Code, as well as the common law. Utah courts have held that a plaintiff must prove the elements of a tort in order to recover damages. Common torts in Utah include negligence, intentional torts, and strict liability.

Another important area of business law is intellectual property. Intellectual property rights provide protection for inventions, designs, and other creative works. In Utah, intellectual property is governed by the Utah Code, as well as the common law. Intellectual property rights are generally divided into two categories: copyrights and patents. Copyrights protect creative works, such as books and music, while patents protect inventions.

Finally, business law covers business organizations. In Utah, business organizations are governed by the Utah Code, as well as the common law. Business organizations can take the form of corporations, partnerships, limited liability companies, and more. Each organization has its own set of rules and regulations that govern how it operates.

Business law covers a wide range of topics, from contracts to torts to intellectual property to business organizations. Utah business law is governed by a combination of state statutes, case law, and common law. Understanding and interpreting business law requires an understanding of the relevant statutes, case law, and common law.

Areas We Serve

We serve individuals and businesses in the following locations:

Salt Lake City Utah

West Valley City Utah

Provo Utah

West Jordan Utah

Orem Utah

Sandy Utah

Ogden Utah

St. George Utah

Layton Utah

South Jordan Utah

Lehi Utah

Millcreek Utah

Taylorsville Utah

Logan Utah

Murray Utah

Draper Utah

Bountiful Utah

Riverton Utah

Herriman Utah

Spanish Fork Utah

Roy Utah

Pleasant Grove Utah

Kearns Utah

Tooele Utah

Cottonwood Heights Utah

Midvale Utah

Springville Utah

Eagle Mountain Utah

Cedar City Utah

Kaysville Utah

Clearfield Utah

Holladay Utah

American Fork Utah

Syracuse Utah

Saratoga Springs Utah

Magna Utah

Washington Utah

South Salt Lake Utah

Farmington Utah

Clinton Utah

North Salt Lake Utah

Payson Utah

North Ogden Utah

Brigham City Utah

Highland Utah

Centerville Utah

Hurricane Utah

South Ogden Utah

Heber Utah

West Haven Utah

Bluffdale Utah

Santaquin Utah

Smithfield Utah

Woods Cross Utah

Grantsville Utah

Lindon Utah

North Logan Utah

West Point Utah

Vernal Utah

Alpine Utah

Cedar Hills Utah

Pleasant View Utah

Mapleton Utah

Stansbury Par Utah

Washington Terrace Utah

Riverdale Utah

Hooper Utah

Tremonton Utah

Ivins Utah

Park City Utah

Price Utah

Hyrum Utah

Summit Park Utah

Salem Utah

Richfield Utah

Santa Clara Utah

Providence Utah

South Weber Utah

Vineyard Utah

Ephraim Utah

Roosevelt Utah

Farr West Utah

Plain City Utah

Nibley Utah

Enoch Utah

Harrisville Utah

Snyderville Utah

Fruit Heights Utah

Nephi Utah

White City Utah

West Bountiful Utah

Sunset Utah

Moab Utah

Midway Utah

Perry Utah

Kanab Utah

Hyde Park Utah

Silver Summit Utah

La Verkin Utah

Morgan Utah

Business Law Utah Consultation

When you need help from a Business Lawyer in Utah, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Home

Related Posts

What are the Trademark Laws in Utah

Business Lawyer Pleasant Grove Utah

Utah Wholesale Business Law

Business Lawyer Kearns Utah

How to Form an LLC in Utah

Business Lawyer Tooele Utah

How to Calculate Overtime Pay in Utah

Business Lawyer Cottonwood Heights Utah

Understanding Utah’s Consumer Protection Laws

Business Lawyer Midvale Utah

Comprehensive Guide To Hiring A Business Lawyer

Business Lawyer Springville Utah

Mergers and Acquisitions from a Legal Perspective

Business Lawyer Eagle Mountain Utah

Understanding Anti-Trust Laws in Utah

Business Lawyer Cedar City Utah

Understanding LLC Laws in Utah

Business Lawyer Kaysville Utah

Understanding Utah’s Non-Profit Laws

Business Lawyer Clearfield Utah

Telemarketing Lawyer

Business Lawyer Holladay Utah

Business Organizations

Business Lawyer American Fork Utah

Business Law Attorney

Business Lawyer Syracuse Utah

How To Handle Customer Complaints In Utah

Business Lawyer Saratoga Springs Utah

The Role of Business Law in Protecting Minority Shareholder Rights

Business Lawyer Magna Utah

What Are The 4 Different Types of Business Law?