Business Succession Lawyer Ogden Utah

Business succession planning is an important part of any business’s long-term success. It is a way to ensure that a business will continue to operate, even after the owner retires, or in the event of death or disability. The process of planning involves a number of steps, including the selection of a successor, the transfer of ownership, and the establishment of a legal framework for the continued operation of the business. An experienced business succession lawyer in Ogden, Utah can help business owners through the process and ensure that their business is protected and able to continue to thrive.

Business succession planning involves a number of legal considerations, including the selection of a successor, the transfer of ownership, and the establishment of a legal framework for the continued operation of the business. The process typically begins with the selection of a successor. This can be a family member, a partner, or a key employee. The succession plan must be documented and signed by all parties and must be approved by the state of Utah. Once the successor is chosen, the transfer of ownership must be completed and the legal framework established.

Once the succession plan is in place, the business succession lawyer in Ogden, Utah will help the business owner to create a plan for the ongoing operation of the business. This will include the creation of a partnership agreement, the establishment of a buy-sell agreement, and the implementation of a key employee retention plan. The lawyer will also help the business owner to review the estate planning documents, such as wills, trusts, and other legal documents, to ensure that the business assets will be managed according to the wishes of the business owner.

The business succession lawyer in Ogden, Utah will also be responsible for keeping the business up to date with the changing laws and regulations in the state. This includes providing legal advice to the business owner on matters such as tax issues, labor laws, and other issues that may affect the operation of the business. The lawyer will also act as a mediator between the business owner and the state of Utah, if disputes arise.

The business succession lawyer in Ogden, Utah will also provide legal services for the business in the event of death or disability of the business owner. This includes preparing the necessary paperwork for the transfer of ownership and ensuring that the estate is properly distributed to the heirs or beneficiaries. The lawyer will also handle the filing of probate documents, the payment of estate taxes, and the distribution of assets.

Finally, the business succession lawyer in Ogden, Utah will provide legal advice to the business owner on other matters related to the business. This includes providing advice on the formation of a partnership agreement, the negotiation of a buy-sell agreement, and other legal matters. The lawyer will also act as a resource to the business owner in case of any disputes or legal issues that may arise.

Business succession planning is a complex process, and it is important that business owners work with an experienced business succession lawyer in Ogden, Utah. An experienced lawyer can provide the necessary legal advice and expertise to ensure that the business is protected and will continue to thrive for years to come.

Business Advice

The reason you should care about the business advice other successful entrepreneurs have to share with you… is that their experiences and words of wisdom may just come in handy one day. They have created products and services we’ve all heard of, turned entire industries upside down, redefined what it means to be successful when you start a business and many have also written business books or taught online business courses about it. Suffice it to say, their business advice is worth its weight in gold.

Not surprisingly, many of these entrepreneurs had very similar pieces of business advice to share, based on what has worked for them when it comes to learning how to grow a business.

Here are some actual advices:

Never forget that your business needs to take in more money than it spends. I know that sounds too simple, but so many people lose sight of that. That’s also why so many first-time entrepreneurs over-invest (or spend so much of their time looking for investors) early on. “Create solutions that cost little to no money & always spend less than you make.” Instead, work to come up with a creative solution that costs little to no money. That forced discipline will help you spend less than you make, even when you’re not making a lot. Sometimes capital is necessary, but at some point there must be return on that capital. There’s nothing wrong with taking equity investment, investing for the future, even losing money for a few years. But your plan has to get you back to that simple equation of making more than you spend.

Entrepreneurs make over-estimating the novelty of their big idea. “Don’t over-estimate the novelty of your big idea. Wait for a truly great one.” It takes so much time and effort to go all-in on a business idea, you might as well wait for a truly great one.

Probably another costly mistake many entrepreneurs make is in choosing the people that they work with or hire, it’s a mistake that has been seen over and over again. “Work with people on projects before handing over equity or large sums of money.” The way we have gotten around that is to always work with somebody on a project before we start handing over significant equity stakes or large sums of money. If the trial project goes well, then talk about expanding the scope of the relationship ‘a bad hire in the first few employees can be detrimental to a startup.’

Another mistake first-time (or inexperienced) entrepreneurs make is that they see others in their industry or blog niche as competition. This can significantly hold you back, as you may never learn industry secrets and tips, make genuine friends, and more. “Don’t view others in your niche as competition. Network and build relationships.” See others in your industry or niche as colleagues and friends. You should network with others, attend conferences, reach out to people, and more.

Across the board, another mistake first-time entrepreneurs make is placing too much focus on building product versus learning from users. There usually isn’t much risk in building software, but there’s a lot of risk in bringing a new product to market. “Take time to learn how your users actually behave with your product.” A few ways to solve this include: constantly talking to users, building an audience while or before you build and taking time to learn how users actually behave with your product. Not easy, but if you can really understand which type of user you want to optimize toward, you will increase your odds of finding an initial wedge in the market.

Most people, particularly those with their first project is striving for perfection over getting it done. Weeks turn into months, months into years. As a result, whatever they are trying to launch isn’t out there gaining traction in the marketplace because of the fear of being perfect. “Go out and break shit, it’s better to ask for forgiveness than permission when you start a business.” The only way your project, your business idea or whatever is in your mind is going to become better, is by having people use it in the real-world.

New entrepreneurs make the mistake of not putting themselves out there. If you want to succeed as an entrepreneur, you need to show others what you are doing. “Put yourself out there and show others what you’re working on.” Instead of praying an audience (or customers) will find you, get in front of people in your space. Start a blog, podcast or create video content. Take advantage of social media. Attend in-person events. One way to make “putting yourself out there” easier is by making an effort to help others. (Sounds counterintuitive, right!) On the individual level, maybe it’s by making an introduction. For a larger audience, perhaps it’s by pursuing and executing on actionable blog post ideas. However, by being helpful you will make a lasting impression.

First-time entrepreneurs mostly try to invent something totally new because their ego tells them they have to. “Don’t invent something new. Copy what works and make tweaks to push over the top.” It is much smarter to copy a competitor you like, then tweak one or two things that you think will put you over the top.

Trying to start a company for years and still making the mistake planning too far ahead. Many new entrepreneurs are stuck on this idea of what the company could be five years from now. They are trying to make the five year version of the company happen tomorrow. “Focus on the next step and don’t try to make your 5yr vision happen tomorrow.” What they need to realize is that if you have no customers, the next milestone is one customer. A very powerful tactic to overcome this is to help young entrepreneurs focus on building on momentum. That means focusing on the next step and trusting that those first few steps will build to the speed and impact you want.

Avoid being a single founder. Creating a company is hard work, most startups fail. The one characteristic you need above all others is resilience. You need to be relentless and work harder than the competition, and even then you will have tough times. It is for this reason that it is advisable to start companies with more than one founder. It means there is someone to share the load, to reflect and to support each other. “Want to be successful in business? Avoid being a single founder.” It is not impossible to be a single founder but it is easier to be resilient and successful as a team.”

First-time entrepreneurs almost always focus too much on non-differentiating work. Work that doesn’t make a difference in their business. Work that definitely doesn’t increase revenue. “Without a focus on doing work that makes a difference, your business is just a hobby.” A few simple examples: Redesigning your logo or website a dozen times in hopes of finding that perfect blog layout, setting up every social media account possible, trying to stay on top of said social media. And the list goes on. Instead, focus on revenue. Do the tasks that will increase revenue and reduce costs. Without a focus on that, your business is just a hobby. In order to even consider doing work that makes a difference, you need to build and leverage your entrepreneurial strength every day.

If your freelance client won’t agree to a 50% deposit, they’re not worth working with. To prevent disasters like this, take a 50% upfront payment before you even start, then taking the final 50% before any final files are provided. Any client not willing to work this way is unlikely to ever pay and should be avoided. I also strongly advise freelancers to have a written freelance contract, signed by the client, detailing what’s been agreed upon and what will happen in various different circumstances. This will give you ammo should your client be unreasonable, and will also add a level of professionalism and credibility to your service.

There’s one incredibly painful mistake that new entrepreneurs make. It’s painful because it keeps them from success. They feel like they’re working hard, but not making any progress. The mistake? Trying to do too many things at once. “Focus on just one project & strategy at a time, you’re more likely to succeed.” Focus, by definition, means narrowing your field of vision and attention. It means choosing which opportunities, projects, and even customers you are NOT going to pursue. And it is really, really hard. Focus in on just ONE strategy, create an incredibly high-value virtual summit, and you would start to make serious progress in your business. “Choose the one thing that will move the needle for you and your business. When you try to be the best podcaster, blogger, author, business coach and event producer all at the same time, you end up being mediocre at all of them. Pick one (like learning how to master the art and science of cold emailing). Focus. And work it, hard.

One piece of bonus advice: As a newer business owner, one of the biggest ROI’s you will get is from investing in growing your email list. Whether you plan on offering a mastermind, writing books or producing online summits, you’ll need a powerful, engaged email list. Make that a focus from day one.

The most painful mistake that first-time entrepreneurs make is they rely on their business idea too much. They are convinced that success in business is pre-determined by the awesomeness of their business idea alone. And they could not be more wrong. Execution is equally (if not more) important than the actual idea. Ideation is the easy and fun part and execution is the hard and tedious one. “Success in business is NOT pre-determined by the awesomeness of your idea.” That is why people would rather put faith in their ideas than invest countless hours of work towards making it happen.

Most entrepreneurs launch before they learn. For example, you may decide you want to launch a marketing consulting company, so you hastily make a website, content and reach out to people, but you have not yet figured out who your target clientele is. What people actually need help with or what you are specifically good at. So no one bites. Or you could launch a new app, but you don’t know what sells well in the app store or how to promote it. So even though you have a great product, no one sees it. Or you decide to write a book but haven’t really spent time with the key concept (researching), talking to people—so your book proposal falls flat and feels generic. Publishers ignore it. “Learn before you launch. Take time to build your plan and be patient.” This common mistake could also be framed as an inspiration/perspiration problem. We’re so inspired by the end result that we forego the process — a lot of which is hard, un-fun work. In turn, we sacrifice the best possible outcome. And this is painful because the solution is retrospectively so obvious: patience. Take time with each new idea; flesh it out; design it fully; have a plan and not just hope.”

First-time entrepreneurs are being deathly afraid that someone will steal their secret idea. “Spoiler alert for first-time entrepreneurs: Ideas are worthless.” It is the execution beyond the idea that really brings home the gold. So focus on getting out there and meeting as many folks as possible to join your team, give you feedback and point you in the right direction. Any successful entrepreneurial journey is the sum total of a rather large (and under-appreciated) team that came together in a magical way. Get cracking on building yours.

First-time entrepreneurs don’t count the cost or figure out how they will actually make money ahead of time. Since entrepreneurs don’t create a business as a ‘charitable deed to mankind,’ they need to think about where their revenue and profit will be once the business scales. “If you want to succeed in business, count your costs and project revenue ahead of time.”

New entrepreneurs bank on an idea that is not valuable to anyone with actual, real-world problems. “Spend time with people who are different than you, it will open your mind to different people and different problems, allowing you to connect the dots faster and make a real contribution to the world.

Many first-time entrepreneurs do not follow the Customer Development Model (the Steve Blank school of thought). They won’t presell their product. They avoid surveying their market, meeting or calling people from their target audience before they pony up substantial money and time building a product. In other words, too often first-timers build a product behind closed doors and don’t get the feedback necessary to ensure they get buy in for their idea. As a result, they don’t reach product-market fit and end up building a product that fails or succeeds by mere chance, not by calculated steps. “Don’t build your product behind closed doors. Get feedback and validate your idea.” Avoid the common mistake of aiming to be the next Facebook. Achieve product-market fit by focusing on building one core feature better than the competition and make sure that feature solves a big pain point for your audience. Don’t get lost in creating a bunch of features off-the-bat.

Keep your first product extremely barebones. Get clear product validation from your target customer before you spend any time or money building a Minimum Viable Product (MVP). Start small. Invest more resources in product development as you generate enough operating income to cover your ongoing research and development expenses. Hold off on executing your product roadmap before you have enough consistent sales revenue to support that vision.

Become your company’s best salesperson and marketer before hiring. One costly and painful mistake is hiring in marketing and sales too early. Things tend to go VERY wrong when a founder brings on board a senior sales or marketing person who is lacking entrepreneurial spirit and/or experience working in startups. Instead of hiring full-time, founders should seek out and consult with experienced marketers and sales veterans who work with startups on a daily basis for a fixed fee or company stock based on specific goals.” And remember, the fact that you can recite all the business slang, blogging terms or industry jargon that’s pervasive within your niche, does not automatically make you a good salesperson. Connect with your target customers and learn how to truly help them.

Business Succession Lawyer Ogden Utah Consultation

When you need an Ogden Utah business succession attorney, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

https://jeremyeveland.com

Areas We Serve

We serve businesses and business owners for succession planning in the following locations:

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Business Succession Lawyer Ogden Utah

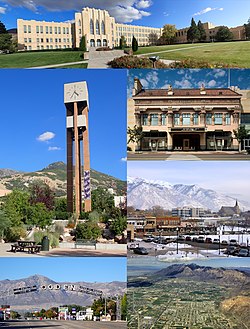

Ogden, Utah“>Ogden, Utah

|

Ogden, Utah

|

|

|---|---|

From top left to bottom right: Ogden High School, Weber State University Bell Tower, Peery’s Egyptian Theater, Downtown, Gantry Sign, aerial view

|

|

| Nickname:

Junction City

|

|

| Motto:

Still Untamed

|

|

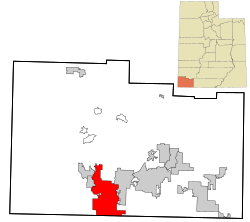

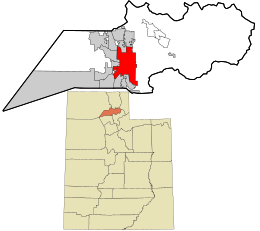

Location in Weber County and the state of Utah

|

|

| Coordinates: 41°13′40″N 111°57′40″WCoordinates: 41°13′40″N 111°57′40″W | |

| Country | United States |

| State | Utah |

| County | Weber |

| Settled | 1844 |

| Incorporated | February 6, 1851 (As Brownsville) |

| Named for | Peter Skene Ogden[1] |

| Government

|

|

| • Type | Council-Mayor |

| • Mayor | Mike Caldwell |

| Area | |

| • City | 27.55 sq mi (71.35 km2) |

| • Land | 27.55 sq mi (71.35 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation

|

4,300 ft (1,310 m) |

| Population

(2020)

|

|

| • City | 87,321 |

| • Density | 3,169.55/sq mi (1,223.84/km2) |

| • Urban

|

608,857 (US: 69th) |

| • Urban density | 2,863.9/sq mi (1,105.8/km2) |

| • Metro

|

694,863 (US: 83rd) |

| Demonym | Ogdenite [3] |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP Codes |

84201, 84244, 844xx

|

| Area codes | 385, 801 |

| FIPS code | 49-55980[4] |

| GNIS feature ID | 1444049[5] |

| Website | http://ogdencity.com/ |

Ogden /ˈɒɡdən/ is a city in and the county seat of Weber County,[6] Utah, United States, approximately 10 miles (16 km) east of the Great Salt Lake and 40 miles (64 km) north of Salt Lake City. The population was 87,321 in 2020, according to the US Census Bureau, making it Utah’s eighth largest city.[7] The city served as a major railway hub through much of its history,[8] and still handles a great deal of freight rail traffic which makes it a convenient location for manufacturing and commerce. Ogden is also known for its many historic buildings, proximity to the Wasatch Mountains, and as the location of Weber State University.

Ogden is a principal city of the Ogden–Clearfield, Utah Metropolitan Statistical Area (MSA), which includes all of Weber, Morgan, Davis, and Box Elder counties. The 2010 Census placed the Metro population at 597,159.[9] In 2010, Forbes rated the Ogden-Clearfield MSA as the 6th best place to raise a family.[10] Ogden has had a sister city relationship to Hof in Germany since 1954. The current mayor is Mike Caldwell.

About Ogden, Utah

Ogden is a city in and the county seat of Weber County, Utah, United States, approximately 10 miles (16 km) east of the Great Salt Lake and 40 miles (64 km) north of Salt Lake City. The population was 87,321 in 2020, according to the US Census Bureau, making it Utah's eighth largest city. The city served as a major railway hub through much of its history, and still handles a great deal of freight rail traffic which makes it a convenient location for manufacturing and commerce. Ogden is also known for its many historic buildings, proximity to the Wasatch Mountains, and as the location of Weber State University.

Neighborhoods in Ogden, Utah

Albertsons Center, Nob Hill, Evans Acres, Woodmansee Addition, Anita Lander, 4th Street Park, Nob Hill Addition, Weber County, Utah Neighborhood Connection, Walmart Neighborhood Market, Twenty-First Street Pond, Mount Ogden Park, Miles Goodyear Park, Northwood Hills Subdivision, Ogden River Parkway Trail, Ogden Downtown Alliance, Ogden Community & Economic Development, 22nd Street Trailhead, Historic 25th Street, Confluence Ogden River Parkway