Business Succession Lawyer South Jordan Utah

If you are looking for a lawyer to help you with your South Jordan Utah Business for Succession Planning, you’ve found the right page. A company needs a business lawyer for a variety of reasons. First and foremost, a business lawyer can provide legal advice and representation in a variety of areas. This can include contract formation, intellectual property, labor and employment laws, tax laws, and more. Having a business lawyer on hand ensures that a company is aware of all applicable laws and regulations, and can ensure that the company is in compliance.

Business succession is a critical component of business planning and can be defined as the process of transferring a business from one owner to another. It is a complex process, as it involves assessing the state of the business, understanding the legal implications of the transfer, and planning for the financial implications of the transition. In the United States, business succession law is governed by state laws and it is important for business owners to understand their state’s specific laws and regulations.

For example, in Utah, business succession is a complicated process due to the state’s unique laws and regulations. In addition, there are a variety of business entities, including sole proprietorships, partnerships, corporations, and limited liability companies, that may affect the succession process. To ensure a successful transition, business owners should consult with qualified commercial lawyers or attorneys who specialize in business succession law and estate planning.

One of the first steps in business succession planning is to create a business succession plan. This plan should include a detailed assessment of the business, the current owners and partners, the potential successors, and the type of entity the business operates under. It should also include a buy-sell agreement to ensure that ownership transfers smoothly and a partnership agreement to ensure all partners understand their role in the transition. Additionally, the plan should include a detailed estate plan to address any tax and liability issues that may arise during the transition.

Once the plan is in place, business owners should consult with their lawyers or attorneys to discuss any legal issues and to ensure that their plan is compliant with the laws and regulations of their state. In Utah, for example, business owners should seek the advice of attorneys in South Jordan, Salt Lake City, or Salt Lake County who specialize in business succession law. These attorneys will be able to provide business owners with personalized legal advice tailored to their individual circumstances.

Finally, business owners should consider conducting a free consultation with their lawyers or attorneys to discuss any additional issues or concerns they may have. During this consultation, business owners can ask questions about the succession process, the legal implications of the transition, and any other matters related to the business succession plan.

By taking the time to properly plan and prepare for business succession, business owners can ensure that their transition is smooth and successful. With the help of a qualified lawyer or attorney, business owners can rest assured that their business succession plan meets all of their state’s legal requirements and that their transition will be successful.

Business Succession Plan

A business succession is the process of planning and preparing for the eventual transfer of the ownership and control of a business from one generation to the next. It is essential for any business that wants to sustain its current level of success into the future. A comprehensive succession plan will include strategies such as determining the future ownership and leadership of the business, as well as the financial, legal, and tax implications of the transfer of control. It also involves assessing the business’s current value, considering potential buyers, and identifying strategies to maximize the value of the business. The plan should also take into account the individual goals and objectives of the owners, as well as the impact of the succession on the employees and the business’s vendors, customers, and other stakeholders. By having a well-thought-out succession plan in place, the business will be better positioned to succeed into the future, even if changes occur in the ownership or control of the business.

Another critical role of a business lawyer is to protect the company from potential legal issues. A lawyer can provide guidance on how to best operate the company in a manner that is compliant with all applicable laws. This includes helping to draft contracts, ensuring that the company maintains proper records, and providing advice on how to best handle any disputes that may arise.

A business lawyer can also provide valuable guidance on how to structure and manage the business. This includes advice on how to structure the company, what types of contracts to use, how to best manage employees, and how to protect the company’s assets. This knowledge can be invaluable in ensuring long-term success for a company.

A business lawyer can provide important assistance in resolving disputes. A lawyer can help negotiate settlements and provide guidance on how to handle a dispute in the best way possible. This can be especially helpful in avoiding costly legal battles.

It’s clear that a company needs a business lawyer for a variety of reasons. A lawyer can provide advice and guidance on a variety of legal matters, protect the company from potential legal issues, provide guidance on how to structure and manage the business, and assist in resolving disputes. Having a business lawyer on hand can help ensure the long-term success of the company.

What type of cases do business lawyers work on?

As a business lawyer, I often work on securities and litigation cases. The type of cases that business lawyers work on is determined by the practice area. A major part of legal work revolves around corporate law, which covers anything from corporate mergers and acquisitions to securities law. These types of cases often involve a large amount of paperwork and multiple parties, so it’s important that the contracts are well-written and the filings are accurate. Many legal firms have specialized in this area, so their attorneys are able to handle these cases with ease.

Other types of cases might be more straightforward, but are still very important. White-collar criminal defense focuses on representing individuals as they face charges for business-related crimes such as embezzlement or money laundering, while employment law involves everything from discrimination suits to wrongful termination suits. Even if you’re not involved in a case yourself, it’s important to remember that your company can be affected even if you’re not directly involved. It pays to have a general knowledge of what types of business issues can come up in a court of law.

The legal profession is a broad one, and there are many different types of lawyers. Some of them focus on working with other business people to establish companies, file patents, and bring products to market. These attorneys need to be familiar with the laws governing businesses, including how to handle arbitration and legal disputes.

What is Business Law All About?

Business law is a field of law that deals with a range of subjects, from establishing a business to drafting contracts and handling legal disputes. It is designed to protect your company and its assets.

There are various types of businesses, including manufacturers, retailers, and corporations. All of them have specific rules and regulations to adhere to. The basic structure of a business is different from state to state. A typical step in setting up a business is to file paperwork. This formally establishes the business in the eyes of the government.

The business world can be a confusing place to navigate. Many entrepreneurs don’t know the laws governing them. Luckily, there are a number of laws in place to protect you from committing crimes or exposing yourself to liability.

One of the most important things a business owner can do is understand the legal issues in their industry. They can also use this knowledge to reduce the risk of a lawsuit.

Although the basics of business law are common knowledge, a good understanding of the subject can help you make better decisions. For instance, you can avoid a costly dispute by knowing the right types of contracts to use. You can also keep employees happy by implementing a sound employee policies.

Another useful business law concept is the use of due diligence. A corporate attorney may create a set of guidelines to help your company find a resolution to any legal dispute.

What Is The Legal Meaning Of Due Diligence In Business?

Due diligence refers to a level of care that is expected of a reasonable person before entering into a contract or an agreement. This is the kind of care that prevents bad outcomes from occurring.

Due diligence involves investigating a firm, product, or service in order to evaluate the information presented. It can also be used to identify the risks that are associated with a specific investment. In the era of transforming technologies, due diligence is more important than ever.

Traditional due diligence practices primarily examined financial statements and inventories, and looked into employee benefits and tax conditions. However, the term has since been extended to encompass a wider array of business contexts.

When buying a company, an individual buyer or an equity research firm may undertake the investigation. These people often have significant assets.

The results of this investigation are a tool that a buyer can use in negotiating a deal. If the findings are not satisfactory, the buyer might not proceed with the purchase. Alternatively, a buyer might request an extension from the seller.

In a merger or acquisition, due diligence is usually more rigorous. The buyer’s efforts may include checking out the background of a partner and using news reports to find out more about the business.

Many M&A analyses also include test market data and supplier and customer reviews. This is done to ensure that the deal is fair, or that the re-trade will not affect the value of the purchase.

Do I Need A Business Succession Lawyer?

Business lawyers specialize in providing legal advice to businesses of all sizes, from small startups to large corporations. They work on a wide range of cases, from drafting contracts to helping with mergers and acquisitions. Business lawyers provide advice on a variety of topics, including formation of business entities, corporate governance, employment law, securities law, intellectual property law, international business law, and antitrust law. In addition to providing advice, business lawyers represent clients in court when necessary.

Business lawyers are often called upon to review business documents, such as contracts, leases, and corporate filings. They are also responsible for ensuring that the terms of agreements are legally sound and comply with state and federal laws. Business lawyers may also advise clients on tax and financial issues, such as how to structure investments or comply with tax regulations. They also assist with mergers and acquisitions, helping to ensure that the terms of the transaction are favorable to the clients.

Business lawyers may also provide advice and representation in the areas of bankruptcy, creditors’ rights, and other related matters. They work closely with clients to develop strategies to minimize losses or maximize recoveries in cases of insolvency. Business lawyers are also called upon to mediate or negotiate disputes between businesses, such as contract disputes, wrongful termination, and other related matters.

By now you know that business lawyers work on a wide range of cases and provide legal advice on a variety of topics relating to business formation, corporate governance, employment law, and more. They review business documents, advise clients on tax and financial issues, represent clients in court, mediate or negotiate disputes, and provide other legal services.

South Jordan Utah Business Succession Lawyer Consultation

When you need legal help with a Business Succession Plan in South Jordan UT, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

https://jeremyeveland.com

Recent Posts

The Utah Uniform Partnership Act

The 10 Essential Elements of Business Succession Planning

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Business Succession Lawyer Ogden Utah

Business Succession Lawyer Layton Utah

Business Succession Lawyer South Jordan Utah

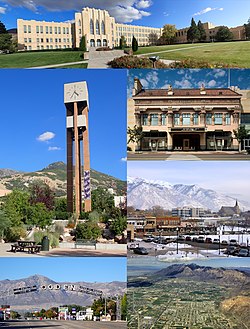

South Jordan, Utah

|

South Jordan, Utah

|

|

|---|---|

South Jordan City Hall, March 2006

|

|

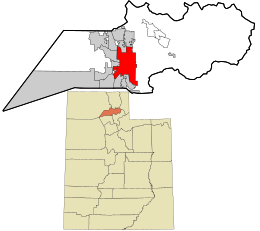

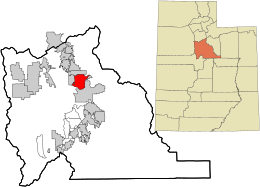

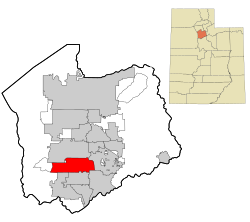

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°33′42″N 111°57′39″WCoordinates: 40°33′42″N 111°57′39″W | |

| Country | |

| State | |

| County | Salt Lake |

| Established | 1859 |

| Incorporated | November 8, 1935[1] |

| Named for | Jordan River |

| Government

|

|

| • Type | council–manager |

| • Mayor | Dawn Ramsey |

| • Manager | Gary L. Whatcott |

| Area | |

| • Total | 22.31 sq mi (57.77 km2) |

| • Land | 22.22 sq mi (57.54 km2) |

| • Water | 0.09 sq mi (0.23 km2) |

| Elevation

|

4,439 ft (1,353 m) |

| Population | |

| • Total | 77,487 |

| • Density | 3,452.07/sq mi (1,332.86/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84009, 84095

|

| Area code(s) | 385, 801 |

| FIPS code | 70850 |

| GNIS feature ID | 1432728[4] |

| Website | www |

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Founded in 1859 by Mormon settlers and historically an agrarian town, South Jordan has become a rapidly growing bedroom community of Salt Lake City. Kennecott Land, a land development company, has recently begun construction on the master-planned Daybreak Community for the entire western half of South Jordan, potentially doubling South Jordan’s population. South Jordan was the first municipality in the world to have two temples of the Church of Jesus Christ of Latter-day Saints (Jordan River Utah Temple and Oquirrh Mountain Utah Temple), it now shares that distinction with Provo, Utah. The city has two TRAX light rail stops, as well as one commuter rail stop on the FrontRunner.

About South Jordan, Utah

South Jordan is a city in south central Salt Lake County, Utah, United States, 18 miles (29 km) south of Salt Lake City. Part of the Salt Lake City metropolitan area, the city lies in the Salt Lake Valley along the banks of the Jordan River between the 10,000-foot (3,000 m) Oquirrh Mountains and the 11,000-foot (3,400 m) Wasatch Mountains. The city has 3.5 miles (5.6 km) of the Jordan River Parkway that contains fishing ponds, trails, parks, and natural habitats. The Salt Lake County fair grounds and equestrian park, 67-acre (27 ha) Oquirrh Lake, and 37 public parks are located inside the city. As of 2020, there were 77,487 people in South Jordan.

Neighborhoods in South Jordan, Utah

South Jordan Heights, North District, South Pointe, Country Crossing, Jordan Heights, Oquirrh Park, Jones Meadows, Prospector Place, High Pointe, Shelbrooke, Midas Creek, Homestead, Whispering Sands, Elk Meadows, Ivory Crossing, Y Worry Estates, Santorini Village, West River Estates, South Jordan, South Jordan City Park