Business Succession Lawyer Murray Utah

Business Succession Law in Utah is an important part of the legal system and the state is home to a number of business lawyers and law firms that specialize in this area. Business Succession Law in Utah includes legal services such as estate planning and business succession lawyers who help business owners plan for the future of their businesses. Business succession law helps business owners plan for the transfer of ownership and/or control of their business in the event of death, disability, retirement, or other unexpected events. This law also helps to protect the rights of the business owners and their families in the event of such events.

Business succession plans are important for all businesses, big and small. Business Succession Law helps business owners create a succession plan that meets their needs and their business objectives. The succession plan should include a clear definition of the succession process, the responsibilities of each party involved, and the transfer of ownership and/or control. Additionally, the plan should also include provisions for Alternative Dispute Resolution, business litigation, and ethical standards.

Succession Planning

Business succession law in Utah is based on the Utah Code and the state’s business law. Business lawyers and law firms that specialize in this area assist business owners in understanding the legal requirements of business succession law in Utah and helping them to draft a comprehensive succession plan. The lawyers and law firms also provide legal advice on business partnerships, LLC business lawyers, professional corporation business, and other business entities.

Business succession law in Murray Utah is important for business owners who are looking to ensure their businesses will continue to operate and thrive in the event of an unexpected event. This law helps business owners plan for the future of their businesses by providing them with the necessary legal tools to do so. Furthermore, business succession law in Utah provides business owners with the necessary legal advice to make sure their succession plans are in accordance with the law and that their rights and interests are protected.

Business succession law in Murray Utah is an integral part of the legal system and the state is home to a number of business lawyers and law firms that specialize in this area. These lawyers and law firms offer valuable legal services such as estate planning, business succession lawyers, and business litigation. Additionally, business succession law in Utah provides business owners with the necessary legal advice to make sure their succession plans are in accordance with the law and that their rights and interests are protected. Business succession law in Utah is an important part of the legal system and provides business owners with the necessary legal tools to ensure their businesses will continue to operate and thrive in the event of an unexpected event.

Business Law Firm

A business law firm is a business entity formed by one or more lawyers to engage in the practice of law. The primary service rendered by a law firm is to advise clients (individuals or corporations) about their legal rights and responsibilities, and to represent this clients in civil or criminal cases, business transactions, and other matters in which legal advice and other assistance are sought.

Business Law Firm Arrangements

Law firms are organized in a variety of ways and different structures, depending on the jurisdiction in which the firm practices. Some common arrangements include:

Sole proprietorship, this is one in which the attorney is the law firm and is responsible for all profit, loss and liability;

General partnership, one in which all the attorneys who are members of the firm share ownership, profits and liabilities;

Professional corporations, this is a structure which issue stock to the attorneys in a fashion similar to that of a business corporation;

Limited liability company, another structure in which the attorney-owners are called “members” but are not directly liable to third party creditors of the law firm (prohibited as against public policy in many jurisdictions but allowed in others in the form of a “Professional Limited Liability Company” or “PLLC”);

Professional association, which operates similarly to a professional corporation or a limited liability company;

Limited liability partnership (LLP), in which the attorney-owners are partners with one another, but no partner is liable to any creditor of the law firm nor is any partner liable for any negligence on the part of any other partner. The LLP is taxed as a partnership while enjoying the liability protection of a corporation.

Restrictions on Ownership Interests in Business Law Firm

Mostly, there is a rule that only lawyers may have an ownership interest in, or be managers of, a law firm. Although some states have revised this or modified it in some way, for the most part, this is true in the United States. Thus, law firms cannot quickly raise capital through initial public offerings on the stock market, like most corporations. They must either raise capital through additional capital contributions from existing or additional equity partners, or must take on debt, usually in the form of a line of credit secured by their accounts receivable.

In Utah, this complete bar to non lawyer ownership has been codified by the American Bar Association as paragraph (d) of Rule 5.4 of the Model Rules of Professional Conduct and has been adopted in one form or another in most jurisdiction. Ownership only by those partners who actively assist the firm’s lawyers in providing legal services, and does not allow for the sale of ownership shares to mere passive non lawyer investors. Law firms have been able to take on a limited number of non-lawyer partners and lawyers have been allowed to enter into a wide variety of business relationships with non-lawyers and non-lawyer owned businesses. This has allowed, for example, grocery stores, banks and community organizations to hire lawyers to provide in-store and online basic legal services to customers which is really necessary and good for business owners (either big or small).

This rule Is very controversial. It is justified by many in the legal profession, notably, most rejected a proposal to change the rule in its Ethics 20/20 reforms, as necessary to prevent conflicts of interest. In the adversarial system of justice, a lawyer has a duty to be a zealous and loyal advocate on behalf of the client, and also has a duty to not bill the client excessively. Also, as an officer of the court, a lawyer has a duty to be honest and to not file frivolous cases or raise frivolous defenses. Many in the legal profession believe that a lawyer working as a shareholder-employee of a publicly traded law firm might be tempted to evaluate decisions in terms of their effect on the stock price and the shareholders, which would directly conflict with the lawyer’s duties to the client and to the courts. Critics of the rule, however, believe that it is an inappropriate way of protecting clients’ interests and that it severely limits the potential for the innovation of less costly and higher quality legal services that could benefit both ordinary consumers and businesses.

Business law firms can vary widely in size. The smallest law firms are lawyers practicing alone, who form the vast majority of lawyers in nearly all areas. Smaller firms tend to focus on particular specialties of the law (e.g. patent law, labor law, tax law, criminal defense, personal injury); larger firms may be composed of several specialized practice groups, allowing the firm to diversify its client base and market, and to offer a variety of services to their clients. Large law firms usually have separate litigation and transactional departments. The transactional department advises clients and handles transactional legal work in the firm, such as drafting contracts, handling necessary legal applications and filings, and evaluating and ensuring compliance with relevant law; while the litigation department represents clients in court and handles necessary matters (such as discovery and motions filed with the court) throughout the process of litigation.

Multinational Law Firms

Law firms operating in multiple countries often have complex structures involving multiple partnerships, which may restrict partnerships between local and foreign lawyers. Some multiple national or regional partnerships form an association in which they share branding, administrative functions and various operating costs, but maintain separate revenue pools and often separate partner compensation structures while other multinational law firms operate as single worldwide partnerships, in which partners also participate in local operating entities in various countries as required by local regulations.

Financial indicators in Business Law Firm

Three financial statistics are typically used to measure and rank law firms’ performance for businesses:

Profits per equity partner (PPEP or PPP): Net operating income divided by number of equity partners. High PPP is often correlated with prestige of a firm and its attractiveness to potential equity partners. However, the indicator is prone to manipulation by re-classifying less profitable partners as non-equity partners.

Revenue per lawyer (RPL): Gross revenue divided by number of lawyers. This statistic shows the revenue-generating ability of the firm’s lawyers in general, but does not factor in the firm’s expenses such as associate compensation and office overhead.

Average compensation of partners (ACP): Total amount paid to equity and nonequity partners (i.e., net operating income plus nonequity partner compensation) divided by the total number of equity and nonequity partners. This results in a more inclusive statistic than PPP, but remains prone to manipulation by changing expense policies and re-classifying less profitable partners as associates.

What Is A Full-Service Law Firm?

A full-service law firm provides legal assistance to a wide variety of clients and is equipped to handle all aspects of a case. For instance, a full-service personal injury firm can handle consultations, settlement talks and litigation proceedings in court. A full-service contract law firm can handle drafting reviews, negotiations and renegotiations. Specialized law firms may cover a specific service or niche. With this, it is necessary and good to have an involvement with a law firm for your business.

Law Firms by Practice Area

There are numerous types of lawyers, broken down by practice area. Choosing one of the many law aspects available can be a way for students or Business owners to frame their careers and establish themselves within a particular area of interest, such as criminal law, tax law, sports law or cybersecurity and business area of interest.

Law Firms by Legal Service

Law firms may limit the services they offer clients. Most law firms offer consultations for legal information and document review. Some firms specialize in helping clients prepare for litigation, and others solely represent clients in out-of-court administrative hearings like arbitration, mediation or contractual signings. Often, smaller firms will choose one or the other while medium and large firms may have two departments pursuing both transactional and litigation cases.

Mergers and Acquisitions Between Law Firms

Mergers, acquisitions, division and reorganizations occur between law firms as in other businesses. The specific books of business and specialization of attorneys as well as the professional ethical structures surrounding conflict of interest can lead to firms splitting up to pursue different clients or practices, or merging or recruiting experienced attorneys to acquire new clients or practice areas. Results often vary between firms experiencing such transitions. Firms that gain new practice areas or departments through recruiting or mergers that are more complex and demanding (and typically more profitable) may see the focus, organization and resources of the firm shift dramatically towards those new departments. Conversely, firms may be merged among experienced attorneys as partners for purposes of shared financing and resources, while the different departments and practice areas within the new firm retain a significant degree of autonomy.

Law firm mergers tend to be assortative, in that only law firms operating in similar legal systems are likely to merge. Though mergers are more common among better economies, slowing down a bit during recessions, big firms sometimes use mergers as a strategy to boost revenue during a recession. Nevertheless, data shows less mergers over time.

Business Succession Lawyer Murray Utah Consultation

When you need legal help with a business succession in Murray Utah, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

Business Succession Lawyer Salt Lake City Utah

The Utah Uniform Partnership Act

The 10 Essential Elements of Business Succession Planning

Business Succession Lawyer Taylorsville Utah

Business Succession Lawyer South Jordan Utah

Business Succession Lawyer Lehi Utah

Business Succession Lawyer Millcreek Utah

Business Succession Lawyer Murray Utah

Business Lawyer Salt Lake City Utah

Business Transaction Lawyer Salt Lake City Utah

Business Succession Lawyer Herriman Utah

What Are The Advantages Of Hiring A Business Lawyer?

Business Succession Lawyer Logan Utah

Murray, Utah

|

Murray, Utah

|

|

|---|---|

|

City

|

|

Murray City Hall

|

|

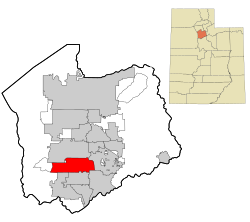

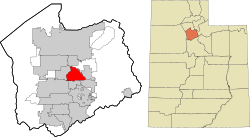

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°39′9″N 111°53′36″WCoordinates: 40°39′9″N 111°53′36″W | |

| Country | United States |

| State | |

| County | Salt Lake |

| Settled | 1848 |

| Incorporated | January 3, 1903 |

| Named for | Eli Houston Murray[1] |

| Government

|

|

| • Type | Mayor-Council |

| • Mayor | Brett Hales[2] |

| Area | |

| • Total | 12.32 sq mi (31.92 km2) |

| • Land | 12.32 sq mi (31.91 km2) |

| • Water | 0.00 sq mi (0.01 km2) |

| Elevation

|

4,301 ft (1,311 m) |

| Population

(2020)

|

|

| • Total | 50,637 |

| • Density | 4,110.15/sq mi (1,532.75/km2) |

| Time zone | UTC−7 (MST) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84107, 84117, 84121, 84123

|

| Area code(s) | 385, 801 |

| FIPS code | 49-53230[4] |

| GNIS feature ID | 1443742[5] |

| Demonym | Murrayite |

| Website | www |

Murray (/ˈmʌri/) is a city situated on the Wasatch Front in the core of Salt Lake Valley in the U.S. state of Utah. Named for territorial governor Eli Murray, it is the state’s fourteenth largest city. According to the 2020 census, Murray had a population of 50,637.[6] Murray shares borders with Taylorsville, Holladay, South Salt Lake and West Jordan, Utah. Once teeming with heavy industry, Murray’s industrial sector now has little trace and has been replaced by major mercantile sectors. Known for its central location in Salt Lake County, Murray has been called the Hub of Salt Lake County. Unlike most of its neighboring communities, Murray operates its own police, fire, power, water, library, and parks and recreation departments and has its own school district.[7] While maintaining many of its own services, Murray has one of the lowest city tax rates in the state.[8]

Thousands of people each year visit Murray City Park for organized sports and its wooded areas. Murray is home to the Intermountain Medical Center, a medical campus that is also Murray’s largest employer. Murray has been designated a Tree City USA since 1977.[7]

[geocentric_weather id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_about id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_neighborhoods id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_thingstodo id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_busstops id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_mapembed id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_drivingdirections id=”b0824497-c005-4e06-8eed-3d14d7069c61″]

[geocentric_reviews id=”b0824497-c005-4e06-8eed-3d14d7069c61″]