Business Succession Lawyer Draper Utah

-

Legal Topics

- Introduction

- The Benefits of Working with a Business Succession Lawyer in Draper

- What to Expect from a Draper Business Succession Lawyer Consultation

- Understanding the Process of Business Succession Planning in Draper

- The Benefits of Working with an Experienced Draper Business Succession Lawyer

- How to Choose the Right Business Succession Lawyer in Draper

- Business Owner’s Legacy With Succession Planning

- Q&A

“Secure Your Business’s Future with Business Succession Lawyer Draper Utah”

Introduction

Welcome to the Law Office of Business Succession Lawyer Draper Utah. We are a full-service law firm dedicated to providing comprehensive legal services to businesses and individuals in the Draper area. Our experienced attorneys specialize in business succession planning, estate planning, and asset protection. We understand the importance of protecting your business and your family’s future, and we are committed to helping you achieve your goals. Our team of experienced attorneys will work with you to develop a comprehensive plan that meets your needs and ensures your success. We look forward to working with you and helping you achieve your goals.

The Benefits of Working with a Business Succession Lawyer in Draper

When it comes to business succession planning, it is important to work with a qualified business succession lawyer in Draper. A business succession lawyer can help you navigate the complex legal and financial issues associated with transferring ownership of a business. Here are some of the benefits of working with a business succession lawyer in Draper.

1. Expertise: A business succession lawyer in Draper has the expertise and experience to help you create a comprehensive succession plan that meets your needs. They understand the legal and financial implications of transferring ownership of a business and can help you create a plan that is tailored to your specific situation.

2. Guidance: A business succession lawyer in Draper can provide you with guidance and advice throughout the process. They can help you understand the legal and financial implications of transferring ownership of a business and can help you make informed decisions.

3. Tax Planning: A business succession lawyer in Draper can help you with tax planning. They can help you understand the tax implications of transferring ownership of a business and can help you create a plan that minimizes your tax liability.

4. Negotiation: A business succession lawyer in Draper can help you negotiate the terms of the transfer of ownership. They can help you ensure that the terms of the transfer are fair and equitable for all parties involved.

5. Documentation: A business succession lawyer in Draper can help you create the necessary documents to transfer ownership of a business. They can help you draft contracts, wills, trusts, and other documents that are necessary for the transfer of ownership.

Working with a business succession lawyer in Draper can help you create a comprehensive succession plan that meets your needs. They have the expertise and experience to help you navigate the complex legal and financial issues associated with transferring ownership of a business. They can provide you with guidance and advice throughout the process and can help you create a plan that minimizes your tax liability. They can also help you negotiate the terms of the transfer of ownership and create the necessary documents to transfer ownership of a business.

What to Expect from a Draper Business Succession Lawyer Consultation

A consultation with a Draper business succession lawyer is an important step in ensuring the successful transition of a business from one owner to another. During the consultation, the lawyer will discuss the legal aspects of the succession process, including the transfer of ownership, the division of assets, and the tax implications of the transition.

The lawyer will review the current business structure and any existing contracts or agreements that may be affected by the succession. They will also discuss the legal requirements for transferring ownership, such as filing documents with the state and obtaining any necessary licenses or permits. The lawyer will also explain the tax implications of the transition, including any potential capital gains taxes or estate taxes that may be due.

The lawyer will also review any existing estate planning documents, such as wills or trusts, to ensure that the succession process is in line with the wishes of the current owner. They will also discuss any potential conflicts of interest that may arise during the succession process, such as family members who may be involved in the business.

Finally, the lawyer will discuss any potential legal issues that may arise during the succession process, such as disputes between the current and new owners. They will also provide advice on how to best protect the interests of all parties involved in the transition.

At the end of the consultation, the lawyer will provide a summary of the discussion and any recommendations they may have. They will also provide a timeline for the succession process and any additional steps that may need to be taken.

Understanding the Process of Business Succession Planning in Draper

Business succession planning is an important process for business owners in Draper, Utah. It is the process of preparing for the transfer of ownership and management of a business from one generation to the next. It is a complex process that requires careful planning and consideration of the various legal, financial, and tax implications.

The first step in business succession planning is to identify the goals and objectives of the business. This includes determining the desired outcome of the succession plan, such as the transfer of ownership to a family member or the sale of the business to an outside party. It is important to consider the long-term goals of the business and the desired outcome of the succession plan.

The next step is to develop a succession plan. This plan should include the transfer of ownership, management, and control of the business. It should also include the financial and legal aspects of the transition, such as the transfer of assets, liabilities, and taxes. It is important to consider the tax implications of the succession plan and to ensure that the plan is in compliance with applicable laws and regulations.

The third step is to create a timeline for the succession plan. This timeline should include the steps necessary to complete the transition, such as the transfer of ownership, management, and control of the business. It should also include the timeline for the transfer of assets, liabilities, and taxes.

The fourth step is to create a budget for the succession plan. This budget should include the costs associated with the transition, such as legal fees, accounting fees, and taxes. It is important to consider the long-term financial implications of the succession plan and to ensure that the plan is financially feasible.

The fifth step is to create a communication plan. This plan should include the steps necessary to inform stakeholders of the succession plan, such as family members, employees, and customers. It is important to ensure that all stakeholders are informed of the plan and that they understand the implications of the transition.

Finally, the sixth step is to implement the succession plan. This includes the transfer of ownership, management, and control of the business. It is important to ensure that the transition is completed in a timely manner and that all stakeholders are informed of the plan.

Business succession planning is an important process for business owners in Draper, Utah. It is a complex process that requires careful planning and consideration of the various legal, financial, and tax implications. By following these steps, business owners can ensure that their succession plan is successful and that their business is prepared for the future.

The Benefits of Working with an Experienced Draper Business Succession Lawyer

When it comes to business succession planning, it is important to work with an experienced draper business succession lawyer. A draper business succession lawyer can provide invaluable guidance and advice to ensure that your business succession plan is properly structured and executed. Here are some of the benefits of working with an experienced draper business succession lawyer:

1. Knowledge of the Law: An experienced draper business succession lawyer will have a thorough understanding of the laws and regulations that govern business succession planning. This knowledge can help you ensure that your plan is compliant with all applicable laws and regulations.

2. Experience: An experienced draper business succession lawyer will have a wealth of experience in helping clients create and execute business succession plans. This experience can be invaluable in helping you create a plan that meets your needs and goals.

3. Expertise: An experienced draper business succession lawyer will have a deep understanding of the complexities of business succession planning. This expertise can help you create a plan that is tailored to your specific needs and goals.

4. Guidance: An experienced draper business succession lawyer can provide invaluable guidance and advice throughout the process of creating and executing your business succession plan. This guidance can help you make informed decisions and ensure that your plan is properly structured and executed.

5. Cost Savings: Working with an experienced draper business succession lawyer can help you save money in the long run. An experienced lawyer can help you create a plan that is cost-effective and efficient, which can help you save money in the long run.

By working with an experienced draper business succession lawyer, you can ensure that your business succession plan is properly structured and executed. An experienced lawyer can provide invaluable guidance and advice throughout the process, helping you make informed decisions and save money in the long run.

How to Choose the Right Business Succession Lawyer in Draper

Choosing the right business succession lawyer in Draper is an important decision that can have a significant impact on the future of your business. It is important to take the time to research and select a lawyer who is experienced in business succession law and who can provide the best legal advice and representation for your particular situation. Here are some tips to help you choose the right business succession lawyer in Draper:

1. Research the lawyer’s experience and qualifications. Make sure the lawyer you choose has experience in business succession law and is familiar with the laws and regulations in Draper. Ask for references and check the lawyer’s credentials to ensure they are qualified to handle your case.

2. Ask for a consultation. Before you hire a lawyer, it is important to meet with them in person to discuss your case and get a better understanding of their experience and qualifications. During the consultation, ask questions about their experience and qualifications, as well as their fees and payment terms.

3. Consider the lawyer’s communication style. It is important to choose a lawyer who is easy to communicate with and who is willing to take the time to explain the legal process and answer any questions you may have.

4. Check the lawyer’s reputation. Ask around to see what other people have to say about the lawyer. Check online reviews and ratings to get an idea of the lawyer’s reputation.

By following these tips, you can ensure that you choose the right business succession lawyer in Draper for your particular situation. With the right lawyer on your side, you can rest assured that your business succession will be handled properly and efficiently.

Business Owner’s Legacy With Succession Planning

Succession planning is an important part of any business owner’s legacy. It is the process of preparing for the future of the business by ensuring that the right people are in place to take over when the current owner is no longer able to manage the business. It is a critical part of any business owner’s long-term strategy and should be taken seriously.

The first step in succession planning is to identify the key people in the business who will be responsible for taking over when the current owner is no longer able to manage the business. This includes identifying the right people to fill key roles such as CEO, CFO, and other senior management positions. It is important to ensure that these people have the right skills and experience to be successful in their roles.

Once the key people have been identified, the next step is to develop a plan for how the business will be managed in the future. This includes developing a strategy for how the business will be run, how decisions will be made, and how the business will be structured. It is important to ensure that the plan is realistic and achievable.

Finally, it is important to ensure that the succession plan is communicated to all stakeholders in the business. This includes employees, customers, suppliers, and other stakeholders. It is important to ensure that everyone understands the plan and is on board with it.

Succession planning is an important part of any business owner’s legacy. It is a critical part of any long-term strategy and should be taken seriously. By taking the time to identify the right people, develop a plan, and communicate it to all stakeholders, a business owner can ensure that their legacy will be one of success.

Q&A

1. What is a business succession lawyer?

A business succession lawyer is a lawyer who specializes in helping business owners plan for the future of their business. They can help with the legal aspects of succession planning, such as drafting wills, trusts, and other documents to ensure that the business is passed on to the right people in the right way. They can also help with tax planning, asset protection, and other legal matters related to business succession.

2. What services does a business succession lawyer provide?

A business succession lawyer can provide a variety of services, including drafting wills and trusts, creating business succession plans, advising on tax planning, and helping to protect assets. They can also provide guidance on the legal aspects of transferring ownership of a business, such as negotiating contracts and dealing with creditors. You really need to make sure your succession plans is done right to avoid future lawsuits or debacles that may follow incorrectly drafted paperwork.

3. How much does a business succession lawyer cost?

The cost of a business succession lawyer will vary depending on the complexity of the case and the services required. Generally, lawyers charge an hourly rate for their services, and the cost can range from a few thousand dollars to tends of thousand dollars. If your business is worth over a million dollars or more, then paying a succession attorney to help you is worth $10,000 to $20,000 or more to make sure it is done properly. Depending on your circumstances you may also be also to deduct the cost of the lawyer from your taxes. A business attorney is a business expense.

4. What qualifications should I look for in a business succession lawyer?

When looking for a business succession lawyer, it is important to make sure that they have experience in the area of business succession planning. You should also find someone who’s done this before. Find a business lawyer who also has a degree in business, has done business consulting, and regularly does this type of work. It is also important to make sure that they are licensed to practice law in your state.

5. What should I expect from a business succession lawyer?

A business succession lawyer should be able to provide advice and guidance on the legal aspects of succession planning. They should also be able to help you create a plan that meets your needs and goals.

6. Where can I find a business succession lawyer in Draper, Utah?

There are several business succession lawyers in Draper, Utah. You can search online for lawyers in your area, or you can contact your local bar association for a list of lawyers in your area. You can also call attorney Jeremy Eveland (801) 613-1472 for a consultation.

Business Succession Lawyer Draper Utah Consultation

When you need legal help with a business succession in Draper Utah, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

Business Succession Lawyer Taylorsville Utah

Business Succession Lawyer South Jordan Utah

Business Succession Lawyer Lehi Utah

Business Succession Lawyer Millcreek Utah

Business Succession Lawyer Murray Utah

Business Lawyer Salt Lake City Utah

Salt Lake City Business Transaction Attorney

Business Succession Lawyer Herriman Utah

What Are The Advantages Of Hiring A Business Lawyer?

Business Succession Lawyer Logan Utah

What Is The Relationship Between Business Law And Economies?

Business Transaction Lawyer West Valley City Utah

Do I Need A Permit To Start A Business In Utah?

Business Succession Lawyer Draper Utah

Draper, Utah

|

Draper, Utah

|

|

|---|---|

Draper Historic Park

|

|

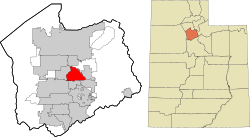

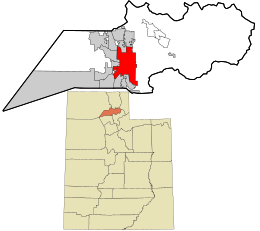

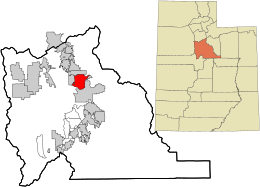

Location in Salt Lake County and the state of Utah.

|

|

| Coordinates: 40°30′53″N 111°52′23″WCoordinates: 40°30′53″N 111°52′23″W | |

| Country | United States |

| State | Utah |

| Counties | Salt Lake, Utah |

| Settled | 1849 |

| Incorporated | 1978[1] |

| Founded by | Ebenezer Brown and his wife Phebe DRAPER Palmer Brown |

| Named for | William Draper Jr. |

| Government

|

|

| • Mayor | Troy K. Walker |

| Area | |

| • Total | 29.96 sq mi (77.61 km2) |

| • Land | 29.95 sq mi (77.57 km2) |

| • Water | 0.01 sq mi (0.04 km2) |

| Elevation

|

4,505 ft (1,373 m) |

| Population

(2020)

|

|

| • Total | 51,017 |

| • Density | 1,700/sq mi (660/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP code |

84020

|

| Area code(s) | 385, 801 |

| FIPS code | 49-20120 |

| GNIS feature ID | 1427473 |

| Website | www |

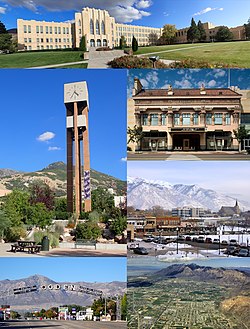

Draper is a city in Salt Lake and Utah counties in the U.S. state of Utah, about 20 miles (32 km) south of Salt Lake City along the Wasatch Front. As of the 2020 census, the population is 51,017, up from 7,143 in 1990.[3]

Draper is part of two metropolitan areas; the Salt Lake County portion is in the Salt Lake City metropolitan area, while the Utah County portion is in the Provo-Orem metropolitan area.

The Utah State Prison is in Draper, near Point of the Mountain, alongside Interstate 15. Gary Gilmore‘s execution occurred on 17 January 1977. The Utah Legislature voted to relocate the state prison to Draper in 2014 and in 2015 approved the Salt Lake City location the prison relocation commission recommended. The Draper Prison will close in 2022. Inmates will be moved to a new prison facility in Salt Lake City; the new prison is slated for completion in mid-2022.[4]

Draper has two UTA TRAX stations (Draper Town Center, 12300/12400 South and Kimball’s Lane 11800 South) as well as one on the border with Sandy (Crescent View 11400 South). A FrontRunner commuter rail station serves the city’s west side. The city has around 5 FLEX bus routes connecting neighboring communities and two bus routes to Lehi Frontrunner Station and River/Herriman, connecting at Draper Town Center and the Draper Frontrunner Stations.

The city is home of 1-800 Contacts and a large eBay campus.

About Draper, Utah

Draper is a city in Salt Lake and Utah counties in the U.S. state of Utah, about 20 miles (32 km) south of Salt Lake City along the Wasatch Front. As of the 2020 census, the population is 51,017, up from 7,143 in 1990.

Neighborhoods in Draper, Utah

Willowbrook Estates, Whisperwood Neighborhood Park, Draper, Inauguration Park, Draper Historic Park, Draper City Park, Mehraban Wetland Park, Cranberry Park, Draper Peaks, Wheadon Farm Regional Park, SunCrest Lifestyle | Windermere Real Estate