How to Choose the Right Business Transaction Lawyer in Salt Lake City

When selecting a business transaction lawyer in Salt Lake City, it is important to consider a few key factors. First, it is important to ensure that the lawyer has experience in the specific area of business transaction law that is relevant to your needs. It is also important to consider the lawyer’s reputation and track record of success. Additionally, it is important to ensure that the lawyer is familiar with the local laws and regulations that may affect your business transaction.

When researching potential business transaction lawyers in Salt Lake City, it is important to read reviews and ask for references. This will help you to get a better understanding of the lawyer’s experience and reputation. Additionally, it is important to ask questions about the lawyer’s fees and payment structure. It is also important to ensure that the lawyer is willing to provide a written agreement outlining the terms of the representation.

When interviewing potential business transaction lawyers in Salt Lake City, it is important to ask questions about their experience and qualifications. Additionally, it is important to ask questions about the lawyer’s approach to business transactions and their understanding of the relevant laws and regulations. It is also important to ask questions about the lawyer’s communication style and availability.

Finally, it is important to ensure that the attorney is someone you feel comfortable working with. It is important to ensure that the lawyer is someone who is willing to listen to your needs and provide sound legal advice. Additionally, it is important to ensure that the lawyer is someone who is willing to work with you to ensure that your business transaction is successful. By taking the time to research and interview potential business transaction lawyers in Salt Lake City, you can ensure that you select the right lawyer for your needs.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. The state is home to five national parks, seven national monuments, and numerous state parks and recreation areas.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 11th most populous state, with a population of 3,205,958 as of 2019. The capital of Utah is Salt Lake City, which is also the most populous city in the state. Other major cities include West Valley City, Provo, West Jordan, and Ogden.

Utah is known for its natural beauty and outdoor recreation opportunities. The state is home to five national parks, including Arches National Park, Bryce Canyon National Park, Canyonlands National Park, Capitol Reef National Park, and Zion National Park. These parks offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to seven national monuments, including Cedar Breaks National Monument, Dinosaur National Monument, Hovenweep National Monument, Natural Bridges National Monument, Rainbow Bridge National Monument, Timpanogos Cave National Monument, and Zion National Park. These monuments offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to numerous state parks and recreation areas. These parks offer visitors a variety of activities, such as hiking, camping, fishing, boating, and more. Some of the most popular state parks in Utah include Antelope Island State Park, Bear Lake State Park, Goblin Valley State Park, and Wasatch Mountain State Park.

Additional Articles on Business Law

We have also posted the following articles regarding the topic of business law:

Corporate Criminal Liability

What Is A Tender In Business Law?

AI Business Consultant

Business Credit

Due Diligence

Tax Law

Commercial Law

Litigation

Utah is a great place to visit for outdoor recreation and sightseeing. With its diverse landscape and numerous parks and monuments, Utah offers something for everyone. Whether you’re looking for a relaxing getaway or an adventure-filled vacation, Utah has something for you.

Understanding the Benefits of Working with a Business Transaction Lawyer in Salt Lake City

When it comes to business transactions, it is important to have a knowledgeable and experienced lawyer on your side. A business transaction lawyer in Salt Lake City can provide invaluable assistance in a variety of areas, from contract negotiation to dispute resolution. Working with a business transaction lawyer can help ensure that your business transactions are conducted in a legally sound manner and that your interests are protected.

One of the primary benefits of working with a business transaction lawyer is that they can provide guidance and advice on the legal aspects of a transaction. A business transaction lawyer can help you understand the legal implications of a contract or agreement, as well as the potential risks and rewards associated with it. They can also provide advice on how to structure a transaction to maximize the benefits for all parties involved.

A business transaction lawyer can also help you negotiate the terms of a contract or agreement. They can help you identify potential areas of dispute and provide advice on how to resolve them. They can also help you draft contracts and agreements that are legally sound and protect your interests.

In addition, a business transaction lawyer can provide assistance in dispute resolution. If a dispute arises between parties involved in a transaction, a business transaction lawyer can help you navigate the legal process and ensure that your interests are protected. They can also provide advice on how to resolve the dispute in a timely and cost-effective manner.

Finally, a business transaction lawyer can provide assistance in the enforcement of contracts and agreements. They can help you ensure that the terms of a contract or agreement are followed and that any disputes are resolved in a timely and cost-effective manner.

By working with a business transaction lawyer in Salt Lake City, you can ensure that your business transactions are conducted in a legally sound manner and that your interests are protected. A business transaction lawyer can provide invaluable assistance in a variety of areas, from contract negotiation to dispute resolution. With their help, you can ensure that your business transactions are conducted in a legally sound manner and that your interests are protected.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. The state is home to five national parks, seven national monuments, and numerous state parks and recreation areas.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 11th most populous state, with a population of 3,205,958 as of 2019. The capital of Utah is Salt Lake City, which is also the most populous city in the state. Other major cities include West Valley City, Provo, West Jordan, and Ogden.

Utah is known for its natural beauty and outdoor recreation opportunities. The state is home to five national parks, including Arches National Park, Bryce Canyon National Park, Canyonlands National Park, Capitol Reef National Park, and Zion National Park. These parks offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to seven national monuments, including Cedar Breaks National Monument, Dinosaur National Monument, Hovenweep National Monument, Natural Bridges National Monument, Rainbow Bridge National Monument, Timpanogos Cave National Monument, and Zion National Park. These monuments offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to numerous state parks and recreation areas. These parks offer visitors a variety of activities, such as hiking, camping, fishing, boating, and more. Some of the most popular state parks in Utah include Antelope Island State Park, Bear Lake State Park, Goblin Valley State Park, and Wasatch Mountain State Park.

Utah is a great place to visit for outdoor recreation and sightseeing. With its diverse landscape and numerous parks and monuments, Utah offers something for everyone. Whether you’re looking for a relaxing getaway or an adventure-filled vacation, Utah has something for you.

The Role of a Business Transaction Lawyer in Salt Lake City

A business transaction lawyer in Salt Lake City plays an important role in helping businesses navigate the complexities of the legal system. Business transaction lawyers provide legal advice and representation to businesses in a variety of areas, including contract negotiation, corporate formation, mergers and acquisitions, and intellectual property protection.

Business transaction lawyers in Salt Lake City are responsible for helping businesses understand the legal implications of their decisions and actions. They provide advice on the best course of action to take in order to protect the interests of the business. They also help businesses draft and review contracts, ensuring that all parties involved are aware of their rights and obligations.

Business transaction lawyers in Salt Lake City also help businesses with the formation of corporations and other business entities. They can provide advice on the best type of entity to form, as well as the necessary paperwork and filings required to establish the entity. They can also help businesses with the dissolution of entities, as well as the transfer of ownership.

Business transaction lawyers in Salt Lake City also provide advice and representation to businesses involved in mergers and acquisitions. They can help businesses understand the legal implications of the transaction, as well as the potential risks and rewards. They can also help businesses negotiate the terms of the transaction and draft the necessary documents.

Finally, business transaction lawyers in Salt Lake City can help businesses protect their intellectual property. They can provide advice on the best way to protect a business’s intellectual property, as well as the necessary paperwork and filings required to do so. They can also help businesses with the enforcement of their intellectual property rights.

Business transaction lawyers in Salt Lake City play an important role in helping businesses navigate the complexities of the legal system. They provide advice and representation to businesses in a variety of areas, helping them make informed decisions and protect their interests.

Utah in Mergers and Acquisitions

Mergers and acquisitions (M&A) are a common business strategy used by companies to expand their operations, increase their market share, and gain access to new technologies. In Utah, M&A activity has been on the rise in recent years, with a number of high-profile deals taking place.

The most notable M&A deal in Utah in recent years was the acquisition of Vivint Smart Home by Blackstone in 2020. The deal, valued at $3 billion, saw Blackstone acquire Vivint, a leading provider of home security and automation services. The acquisition was seen as a major win for Blackstone, as it gave the company access to Vivint’s technology and customer base.

Another major M&A deal in Utah was the acquisition of Zions Bancorporation by Goldman Sachs in 2019. The deal, valued at $1.8 billion, saw Goldman Sachs acquire Zions, a leading regional bank in the western United States. The acquisition was seen as a strategic move by Goldman Sachs, as it gave the company access to Zions’ customer base and banking operations.

In addition to these two major deals, there have been a number of smaller M&A deals in Utah in recent years. These deals have included the acquisition of Vivint Solar by Sunrun in 2018, the acquisition of Instructure by Pluralsight in 2017, and the acquisition of Ancestry.com by Permira in 2016.

Overall, M&A activity in Utah has been on the rise in recent years, with a number of high-profile deals taking place. These deals have been beneficial for both the companies involved and the state of Utah, as they have provided access to new technologies and markets, as well as increased employment opportunities. As such, M&A activity is likely to remain strong in Utah in the years to come.

Navigating Complex Business Transactions with the Help of a Business Transaction Lawyer in Salt Lake City

Navigating complex business transactions can be a daunting task, especially for those who are unfamiliar with the legal process. Fortunately, a business transaction lawyer in Salt Lake City can provide invaluable assistance in this area. With their expertise and experience, they can help ensure that all parties involved in the transaction are protected and that the transaction is conducted in a legally sound manner.

A business transaction lawyer in Salt Lake City can provide a variety of services to help facilitate a successful transaction. They can review and draft contracts, negotiate terms, and provide advice on the best course of action. They can also help to ensure that all parties involved in the transaction are aware of their rights and obligations. Additionally, they can provide guidance on the tax implications of the transaction and help to ensure that all applicable laws and regulations are followed.

When selecting a business transaction lawyer in Salt Lake City, it is important to choose one who is experienced and knowledgeable in the area of business transactions. They should have a thorough understanding of the applicable laws and regulations and be able to provide sound legal advice. Additionally, they should be able to provide clear and concise communication to ensure that all parties involved in the transaction are on the same page.

By working with a business transaction lawyer in Salt Lake City, you can rest assured that your transaction will be conducted in a legally sound manner. They can provide invaluable assistance in navigating the complexities of the transaction and ensure that all parties involved are protected. With their expertise and experience, they can help to ensure that the transaction is conducted in a manner that is beneficial to all parties involved.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. The state is home to five national parks, seven national monuments, and numerous state parks and recreation areas.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 11th most populous state, with a population of 3,205,958 as of 2019. The capital of Utah is Salt Lake City, which is also the most populous city in the state. Other major cities include West Valley City, Provo, West Jordan, and Ogden.

Utah is known for its natural beauty and outdoor recreation opportunities. The state is home to five national parks, including Arches National Park, Bryce Canyon National Park, Canyonlands National Park, Capitol Reef National Park, and Zion National Park. These parks offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to seven national monuments, including Cedar Breaks National Monument, Dinosaur National Monument, Hovenweep National Monument, Natural Bridges National Monument, Rainbow Bridge National Monument, Timpanogos Cave National Monument, and Zion National Park. These monuments offer visitors a variety of activities, such as hiking, camping, and sightseeing.

Utah is also home to numerous state parks and recreation areas. These parks offer visitors a variety of activities, such as hiking, camping, fishing, boating, and more. Some of the most popular state parks in Utah include Antelope Island State Park, Bear Lake State Park, Goblin Valley State Park, and Wasatch Mountain State Park.

Utah is a great place to visit for outdoor recreation and sightseeing. With its diverse landscape and numerous parks and monuments, Utah offers something for everyone. Whether you’re looking for a relaxing getaway or an adventure-filled vacation, Utah has something for you.

Common Mistakes to Avoid When Working with a Business Transaction Lawyer in Salt Lake City

1. Not Being Prepared: Before meeting with a business transaction lawyer in Salt Lake City, it is important to be prepared. Gather all relevant documents, such as contracts, financial statements, and other legal documents, and have them ready to discuss.

2. Not Understanding the Process: It is important to understand the process of working with a business transaction lawyer. Ask questions and make sure you understand the process before signing any documents.

3. Not Being Clear About Your Goals: Before meeting with a business transaction lawyer, it is important to be clear about your goals. Make sure you understand what you want to accomplish and communicate this to the lawyer.

4. Not Being Open to Advice: A business transaction lawyer can provide valuable advice and guidance. Be open to their advice and consider their suggestions before making any decisions.

5. Not Following Through: Once you have agreed to a plan of action, it is important to follow through. Make sure you are taking the necessary steps to ensure the success of the transaction.

6. Not Keeping Records: It is important to keep records of all communication and documents related to the transaction. This will help ensure that everything is handled properly and that all parties are held accountable.

Utah

Utah is a state located in the western United States. It is bordered by Idaho to the north, Wyoming to the northeast, Colorado to the east, Arizona to the south, and Nevada to the west. Utah is known for its diverse landscape, which includes mountains, deserts, and forests. It is also home to some of the most spectacular national parks in the United States, including Zion National Park, Bryce Canyon National Park, and Arches National Park.

Utah is the 13th largest state in the United States, with an area of 84,899 square miles. It is the 33rd most populous state, with a population of 3,205,958 as of 2020. The capital of Utah is Salt Lake City, which is also the most populous city in the state.

Utah is known for its strong economy, which is largely based on the mining and energy industries. It is also home to a number of technology companies, including Adobe, eBay, and Oracle. The state is also home to a number of universities, including the University of Utah, Brigham Young University, and Utah State University.

Utah is known for its unique culture, which is heavily influenced by its Mormon heritage. The state is home to a number of popular tourist attractions, including Temple Square in Salt Lake City, the Great Salt Lake, and the Bonneville Salt Flats. Utah is also home to a number of outdoor activities, including skiing, snowboarding, hiking, and camping.

Utah is a beautiful and diverse state with a lot to offer. From its stunning national parks to its vibrant cities, Utah is a great place to visit and explore.

Salt Lake City Business Transaction Attorney Consultation

When you need legal help with a Salt Lake City business transaction, call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Home

Related Posts

Business Succession Lawyer Salt Lake City Utah

The Utah Uniform Partnership Act

The 10 Essential Elements of Business Succession Planning

Utah Business Law

Business Lawyer

Mergers and Acquisitions

Advertising Law

Business Succession Lawyer Taylorsville Utah

Business Succession Lawyer South Jordan Utah

Purchase and Sale Agreement

Business Succession Lawyer Lehi Utah

Business Succession Lawyer Millcreek Utah

Business Succession Lawyer Murray Utah

Business Transaction Lawyer

Construction Law

Business Lawyer Salt Lake City Utah

What Is An Express Contract?

Antitrust Law

Salt Lake City Business Transaction Attorney

Business Succession Lawyer Herriman Utah

What Are The Advantages Of Hiring A Business Lawyer?

Business Succession Lawyer Logan Utah

Buy Sell Agreement

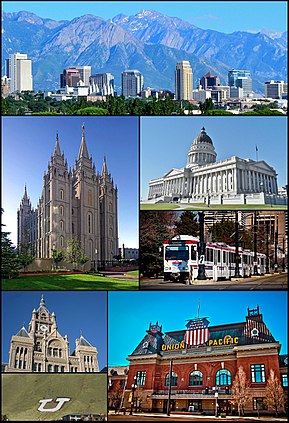

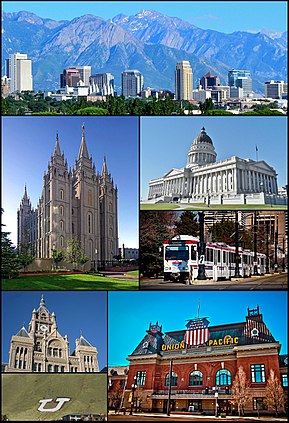

Salt Lake City

From Wikipedia, the free encyclopedia

|

Salt Lake City, Utah

|

| City of Salt Lake City[1] |

|

|

|

| Nickname:

“The Crossroads of the West”

|

Interactive map of Salt Lake City

|

Coordinates:  40°45′39″N 111°53′28″WCoordinates: 40°45′39″N 111°53′28″WCoordinates:  40°45′39″N 111°53′28″W 40°45′39″N 111°53′28″W |

| Country |

United States United States |

| State |

Utah Utah |

| County |

Salt Lake |

| Platted |

1857; 166 years ago[2] |

| Named for |

Great Salt Lake |

| • Type |

Strong Mayor–council |

| • Mayor |

Erin Mendenhall (D) |

| • City |

110.81 sq mi (286.99 km2) |

| • Land |

110.34 sq mi (285.77 km2) |

| • Water |

0.47 sq mi (1.22 km2) |

| Elevation

|

4,327 ft (1,288 m) |

| • City |

200,133 |

| • Rank |

122nd in the United States

1st in Utah |

| • Density |

1,797.52/sq mi (701.84/km2) |

| • Urban

|

1,178,533 (US: 41st) |

| • Urban density |

3,923.0/sq mi (1,514.7/km2) |

| • Metro

|

1,257,936 (US: 47th) |

| • CSA

|

2,746,164 (US: 22nd) |

| Demonym |

Salt Laker[5] |

| Time zone |

UTC−7 (Mountain) |

| • Summer (DST) |

UTC−6 |

| ZIP Codes |

|

| Area codes |

801, 385 |

| FIPS code |

49-67000[7] |

| GNIS feature ID |

1454997[8] |

| Major airport |

Salt Lake City International Airport |

| Website |

Salt Lake City Government |

Salt Lake City (often shortened to Salt Lake and abbreviated as SLC) is the capital and most populous city of Utah, United States. It is the seat of Salt Lake County, the most populous county in Utah. With a population of 200,133 in 2020,[10] the city is the core of the Salt Lake City metropolitan area, which had a population of 1,257,936 at the 2020 census. Salt Lake City is further situated within a larger metropolis known as the Salt Lake City–Ogden–Provo Combined Statistical Area, a corridor of contiguous urban and suburban development stretched along a 120-mile (190 km) segment of the Wasatch Front, comprising a population of 2,746,164 (as of 2021 estimates),[11] making it the 22nd largest in the nation. It is also the central core of the larger of only two major urban areas located within the Great Basin (the other being Reno, Nevada).

Salt Lake City was founded July 24, 1847, by early pioneer settlers led by Brigham Young, who were seeking to escape persecution they had experienced while living farther east. The Mormon pioneers, as they would come to be known, entered a semi-arid valley and immediately began planning and building an extensive irrigation network which could feed the population and foster future growth. Salt Lake City’s street grid system is based on a standard compass grid plan, with the southeast corner of Temple Square (the area containing the Salt Lake Temple in downtown Salt Lake City) serving as the origin of the Salt Lake meridian. Owing to its proximity to the Great Salt Lake, the city was originally named Great Salt Lake City. In 1868, the word “Great” was dropped from the city’s name.[12]

Immigration of international members of the Church of Jesus Christ of Latter-day Saints (LDS Church), mining booms, and the construction of the first transcontinental railroad initially brought economic growth, and the city was nicknamed “The Crossroads of the West”. It was traversed by the Lincoln Highway, the first transcontinental highway, in 1913. Two major cross-country freeways, I-15 and I-80, now intersect in the city. The city also has a belt route, I-215.

Salt Lake City has developed a strong tourist industry based primarily on skiing, outdoor recreation, and religious tourism. It hosted the 2002 Winter Olympics and is a candidate city for the 2030 Winter Olympics. It is known for its politically liberal culture, which stands in contrast with the rest of the state’s highly conservative leanings.[13] It is home to a significant LGBT community and hosts the annual Utah Pride Festival.[14] It is the industrial banking center of the United States.[15] Salt Lake City and the surrounding area are also the location of several institutions of higher education including the state’s flagship research school, the University of Utah. Sustained drought in Utah has more recently strained Salt Lake City’s water security and caused the Great Salt Lake level drop to record low levels,[16][17] and has impacted the local and state economy.[18]

About Salt Lake City, Utah

Salt Lake City is the capital and most populous city of Utah, United States. It is the seat of Salt Lake County, the most populous county in Utah. With a population of 200,133 in 2020, the city is the core of the Salt Lake City metropolitan area, which had a population of 1,257,936 at the 2020 census. Salt Lake City is further situated within a larger metropolis known as the Salt Lake City–Ogden–Provo Combined Statistical Area, a corridor of contiguous urban and suburban development stretched along a 120-mile (190 km) segment of the Wasatch Front, comprising a population of 2,746,164, making it the 22nd largest in the nation. It is also the central core of the larger of only two major urban areas located within the Great Basin.

Neighborhoods in Salt Lake City, Utah

Poplar Grove, The Avenues, Central City, Fairpark, Liberty Wells, Marmalade, Ballpark, Downtown, Capitol Hill, Woodbury, Neighborhood House, The Neighborhood Hive, Salt Lake City Community Development, Rose Park Neighborhood Center, Neighborhood Services, University Neighborhood Partners, Airport East Business Park, Community Health Centers Inc., Neighborhood Medical & Dental Clinic, Neighborhood Auto Service, Hartland Partnership Center

Things To Do in Salt Lake City, Utah

Bus Stops in Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Greyhound: Bus Station Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Greyhound: Bus Stop Salt Lake City, Utah to Jeremy Eveland

Bus Stop in UTA Bus Salt Lake Central Station Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Stadium Station (EB) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in South Salt Lake City Station Salt Lake City, Utah to Jeremy Eveland

Bus Stop in 200 S / 1000 E (EB) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Salt Lake Central Station (Bay B) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in 2100 S / 700 E (WB) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in 900 E / Wilson Ave (SB) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Intermodal Hub - Salt Lake City Salt Lake City, Utah to Jeremy Eveland

Bus Stop in Us Hwy 89 @ 270 S (N. Salt Lake) Salt Lake City, Utah to Jeremy Eveland

Bus Stop in 200 S / 1100 E (Wb) Salt Lake City, Utah to Jeremy Eveland

Map of Salt Lake City, Utah

Driving Directions in Salt Lake City, Utah to Jeremy Eveland

Driving Directions from Snow Christensen & Martineau to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Parr Brown Gee & Loveless to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Shumway Van - Lawyers in Salt Lake City to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Lewis Hansen Law Firm to 17 N State St, Lindon, UT 84042, USA

Driving Directions from McKay, Burton & Thurman, P.C. to 17 N State St, Lindon, UT 84042, USA

Driving Directions from The Franchise & Business Law Group to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Richards Brandt to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Henriksen & Henriksen to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Scalley Reading Bates Hansen & Rasmussen, P.C. to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Hepworth Legal to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Lincoln Law to 17 N State St, Lindon, UT 84042, USA

Driving Directions from Holland & Hart LLP - Salt Lake City to 17 N State St, Lindon, UT 84042, USA

Reviews for Jeremy Eveland Salt Lake City, Utah