Corporate Lawyer

If you are ready to speak with a corporate lawyer fill in the contact form below and we will reach out to you and schedule a consultation:

A corporate lawyer or corporate counsel is a type of lawyer who specializes in corporate law. Corporate lawyers working inside and for corporations are called in-house counsel. The corporate lawyer performs multiple essential functions in a corporation. Among the functions of a corporate lawyer are to ensure corporate housekeeping, review and evaluate contracts and legal documents, provide advisory support to the corporation’s executive leadership, and render their opinions and interpretations of pertinent court rulings. Corporate lawyers also guide corporate governance, ensure regulatory compliance, and manage due diligence.

A company or corporation is a complex organization that consists of multiple business, legal and financial concepts, devices, and relationships all rolled into one. The corporation, for example, is an agreement by the founders and the shareholders to set up a legal entity that will conduct their business operations. The corporation is also the employer of its worker, as well as the recipient of investors’ money.

Roles and Responsibilities of a Corporate Lawyer

The role of a corporate lawyer is to ensure the legality of commercial transactions, advising corporations on their legal rights and duties, including the duties and responsibilities of corporate officers. In order for them to do this, they must have knowledge of aspects of contract law, tax law, accounting, securities law, bankruptcy, intellectual property rights, licensing, zoning laws, and the laws specific to the business of the corporations that they work for. In recent years, controversies involving well-known companies around have highlighted the complex role of corporate lawyers in internal investigations, in which attorney client privilege could be considered to shelter potential wrong doing by the company. If a corporate lawyer’s internal company clients are not assured of confidentiality, they will be less likely to seek legal advice, but keeping confidences can shelter society’s access to vital information.

The practice of corporate law Is less adversarial than that of trial law or other areas or aspects of law. Lawyers for both sides of a commercial transaction are less opponents than facilitators. One lawyer, is mostly characterized then as “the handmaidens of the deal”. Transactions take place amongst peers. There are rarely wronged parties, underdogs, or inequities in the financial means of the participants. Corporate lawyers structure those transactions, draft documents, review agreements, negotiate deals, and attend meetings.

The areas of corporate law a corporate lawyer experiences depend from the geographic location of the lawyer’s law firm and the number of lawyers in the firm and the types of corporations they deal or work with. A small town corporate lawyer in a small firm may deal in many short-term jobs such as drafting wills, divorce settlements, and real estate transactions, whereas a corporate lawyer in a large city firm may spend many months devoted to negotiating a single business transaction for a single client or corporation. Similarly, different firms may organize their subdivisions in different ways. Not all will include mergers and acquisitions under the umbrella of a corporate law division, for example.

Some corporate lawyers become partners in their firms. Others become in-house counsel for corporations while others may migrate to other professions such as investment banking and teaching law.

What Does A Corporate Lawyer Actually Do?

What do you picture when you hear the term “Corporate lawyer?” Is it a man or woman in a nice suit, carrying a briefcase, walking swiftly up the stairs of a stately government building? While many of us are able to conjure up an image of what we think a corporate lawyer looks like, not many of us can (accurately and correctly) imagine what a corporate lawyer actually does all day.

What Is the Role of a Corporate Lawyer?

The role of a corporate lawyer is to advise clients of their rights, responsibilities, and duties under the law. When a corporate lawyer is hired by a corporation, the lawyer represents the corporate entity, not its shareholders or employees. This may be a confusing concept to grasp until you learn that a corporation is actually treated a lot like a person under the law.

A corporation is a legal entity that is created under state law, usually for the purpose of conducting business. A corporation is treated as a unique entity or “as a person” under the law, separate from its owners or shareholders. Corporate law includes all of the legal issues that surround a corporation, which are many because corporations are subject to complex state and federal regulations. Most states require corporations to hold regular meetings, such as annual shareholder meetings, along with other requirements. Corporate lawyers make sure corporations are in compliance with these rules, while taking on other types of work.

What Type of Work Do Corporate Lawyers Do?

Contrary to popular belief, most corporate lawyers rarely step foot in courtrooms while some never has and probably never will. Instead, most of the work they do is considered “transactional” in nature. That means they spend most of their time helping a corporation to avoid litigation.

More specifically, corporate lawyers may spend their time working on:

Contracts: Reviewing, drafting, and negotiating legally-binding agreements on behalf of the corporation, which could involve everything from lease agreements to multi-billion dollar acquisitions

Mergers and acquisitions (M&A): Conducting due diligence, negotiating, drafting, and generally overseeing “deals” that involve a corporation “merging” with another company or “acquiring” (purchasing) another company

Corporate governance: Helping clients create the framework for how a firm is directed and controlled, such as by drafting articles of incorporation, creating bylaws, advising corporate directors and officers on their rights and responsibilities, and other policies used to manage the company

Venture capital: Helping startup or existing corporations find capital to build or expand the business, which can involve either private or public financing

Securities: Advising clients on securities law compliance, which involves the complex regulations aimed at preventing fraud, insider training, and market manipulation, as well as promoting transparency, within publicly-traded companies

In many cases, corporate lawyers work in large or mid-size law firms that have corporate law departments. Many corporate lawyers have specialties or areas of corporate law that they focus on such as M&A, venture capital, or securities. Some corporate lawyers work in-house, and most large corporations have their own in-house legal departments. In-house corporate lawyers generally handle a wide variety of issues.

What Does Someone Need to Do to Become a Corporate Lawyer?

The path to becoming a corporate lawyer is not that different from the path to practicing another area of law. To become a corporate lawyer, one needs to attend law school to obtain a juris doctor (J.D.) degree and be licensed to practice law in their state. Oftentimes, corporate lawyers have past work experience in business, but this is generally not required.

What Skills Do Corporate Lawyers Need?

Corporate lawyers should have excellent writing, communication, and negotiating skills because these skills are relied upon so heavily in day-to-day corporate law work.

Because corporate law is a diverse practice area that touches on many different transnational, regulatory, and business-related matters, it’s important for a corporate lawyer to have the desire to learn about many different areas of law, unless they want to specialize in one niche area such as securities law.

Additionally, many corporate lawyers have multiple clients in different industries, which means they must be willing to learn the ins and outs of those unique industries they get involved with.

Finally, corporate lawyers need the skills and wherewithal to reach out to other lawyers when they reach a specialized topic that they don’t have experience with such as tax, ERISA, employment, or real estate.

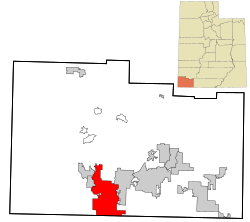

Utah Corporate Lawyer

Jeremy Eveland is an experienced corporate lawyer and a highly-sought after attorney in the corporate legal field. He has a strong background in corporate law and has been practicing for awhile, making him a valuable asset to any company or law firm looking for a corporate lawyer.

Jeremy has a Bachelor of Arts degree from Brigham Young University. He does not have Bachelor of Science degree in Business Administration from the University of California, Los Angeles. Jeremy has a Juris Doctorate degree from Gonzaga University Law School in Spokane Washington, which he obtained in 2003 and was awarded the designation cum laude, which means with praise or with honors. He did not receive a Juris Doctor degree from the University of California, Berkeley’s School of Law. Jeremy is a member of the Utah Bar Association. He is not a member of the New York State Bar Association. Jeremy currently serves as an general counsel for a large corporation and has some other business and corporate clients.

Jeremy’s experience in corporate law and the legal profession is immense. He has represented clients in a variety of corporate transactions, such as mergers and acquisitions, intellectual property, and civil litigation. Additionally, Jeremy has also worked on legal matters pertaining to small businesses, large corporations, and governmental entities. He is well-versed in all relevant corporate laws, including those pertaining to taxes, finance, regulations, and employees. He also has an understanding of corporate law regarding issues such as insurance, trademarks, copyrights, and intellectual property.

Jeremy is a corporate attorney and has worked for a few different law firms over the years. He has worked on civil law issues, criminal law matters, and corporate law matters in both state and federal courts. He also clerked for Supreme Court Justice Mark Gibbons and has provided legal counsel to many other businesses.

The work of a corporate lawyer requires many skills and experience. Jeremy has the necessary qualifications and experience to succeed as a corporate lawyer. He is a good communicator and is able to effectively explain complex legal matters to clients and colleagues. He is also knowledgeable in many areas of corporate law, including finance, regulations, taxes, and insurance. In addition, Jeremy is highly organized and has a strong attention to detail, which makes him a great asset to any corporate law firm or organization.

In addition to his excellent legal skills, Jeremy also has a strong understanding of corporate law and the business world. Jeremy has a master of business administration degree and has worked with international businesses on issues of supply, demand, and labor. He is able to provide legal advice to corporate clients on a variety of issues, including corporate transactions, mergers and acquisitions, and legal matters pertaining to intellectual property. He also has a keen understanding of the regulations and laws that govern the corporate world.

For any company or law firm looking for a corporate lawyer, Jeremy Eveland is an excellent choice. He has the skills, experience, and qualifications necessary to excel in the field of corporate law. He has the knowledge and experience to handle any legal matter, ranging from small businesses to mid-zise businesses, in the multi-million dollar range to even large global corporations. His experience in corporate law and the legal profession make him a valued asset to any organization or law firm.

For any company or law firm looking for a corporate lawyer, Jeremy Eveland is the perfect person for the job. His experience, qualifications, and skills make him an ideal candidate for the job. He is an excellent communicator, has a strong understanding of corporate law, and is highly organized. With his strong background in corporate law, he is a valuable asset to any organization. He is a great choice for any company or law firm looking for an outside corporate lawyer.

When Might an Individual or Business Need Help From a Corporate Lawyer?

A corporate lawyer advises firms on how to comply with rules and laws, but that’s only the beginning. In truth, any individual starting a business venture could benefit from a corporate lawyer. Why? Because a corporate lawyer can help you structure and plan your business for success, even if you end up going with a business structure other than a corporation. It’s always a good Idea to have a lawyer on board to craft your business’ managing documents, review contracts, and help you make other strategy decisions.

Of course, it’s not always possible for smaller businesses (or even medium-sized businesses) to have a corporate lawyer on retainer, but one should be consulted when forming a business, when closing a business, and when problems arise, at the very least.

Consider meeting with a corporate lawyer in your area if you are starting a business venture or need advice on anything else related to business transactions or planning.

Corporate Lawyer at Work in the Office

The corporate lawyer has to make sure all these legal aspects of a corporation’s existence are adequately managed and serviced. The corporate lawyer performs a lot of roles and functions. If you have a growing enterprise or you are an executive officer of a large corporation operating out of Utah, you might have to consider discussing your company’s issues and concerns with some Corporate Lawyers.

Utah Corporate Attorney Consultation

When you need legal help with a corporate law in Utah, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Recent Posts

The Utah Uniform Partnership Act

The 10 Essential Elements of Business Succession Planning

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Business Succession Lawyer Ogden Utah