Business Workplace Safety

-

Business Lawyer for Workplace Safety

- Introduction

- What is Workplace Safety and What is OSHA?

- How to Create a Safe and Healthy Workplace Environment Through Occupational Health and Safety Laws

- The Benefits of Regular Safety Training for Employees

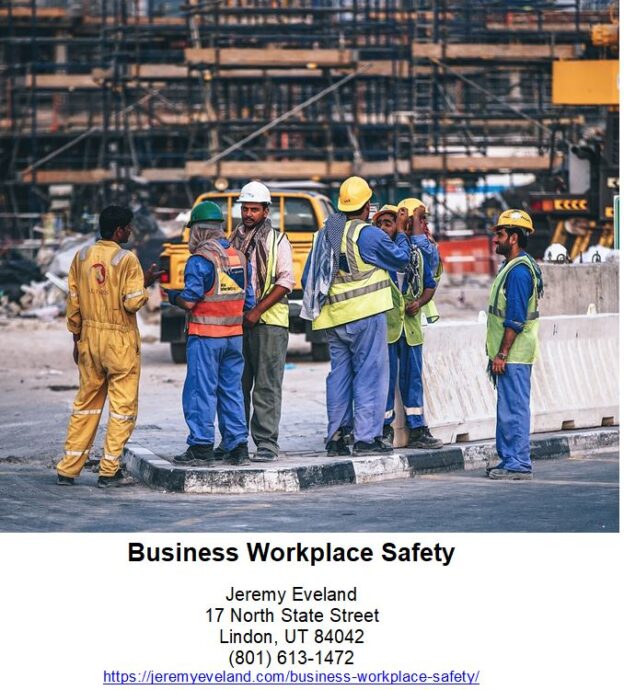

- The Importance of Safety Helmets in the Construction Workplace

- How to Ensure Compliance with the Occupational Safety and Health Act of 1970

- The Benefits of Implementing a Comprehensive Hearing Protection Program in the Workplace

- The Importance of Reflective Vests in the Construction Workplace

- Why you Should Work with a Business Lawyer for Workplace Safety

- Q&A

“Creating a Safe Workplace for Everyone: Business Workplace Safety”

Introduction

Business workplace safety is an important part of any successful business. It is essential to ensure that employees are safe and healthy while they are working. This includes providing a safe and secure environment, ensuring that all safety regulations are followed, and providing training and education to employees on how to stay safe in the workplace. By taking the necessary steps to ensure workplace safety, businesses can reduce the risk of accidents, injuries, and illnesses, as well as improve employee morale and productivity.

What is Workplace Safety and What is OSHA?

Workplace safety is the practice of taking steps to ensure the health and safety of employees in the workplace. This includes providing a safe and healthy work environment, following safety regulations, and providing safety training and equipment.

The Occupational Safety and Health Administration (OSHA) is a federal agency within the United States Department of Labor. OSHA is responsible for setting and enforcing safety and health standards in the workplace. OSHA also provides training, outreach, education, and assistance to employers and employees in order to ensure safe and healthful working conditions. OSHA also investigates workplace accidents and fatalities, and can issue citations and fines for violations of safety and health standards.

How to Create a Safe and Healthy Workplace Environment Through Occupational Health and Safety Laws

Creating a safe and healthy workplace environment is essential for any business. Occupational health and safety laws are designed to protect workers from potential hazards and ensure that employers provide a safe and healthy work environment. By following these laws, employers can create a safe and healthy workplace environment for their employees.

The first step in creating a safe and healthy workplace environment is to understand the applicable occupational health and safety laws. These laws vary from state to state, so it is important to research the laws in your state. Generally, these laws require employers to provide a safe and healthy work environment, free from recognized hazards that could cause death or serious physical harm. Employers must also provide safety training and equipment to protect workers from potential hazards.

Once employers understand the applicable laws, they should create a safety plan. This plan should include policies and procedures to ensure that the workplace is safe and healthy. Employers should also create a safety committee to review the safety plan and make sure it is being followed.

Employers should also conduct regular safety inspections of the workplace. These inspections should be conducted by a qualified safety inspector and should include a review of the safety plan, equipment, and procedures. The safety inspector should also look for potential hazards and make recommendations for corrective action.

Finally, employers should provide safety training to their employees. This training should include information on how to identify potential hazards, how to use safety equipment, and how to report any safety concerns.

By following these steps, employers can create a safe and healthy workplace environment for their employees. Occupational health and safety laws are designed to protect workers from potential hazards and ensure that employers provide a safe and healthy work environment. By following these laws, employers can create a safe and healthy workplace environment for their employees.

The Benefits of Regular Safety Training for Employees

Regular safety training for employees is essential for any business. It helps to ensure that employees are aware of the risks associated with their job and how to protect themselves and others from harm. Safety training also helps to reduce the risk of workplace accidents and injuries, which can lead to costly legal and medical expenses.

Safety training helps to ensure that employees are aware of the safety protocols and procedures that must be followed in the workplace. This includes the proper use of safety equipment, such as protective clothing and eyewear, as well as the proper handling of hazardous materials. Employees who are properly trained in safety protocols are less likely to make mistakes that could lead to accidents or injuries.

Safety training also helps to create a culture of safety in the workplace. When employees are aware of the safety protocols and procedures, they are more likely to follow them. This helps to create a safe and healthy work environment, which can lead to increased productivity and morale.

Safety training also helps to ensure that employees are aware of the potential risks associated with their job. This includes the potential for exposure to hazardous materials, such as chemicals or radiation, as well as the potential for physical injury. By being aware of these risks, employees can take steps to protect themselves and others from harm.

Also, safety training helps to ensure that employees are aware of the legal requirements associated with their job. This includes understanding the Occupational Safety and Health Administration (OSHA) regulations and other laws that may apply to their job. By understanding these regulations, employees can ensure that they are in compliance with the law and that they are taking the necessary steps to protect themselves and others from harm.

With that being said, regular safety training for employees is essential for any business. If fact you can turn it into a lunch and learn — provide a meal to your employees will show that you care about them and want them to be happy. There is even a way you can use the modern business model of gamification to assist your employees in earning achievements while staying safe. There employee safety meetings help to ensure that employees are aware of the risks associated with their job and how to protect themselves and others from harm. It also helps to create a culture of safety in the workplace, which can lead to increased productivity and morale. Finally, safety training helps to ensure that employees are aware of the legal requirements associated with their job, which can help to ensure that they are in compliance with the law.

The Importance of Safety Helmets in the Construction Workplace

Safety helmets are an essential piece of personal protective equipment (PPE) in the construction workplace. They provide protection from head injuries caused by falling objects, slips, trips, and falls. Wearing a safety helmet can help to reduce the severity of head injuries and even save lives.

Safety helmets are designed to absorb the impact of a blow to the head, reducing the risk of serious injury or death. They are made from a variety of materials, including hard plastic, foam, and metal. The most common type of safety helmet is the hard hat, which is designed to protect the head from falling objects and other hazards.

Safety helmets should be worn at all times when working in a construction environment. They should be inspected regularly for signs of wear and tear, and replaced when necessary. It is important to ensure that the helmet fits properly and is comfortable to wear.

Safety helmets should be worn in combination with other PPE, such as safety glasses, gloves, and protective clothing. This will help to ensure that workers are adequately protected from potential hazards.

In addition to providing protection from physical hazards, safety helmets can also help to reduce the risk of hearing loss. Many construction sites are noisy environments, and wearing a helmet can help to reduce the amount of noise that reaches the ears.

Safety helmets are an essential part of any construction worker’s PPE. They provide protection from head injuries, reduce the risk of hearing loss, and help to ensure that workers are adequately protected from potential hazards. By wearing a safety helmet, construction workers can help to ensure their own safety and the safety of those around them.

How to Ensure Compliance with the Occupational Safety and Health Act of 1970

The Occupational Safety and Health Act of 1970 (OSHA) is a federal law that requires employers to provide a safe and healthy work environment for their employees. To ensure compliance with OSHA, employers should take the following steps:

1. Develop a safety policy: Employers should develop a comprehensive safety policy that outlines the safety and health standards that must be followed in the workplace. This policy should include information on how to report hazards, how to respond to accidents, and how to prevent future incidents.

2. Train employees: Employers should provide training to all employees on the safety and health standards outlined in the safety policy. This training should include information on how to identify and report hazards, how to use safety equipment, and how to respond to accidents.

3. Monitor the workplace: Employers should regularly monitor the workplace to ensure that safety and health standards are being followed. This can include conducting regular safety inspections, reviewing accident reports, and conducting employee surveys.

4. Invest in safety equipment: Employers should invest in safety equipment such as protective clothing, safety goggles, and respirators to ensure that employees are adequately protected from potential hazards.

5. Report incidents: Employers should report any incidents or accidents that occur in the workplace to the appropriate authorities. This will help ensure that the incident is properly investigated and that any necessary corrective actions are taken.

By taking these steps, employers can ensure that they are in compliance with OSHA and that their employees are safe and healthy.

The Benefits of Implementing a Comprehensive Hearing Protection Program in the Workplace

Implementing a comprehensive hearing protection program in the workplace is essential for the health and safety of employees. Hearing loss is one of the most common occupational illnesses, and it can have a significant impact on an individual’s quality of life. By implementing a comprehensive hearing protection program, employers can reduce the risk of hearing loss and ensure that their employees are safe and healthy.

The first benefit of implementing a comprehensive hearing protection program is that it can help to reduce the risk of hearing loss. Exposure to loud noises can cause permanent damage to the inner ear, leading to hearing loss. By providing employees with the proper hearing protection, employers can reduce the risk of hearing loss and ensure that their employees are safe.

The second benefit of implementing a comprehensive hearing protection program is that it can help to improve employee morale. Hearing loss can be a source of frustration and embarrassment for employees, and it can lead to decreased productivity and job satisfaction. By providing employees with the proper hearing protection, employers can help to ensure that their employees are comfortable and safe in the workplace.

The third benefit of implementing a comprehensive hearing protection program is that it can help to reduce the risk of other health issues. Exposure to loud noises can cause physical and psychological stress, which can lead to a variety of health issues. By providing employees with the proper hearing protection, employers can help to reduce the risk of these health issues and ensure that their employees are safe and healthy.

Finally, implementing a comprehensive hearing protection program can help to reduce the risk of legal liability. If an employee suffers from hearing loss due to workplace noise, the employer may be held liable for any resulting damages. By providing employees with the proper hearing protection, employers can help to reduce the risk of legal liability and ensure that their employees are safe and healthy.

Look: implementing a comprehensive hearing protection program in the workplace is essential for the health and safety of employees. By providing employees with the proper hearing protection, employers can reduce the risk of hearing loss and other health issues, improve employee morale, and reduce the risk of legal liability.

The Importance of Reflective Vests in the Construction Workplace

The construction workplace is a hazardous environment, and reflective vests are an important tool for keeping workers safe. Reflective vests are designed to make workers more visible to other workers, vehicles, and pedestrians, reducing the risk of accidents and injuries.

Reflective vests are made of a highly reflective material that reflects light back to its source. This makes the wearer more visible in low-light conditions, such as at night or in foggy weather. The reflective material also helps to make the wearer more visible during the day, as the bright colors of the vest stand out against the background.

The reflective material used in reflective vests is designed to be durable and long-lasting. It is also designed to be lightweight and comfortable, so that workers can wear the vest for long periods of time without feeling uncomfortable.

In addition to making workers more visible, reflective vests also provide protection from the elements. The material is designed to be waterproof and windproof, so that workers can stay dry and warm in inclement weather. The material is also designed to be breathable, so that workers can stay cool in hot weather.

The use of reflective vests in the construction workplace is essential for keeping workers safe. The reflective material helps to make workers more visible, reducing the risk of accidents and injuries. The material is also designed to be durable and comfortable, so that workers can wear the vest for long periods of time without feeling uncomfortable. By wearing reflective vests, workers can stay safe and protected in the construction workplace.

Why you Should Work with a Business Lawyer for Workplace Safety

Workplace safety is an important issue for any business. It is essential to ensure that employees are safe and secure while they are on the job. A business lawyer can help you create a safe and secure workplace for your employees.

A business lawyer can help you create a comprehensive workplace safety policy. This policy should include guidelines for safety procedures, such as the use of protective equipment, proper storage of hazardous materials, and emergency response plans. The policy should also include a system for reporting and investigating workplace accidents and injuries.

A business lawyer can also help you create a system for training employees on workplace safety. This training should include information on how to identify and avoid potential hazards, as well as how to respond in the event of an emergency. The training should also include information on how to report any safety concerns to management.

A business lawyer can also help you create a system for enforcing workplace safety policies. This system should include a system for disciplining employees who violate safety policies, as well as a system for rewarding employees who follow safety procedures.

Finally, a business lawyer can help you create a system for monitoring workplace safety. This system should include regular inspections of the workplace, as well as a system for tracking and reporting any safety incidents.

By working with a business lawyer, you can ensure that your workplace is safe and secure for your employees. A business lawyer can help you create a comprehensive workplace safety policy, a system for training employees on safety procedures, a system for enforcing safety policies, and a system for monitoring workplace safety. With the help of a business lawyer, you can ensure that your workplace is safe and secure for your employees.

Q&A

Q1: What is workplace safety?

A1: Workplace safety is the practice of taking steps to ensure the health and safety of employees in the workplace. This includes providing a safe environment, proper training, and the use of protective equipment. It also involves creating policies and procedures to reduce the risk of accidents and injuries.

Business Workplace Safety Consultation

When you need legal help with Business Workplace Safety call Jeremy D. Eveland, MBA, JD (801) 613-1472 for a consultation.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Related Posts

Trusted Personal Injury Attorneys in Utah

Legal Requirements to Start a Business

Real Estate Attorneys in Salt Lake City Utah

Business Contract Lawyer Riverton UT

Business Law and Intellectual Property

Commercial Litigation Strategies