Business Succession Lawyer Layton Utah

Layton, Utah is located in Davis County in the United States, and it is the home of many experienced attorneys and attorneys-at-law. The city is known for its large population of Mormons (also known as Latter-day Saints or LDS), and it is a great place for businesses to set up shop and for individuals to come for legal advice. The city is also home to many businesses and law firms, and one of the attorneys who does business succession law is Jeremy Eveland. Mr. Eveland is a business attorney that focuses on business succession law and estate planning. He offers a wide range of legal services, including business succession law, estate planning, and probate and estate administration.

Business Succession

Business succession law is a complex area of the law that governs the transfer of business ownership from one generation to the next. The laws in the United States vary from state to state, and each state has its own unique set of rules and regulations governing business succession. In this paper, we will explore the business succession law in the state of Utah, including a look at the Utah Code, Utah case law, and the experience of business lawyers in the state. We will also discuss the areas of business succession law that are of particular importance to business owners in Utah, including the role of business partnerships, estate planning, and the use of alternative dispute resolution.

Business Succession Law in Layton Utah

Business succession law in Utah is governed primarily by the Utah Code and Utah case law. The Utah Code outlines the laws and regulations that govern the transfer of business ownership from one generation to the next, including provisions for the formation of business partnerships, the drafting of partnership agreements, and the winding up of a business in the event of death or incapacity. The Utah Code also sets forth rules governing the probate of a decedent’s estate, the descent and distribution of assets, and the intestate succession of assets.

In addition to the Utah Code, Utah case law also provides guidance on business succession law. The Utah Supreme Court has issued numerous opinions on the topic, including decisions in cases involving business partnerships, the transfer of ownership interests, and the interpretation of partnership agreements. These opinions provide important guidance for business lawyers in the state, as well as business owners seeking to understand the nuances of Utah business succession law.

Business Lawyers in Layton Utah

Utah is home to a number of experienced business lawyers who specialize in business succession law. These lawyers are experienced in the drafting and interpretation of partnership agreements, the creation of business entities, and the handling of probate matters. Many of these lawyers are located in the major cities of Utah, including Layton, Lindon, St. George, Salt Lake City, and the Provo Orem area.

Business lawyers in Utah can provide a variety of services to business owners, including legal advice and guidance on the transfer of ownership interests, the formation of business partnerships, and the drafting of partnership agreements. They can also provide counsel on estate planning, asset protection, and the use of alternative dispute resolution (ADR) to resolve business disputes. Business lawyers in Utah are also familiar with the unique laws and regulations that govern the transfer of business ownership in the state, including the Utah probate code and the intestacy laws.

Business Partnerships in Layton Utah

Business partnerships are a common form of business entity in Utah, and the Utah Code sets forth the rules and regulations that govern the formation, maintenance, and dissolution of business partnerships. Under the Utah Code, business partnerships are formed when two or more individuals enter into a written partnership agreement that sets forth their respective ownership interests and rights, duties and obligations, and the means of winding up the partnership in the event of death or incapacity.

The partnership agreement also sets forth the rights and duties of the partners, as well as the terms for the winding up of the partnership in the event of a dispute or the death of one of the partners. The partnership agreement is a legally binding document, and all partners are obligated to abide by its terms. In the event of a dispute, the partnership agreement may provide for the use of alternative dispute resolution, such as mediation or arbitration, to resolve the dispute.

Estate Planning and Business Succession

Estate planning is an important component of business succession law in Utah. Estate planning involves the drafting of a will or trust to ensure the orderly transfer of assets upon the death of the business owner. The will or trust can specify the distribution of assets, including business interests, to the business owner’s heirs or beneficiaries. The will or trust can also provide for the appointment of a guardian for a disabled child or an executor to manage the decedent’s estate.

Estate planning can also involve the drafting of advance directives, such as a living will or power of attorney, which allow the business owner to make decisions regarding healthcare and financial matters even in the event of incapacitation. Estate planning also involves the review of insurance policies, such as life insurance, to ensure that the business owner’s assets are properly protected.

Alternative Dispute Resolution

Alternative dispute resolution (ADR) is an increasingly popular method for resolving business disputes in Utah. ADR allows parties to resolve their disputes through mediation, arbitration, or other means, rather than through litigation. ADR can be used to resolve a variety of business disputes, including disputes over the ownership of a business, the interpretation of a partnership agreement, or the winding up of a business in the event of death or incapacity.

Business succession law in Utah is governed by the Utah Code and Utah case law. Business lawyers in the state are experienced in the drafting and interpretation of partnership agreements, the creation of business entities, and the handling of probate matters. Estate planning and the use of alternative dispute resolution are also important components of business succession law in Utah. Business owners should consult with experienced business lawyers in the state to ensure that their business succession plans are properly crafted and executed.

Business Startup Lawyer Layton Utah

Small businesses surround us. They are on every other street and in every corner. Every second thing someone buys comes from a small business. In India where unemployment is a serious issue, small business gains a special position in the industrial structure because of their ability to utilize labor and create employment. Let us learn about meaning, nature and types of small business.

Meaning of Small Business

Small businesses are either services or retail operations like grocery stores, medical stores, trades people, bakeries and small manufacturing units. Small businesses are independently owned organizations that require less capital and less workforce and less or no machinery. These businesses are ideally suited to operate on a small scale to serve a local community and to provide profits to the company owners.

Nature of Small Business

The nature of small businesses can be classified as follows:

1. Shoestring Budget

A sole proprietor or a small group of people operate small businesses. These businesses often run on ‘shoestring budget’ meaning that small businesses function on a very tight budget.

2. Labor intensive

Small businesses are mostly labor intensive. Various types of small business largely rely on labor for their functioning. The primary nature of small businesses is more involvement of physical work rather than intellectual work. The lack of machinery makes the employees manage their operations manually.

3. Community-based

Small businesses are started with the motive of satisfying the needs and demands of a local area or community. These businesses demographically target few areas of concentration and are hence community-based.

4. Indigenous technology

Due to small businesses being community focused and labor oriented they often thrive upon native methods of operations. In India, there are many businesses in the rural sector that still use outdated technology. This might give uniqueness to the products but hinders the development of the business.

The Stages of Small Business Growth

Each stage is characterized by an index of size, diversity, and complexity and described by five management factors: managerial style, organizational structure, and extent of formal systems, major strategic goals, and the owner’s involvement in the business. We depict each stage and describe narratively in this article.

Stage I: Existence.

In this stage the main problems of the business are obtaining customers and delivering the product or service contracted for. Among the key questions are the following:

Can we get enough customers, deliver our products, and provide services well enough to become a viable business?

Can we expand from that one key customer or pilot production process to a much broader sales base?

Do we have enough money to cover the considerable cash demands of this start-up phase?

The organization is a simple one—the owner does everything and directly supervises subordinates, who should be of at least average competence. Systems and formal planning are minimal to nonexistent. The company’s strategy is simply to remain alive. The owner is the business, performs all the important tasks, and is the major supplier of energy, direction, and, with relatives and friends, capital.

Companies in the Existence Stage range from newly started restaurants and retail stores to high-technology manufacturers that have yet to stabilize either production or product quality. Many such companies never gain sufficient customer acceptance or product capability to become viable. In these cases, the owners close the business when the start-up capital runs out and, if they’re lucky, sell the business for its asset value. In some cases, the owners cannot accept the demands the business places on their time, finances, and energy, and they quit. Those companies that remain in business become Stage II enterprises.

Stage II: Survival.

In reaching this stage, the business has demonstrated that it is a workable business entity. It has enough customers and satisfies them sufficiently with its products or services to keep them. The key problem thus shifts from mere existence to the relationship between revenues and expenses. The main issues are as follows:

In the short run, can we generate enough cash to break even and to cover the repair or replacement of our capital assets as they wear out?

Can we, at a minimum, generate enough cash flow to stay in business and to finance growth to a size that is sufficiently large, given our industry and market niche, to earn an economic return on our assets and labor?

The organization is still simple. The company may have a limited number of employees supervised by a sales manager or a general foreman. Neither of them makes major decisions independently, but instead carries out the rather well-defined orders of the owner.

Systems development is minimal. Formal planning is, at best, cash forecasting. The major goal is still survival, and the owner is still synonymous with the business.

Stage III: Success.

The decision facing owners at this stage is whether to exploit the company’s accomplishments and expand or keep the company stable and profitable, providing a base for alternative owner activities. Thus, a key issue is whether to use the company as a platform for growth—a substage III-G company—or as a means of support for the owners as they completely or partially disengage from the company—making it a substage III-D company. Behind the disengagement might be a wish to start up new enterprises, run for political office, or simply to pursue hobbies and other outside interests while maintaining the business more or less in the status quo.

As the business matures, it and the owner increasingly move apart, to some extent because of the owner’s activities elsewhere and to some extent because of the presence of other managers. Many companies continue for long periods in the Success-Disengagement substage. The product-market niche of some does not permit growth; this is the case for many service businesses in small or medium-sized, slowly growing communities and for franchise holders with limited territories.

Stage IV: Take-off.

In this stage the key problems are how to grow rapidly and how to finance that growth. The most important questions, then, are in the following areas:

Delegation. Can the owner delegate responsibility to others to improve the managerial effectiveness of a fast growing and increasingly complex enterprise? Further, will the action be true delegation with controls on performance and a willingness to see mistakes made, or will it be abdication, as is so often the case?

Cash. Will there be enough to satisfy the great demands growth brings (often requiring a willingness on the owner’s part to tolerate a high debt-equity ratio) and a cash flow that is not eroded by inadequate expense controls or ill-advised investments brought about by owner impatience?

The organization is decentralized and, at least in part, divisionalized—usually in either sales or production. The key managers must be very competent to handle a growing and complex business environment. The systems, strained by growth, are becoming more refined and extensive. Both operational and strategic planning are being done and involve specific managers. The owner and the business have become reasonably separate, yet the company is still dominated by both the owner’s presence and stock control.

This is a pivotal period in a company’s life. If the owner rises to the challenges of a growing company, both financially and managerially, it can become a big business. If not, it can usually be sold—at a profit—provided the owner recognizes his or her limitations soon enough. Too often, those who bring the business to the Success Stage are unsuccessful in Stage IV, either because they try to grow too fast and run out of cash (the owner falls victim to the omnipotence syndrome), or are unable to delegate effectively enough to make the company work (the omniscience syndrome).

It is, of course, possible for the company to traverse this high-growth stage without the original management. Often the entrepreneur who founded the company and brought it to the Success Stage is replaced either voluntarily or involuntarily by the company’s investors or creditors.

Stage V: Resource Maturity.

The greatest concerns of a company entering this stage are, first, to consolidate and control the financial gains brought on by rapid growth and, second, to retain the advantages of small size, including flexibility of response and the entrepreneurial spirit. The corporation must expand the management force fast enough to eliminate the inefficiencies that growth can produce and professionalize the company by use of such tools as budgets, strategic planning, management by objectives, and standard cost systems—and do this without stifling its entrepreneurial qualities.

A company in Stage V has the staff and financial resources to engage in detailed operational and strategic planning. The management is decentralized, adequately staffed, and experienced. And systems are extensive and well developed. The owner and the business are quite separate, both financially and operationally.

The company has now arrived. It has the advantages of size, financial resources, and managerial talent. If it can preserve its entrepreneurial spirit, it will be a formidable force in the market. If not, it may enter a sixth stage of sorts: ossification.

Avoiding Future Problems

Do I have the quality and diversity of people needed to manage a growing company?

Do I have now, or will I have shortly, the systems in place to handle the needs of a larger, more diversified company?

Do I have the inclination and ability to delegate decision making to my managers?

Do I have enough cash and borrowing power along with the inclination to risk everything to pursue rapid growth?

Similarly, the potential entrepreneur can see that starting a business requires an ability to do something very well (or a good marketable idea), high energy, and a favorable cash flow forecast (or a large sum of cash on hand). These are less important in Stage V, when well-developed people-management skills, good information systems, and budget controls take priority. Perhaps this is why some experienced people from large companies fail to make good as entrepreneurs or managers in small companies. They are used to delegating and are not good enough at doing.

Layton Utah Business Attorney Consultation

When you need business attorneys, call Jeremy D. Eveland, MBA, JD (801) 613-1472.

Jeremy Eveland

17 North State Street

Lindon UT 84042

(801) 613-1472

Areas We Serve

We serve businesses and business owners for succession planning in the following locations:

Business Succession Lawyer Salt Lake City Utah

Business Succession Lawyer West Jordan Utah

Business Succession Lawyer St. George Utah

Business Succession Lawyer West Valley City Utah

Business Succession Lawyer Provo Utah

Business Succession Lawyer Sandy Utah

Business Succession Lawyer Orem Utah

Business Succession Lawyer Ogden Utah

Business Succession Lawyer Layton Utah

Layton, Utah

|

Layton, Utah

|

|

|---|---|

Historic Downtown Layton

|

|

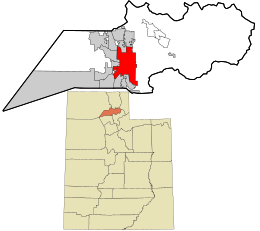

Location within Davis County and the State of Utah

|

|

| Coordinates: 41°4′41″N 111°57′19″WCoordinates: 41°4′41″N 111°57′19″W | |

| Country | United States |

| State | Utah |

| County | Davis |

| Settled | 1850s |

| Incorporated | May 24, 1920 |

| City | 1950 |

| Named for | Christopher Layton |

| Government

|

|

| • Type | Council–manager[1] |

| • Mayor | Joy Petro |

| Area | |

| • Total | 22.65 sq mi (58.67 km2) |

| • Land | 22.50 sq mi (58.27 km2) |

| • Water | 0.16 sq mi (0.40 km2) |

| Elevation | 4,356 ft (1,328 m) |

| Population | |

| • Total | 84,665 (2,022 est) |

| • Density | 3,634.36/sq mi (1,403.35/km2) |

| Time zone | UTC−7 (Mountain (MST)) |

| • Summer (DST) | UTC−6 (MDT) |

| ZIP codes |

84040, 84041

|

| Area code(s) | 385, 801 |

| FIPS code | 49-43660[5] |

| GNIS feature ID | 2411639[3] |

| Website | laytoncity |

Layton is a city in Davis County, Utah, United States. It is part of the Ogden-Clearfield Metropolitan Statistical Area. As of the 2020 census, the city had a population of 81,773,[4][7] with 2022 estimates showing a slight increase to 84,665. Layton is the most populous city in Davis County and the ninth most populous in Utah.

Layton has direct access to Salt Lake City, Ogden, Salt Lake City International Airport, Antelope Island, and the FrontRunner commuter rail. Layton City is a leader in economic development for the region, with immediate adjacency to Hill Air Force Base, a large hospitality district (1,000+ hotel beds) and conference center, the Layton Hills Mall, multiple nationally recognized retail and food chains, the East Gate Business Park, and the Weber State University-Davis campus.

In 2014, Layton contributed $1.34 billion[8] worth of retail sales activity, the second largest market north of Salt Lake City and seventh largest in Utah.

[geocentric_weather id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_about id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_neighborhoods id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_thingstodo id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_busstops id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_mapembed id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_drivingdirections id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]

[geocentric_reviews id=”4e58772d-44f2-4fd9-a146-643961a1c4d9″]